How To Become A Commercial Loan Officer With No Experience Below are the steps generally required to begin and advance your Commercial Loan Officer career 1 Earn a Degree 2 Choose a Specialty in Your Field 3 Get an Entry Level Position as a Commercial Loan Officer 4 Advance in Your Commercial Loan Officer Career

Here are the key responsibilities that commercial loan officers typically undertake 1 Assessing Creditworthiness One of the primary responsibilities is to evaluate the creditworthiness of loan applicants This involves analyzing the applicant s financial statements credit history and overall financial health It typically takes 6 8 years to become a commercial loan officer Years 1 4 Earn a bachelor s degree in a relevant field such as finance accounting or economics Years 5 6 Gain work experience in entry level positions such as a loan officer or credit analyst Years 7 8 Complete on the job training typically lasting 6 12 months to learn

How To Become A Commercial Loan Officer With No Experience

How To Become A Commercial Loan Officer With No Experience

https://vivahr.com/wp-content/uploads/2023/05/commercial-loan-officer-job-description-template.jpg

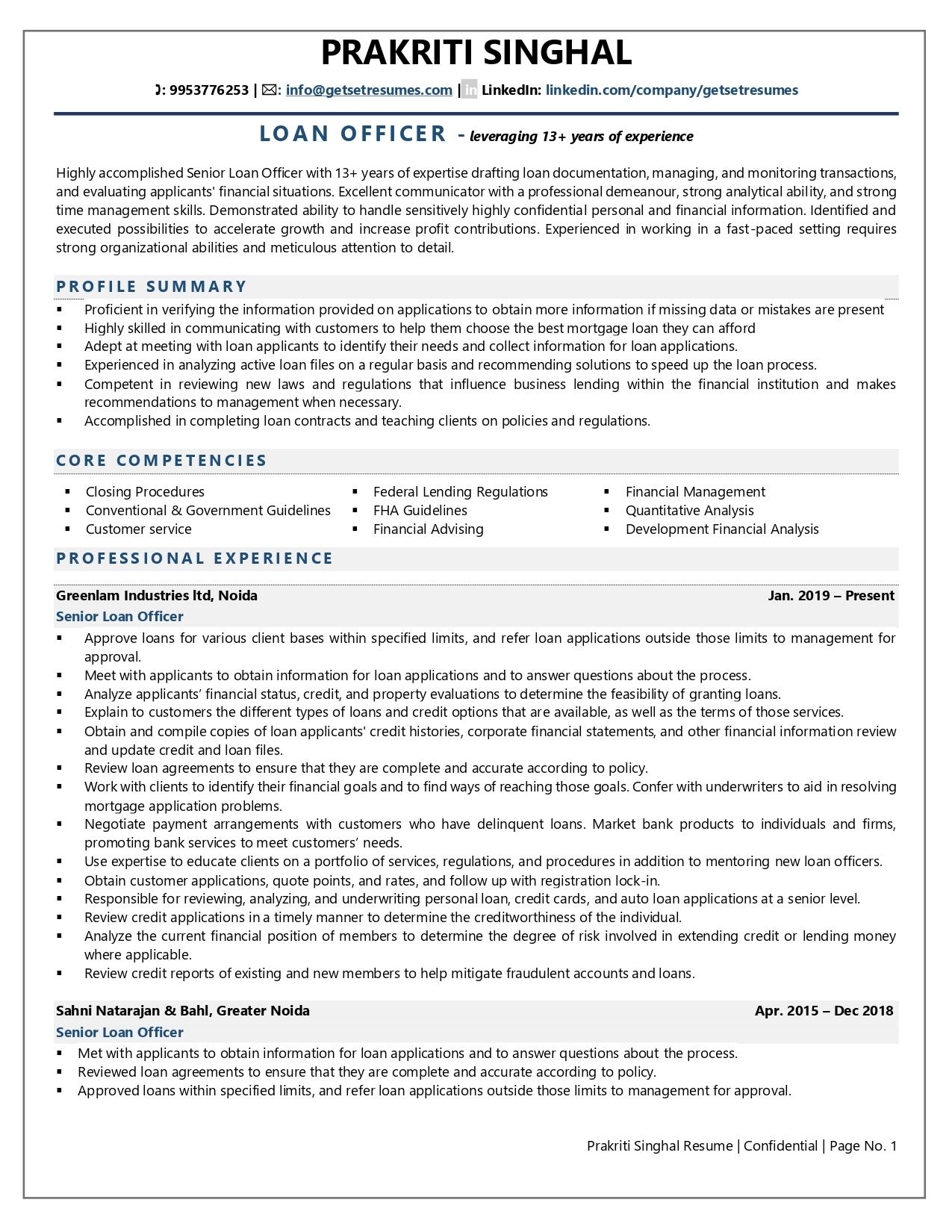

Loan Officer Resume Examples Template with Job Winning Tips

https://www.getsetresumes.com/storage/resume-examples/March2022/SFlmJVZBQ2bbm0iW1Mjm.jpg

Loan Officer Salary Salaries WIKI

https://salarieswiki.com/wp-content/uploads/2016/07/loan-officer-with-clients.jpg

Commercial loan officers specialize in loans to businesses which often use the loans to buy supplies and to upgrade or expand operations Commercial loans frequently are larger and more complicated than other types of loans Some commercial loans are so large and complex that no single bank will provide the entire amount requested Commercial loan officers work for credit unions commercial banks mortgage companies and other financial institutions and are the decision makers who apply critical thinking skills during application review They examine loan applications and verify all financial information applicants provide to determine whether they can meet their monthly

How to Become a Commercial Loan Officer To become a commercial loan officer you need a bachelor s degree in finance business accounting or a related field To become commercial loan certified you need to complete the requirements from a reputable provider such as the ICBA Independent Community Banks of America or ABA American Banking 1 Education and training To become a commercial loan officer you usually need a bachelor s degree in finance accounting business administration or a related field Some employers may also

More picture related to How To Become A Commercial Loan Officer With No Experience

Become A Loan Officer With No Experience Your Step by Step Guide

https://becomingthis.com/wp-content/uploads/2023/07/Loan-officer-drawing-tips.jpg

How To Become A Commercial Loan Officer 11 Steps with Pictures

https://www.wikihow.com/images/thumb/6/63/Become-a-Commercial-Loan-Officer-Step-5.jpg/aid1307240-v4-728px-Become-a-Commercial-Loan-Officer-Step-5.jpg

Commercial Loan Officer Job Description

https://www.betterteam.com/images/commercial-loan-officer-job-description-4000x2667-20201114.jpeg?crop=21:16,smart&width=420&dpr=2

Obtain Certification and Licensing Most Loan Officers need to be licensed especially if they work in mortgage lending This involves completing pre licensure education passing the Nationwide Multistate Licensing System Registry NMLS exam and registering with the NMLS Some states may have additional requirements The Commercial Real Estate Loan Officer occasionally directed in several aspects of the work Gaining exposure to some of the complex tasks within the job function To be a Commercial Real Estate Loan Officer typically requires 2 4 years of related experience People s Opinions on Commercial Real Estate Loan Officer responsibilities

Take the next step to become a loan officer Taking the first steps to become a loan officer can set you up for work in an important and rewarding career See if a career in financial services or the financial industry at large could be a good fit with a course like Personal Family Financial Planning from the University of Florida Commercial loan officers specialize in loans to businesses which often use the loans to buy supplies and upgrade or expand operations Commercial loans frequently are larger and more complicated than other types of loans Because companies have such complex financial situations and statements commercial loans usually require human judgment in addition to the analysis by underwriting software

The Defining Difference

https://thedefiningdifference.com/wp-content/uploads/2022/03/Picture3-768x513.jpg

Become A Loan Officer With No Experience Surety Solutions A

https://suretysolutions.com/wp-content/uploads/2020/03/Loan_Officer_No_Experience-1024x536.jpg

How To Become A Commercial Loan Officer With No Experience - Stand out and gain a competitive edge as a commercial banker loan officer or credit analyst with advanced knowledge real world analysis skills and career confidence Commercial lending training provides an opportunity for loan officers and other credit professionals to build or upgrade their credit acumen