How To Be A Commercial Loan Officer A Commercial Loan Officer internship may be required to earn your Bachelor s Degree and acquire necessary on the job skills before entering the workforce 2 Choose a Specialty in Your Field As an Commercial Loan Officer you may be required to choose a specialty within your field Determine which part of the Commercial Loan Officer field you

Here are the key responsibilities that commercial loan officers typically undertake 1 Assessing Creditworthiness One of the primary responsibilities is to evaluate the creditworthiness of loan applicants This involves analyzing the applicant s financial statements credit history and overall financial health It typically takes 6 8 years to become a commercial loan officer Years 1 4 Earn a bachelor s degree in a relevant field such as finance accounting or economics Years 5 6 Gain work experience in entry level positions such as a loan officer or credit analyst Years 7 8 Complete on the job training typically lasting 6 12 months to learn

How To Be A Commercial Loan Officer

How To Be A Commercial Loan Officer

https://navi.com/blog/wp-content/uploads/2022/06/Heres-all-you-need-to-know-about-Commercial-Loans.jpg

Commercial Loan Officer Interview Questions

https://www.proalt.com/wp-content/uploads/2022/12/business-loan-officer-director.jpg

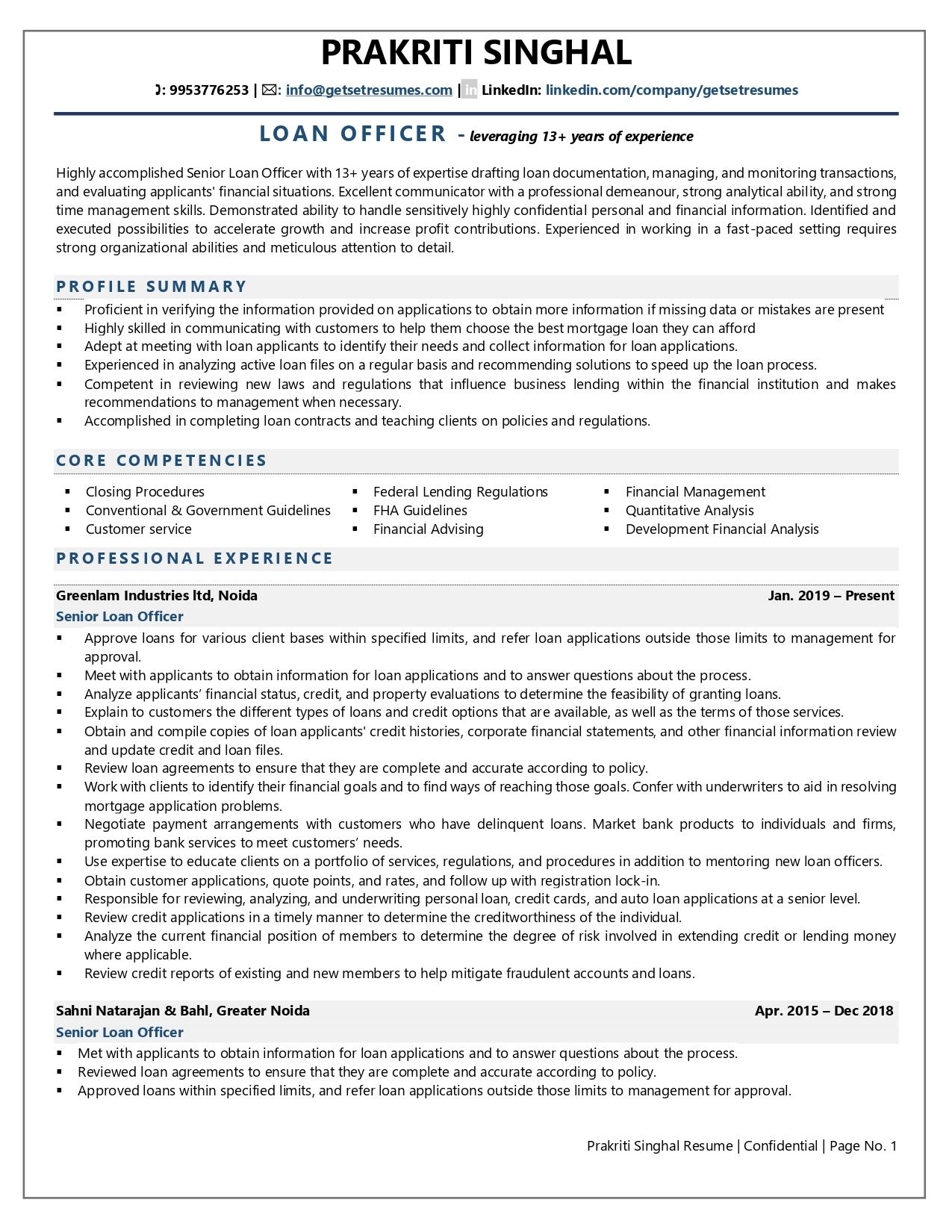

Loan Officer Resume Examples Template with Job Winning Tips

https://www.getsetresumes.com/storage/resume-examples/March2022/SFlmJVZBQ2bbm0iW1Mjm.jpg

If you re ready to launch a career as a loan officer follow the steps below to streamline your process 1 Consider earning a degree There is no strict educational requirement for becoming a loan officer although many employers will look for job candidates that have at least a bachelor s degree According to Zippia 61 percent of loan A commercial loan officer manages the loan process for businesses Their responsibilities include helping clients through the application process and assessing whether the financial health of a client qualifies them for a loan Some commercial loan officers also become certified in mortgage loans to help businesses or organizations acquire

Commercial loan officers specialize in loans to businesses which often use the loans to buy supplies and to upgrade or expand operations Commercial loans frequently are larger and more complicated than other types of loans Some commercial loans are so large and complex that no single bank will provide the entire amount requested Commercial loan officers specialize in loans to businesses which often use the loans to buy supplies and upgrade or expand operations Commercial loans frequently are larger and more complicated than other types of loans Because companies have such complex financial situations and statements commercial loans usually require human judgment in addition to the analysis by underwriting software

More picture related to How To Be A Commercial Loan Officer

Commercial Loan Officer Job Description

https://www.betterteam.com/images/commercial-loan-officer-job-description-4000x2667-20201114.jpeg?crop=21:16,smart&width=420&dpr=2

How To Become A Commercial Loan Officer 11 Steps with Pictures

http://www.wikihow.com/images/2/27/Become-a-Commercial-Loan-Officer-Step-11.jpg

Loan Officer Salary Salaries WIKI

https://salarieswiki.com/wp-content/uploads/2016/07/loan-officer-with-clients.jpg

There are a few different types of loan officers Commercial loan officers focus on business loans while consumer loan officers specialize in loans to individuals such as personal loans or auto 1 Education and training To become a commercial loan officer you usually need a bachelor s degree in finance accounting business administration or a related field Some employers may also

A degree is not required to become a loan officer but is helpful If you are looking into working for a smaller financial institution or mortgage lender you often need to be at least 18 years old and have a high school diploma You should check the educational requirements of the job posting prior to applying to see if you qualify Commercial loan officers work for credit unions commercial banks mortgage companies and other financial institutions and are the decision makers who apply critical thinking skills during application review They examine loan applications and verify all financial information applicants provide to determine whether they can meet their monthly

How To Become A Commercial Loan Officer 11 Steps with Pictures

https://www.wikihow.com/images/thumb/6/63/Become-a-Commercial-Loan-Officer-Step-5.jpg/aid1307240-v4-728px-Become-a-Commercial-Loan-Officer-Step-5.jpg

How Much Does A Commercial Loan Officer Make

https://www.allaboutcareers.com/wp-content/uploads/2022/06/Commercial-Loan-Officer-1140x703.jpeg

How To Be A Commercial Loan Officer - Commercial loan officers specialize in loans to businesses which often use the loans to buy supplies and to upgrade or expand operations Commercial loans frequently are larger and more complicated than other types of loans Some commercial loans are so large and complex that no single bank will provide the entire amount requested