How Much Would You Earn After Tax On 50000 FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

Age Enter the age you were on Jan 1 2024 Your age can have an effect on certain tax rules or deductions For example people aged 65 or older get a higher standard deduction 401 k The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336

How Much Would You Earn After Tax On 50000

How Much Would You Earn After Tax On 50000

https://i.etsystatic.com/27378410/r/il/5b0b44/3236584008/il_fullxfull.3236584008_7job.jpg

Salary In Malta Malta Basic Salary In 2023 How Much Money You Can

https://i.ytimg.com/vi/1F2xa-5QGUQ/maxresdefault.jpg

How Much Can IT Workers In Ireland Earn After Tax In 2023 Solas

https://www.solasit.ie/wp-content/uploads/2023/01/www.solasit.ie_how-much-can-an-it-worker-in-ireland-earn-after-tax-in-2023-1080x720.jpg

Step 6 Your paycheck For the final step divide your net pay by your pay frequency The following is the formula for each pay frequency Daily Your net pay Days worked per week Weeks worked per year Your daily paycheck Weekly Your net pay 52 Your weekly paycheck The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

Estimate your US federal income tax for 2023 2022 2021 2020 2019 2018 2017 2016 or 2015 using IRS formulas The calculator will calculate tax on your taxable income only Does not include income credits or additional taxes Does not include self employment tax for the self employed Also calculated is your net income the amount you Summary If you make 55 000 a year living in the region of New York USA you will be taxed 11 959 That means that your net pay will be 43 041 per year or 3 587 per month Your average tax rate is 21 7 and your marginal tax rate is 36 0 This marginal tax rate means that your immediate additional income will be taxed at this rate

More picture related to How Much Would You Earn After Tax On 50000

60k A Year Is How Much An Hour Best Spending And Saving Tips

https://www.ncesc.com/wp-content/uploads/2022/07/How-Much-Do-You-Earn-After-Taxes-1024x512.png

How To Earn 50 000 In Dividend Income Tax free in Most Provinces

http://findependencehub.com/wp-content/uploads/2017/04/money.jpeg

Help Me Math The Words In The Sentences Please the Words Can Be Used

https://us-static.z-dn.net/files/dbe/23ab882c2c44ce09734f487cf92bfe96.png

The Salary Calculator tells you monthly take home or annual earnings considering UK Tax National Insurance and Student Loan The latest budget information from April 2024 is used to show you exactly what you need to know Hourly rates weekly pay and bonuses are also catered for Why not find your dream salary too 50 000 After Tax Explained This is a break down of how your after tax take home pay is calculated on your 50 000 yearly income If you earn 50 000 in a year you will take home 38 022 leaving you with a net income of 3 169 every month Now let s see more details about how we ve gotten this monthly take home sum of 3 169 after extracting your tax and NI from your yearly

The Salary Calculator converts salary amounts to their corresponding values based on payment frequency Examples of payment frequencies include biweekly semi monthly or monthly payments Results include unadjusted figures and adjusted figures that account for vacation days and holidays per year Salary amount The aim of this 50 000 00 salary example is to provide you detailed information on how income tax is calculated for Federal Tax and State Tax We achieve this in the following steps The salary example begins with an overview of your 50 000 00 salary and deductions for income tax Medicare Social Security Retirement plans and so forth

Required A If Matt Expects His Marginal Tax Rate To Be 22 00 Percent

https://img.homeworklib.com/questions/78617c20-7944-11ea-890a-4794f80408ab.png?x-oss-process=image/resize,w_560

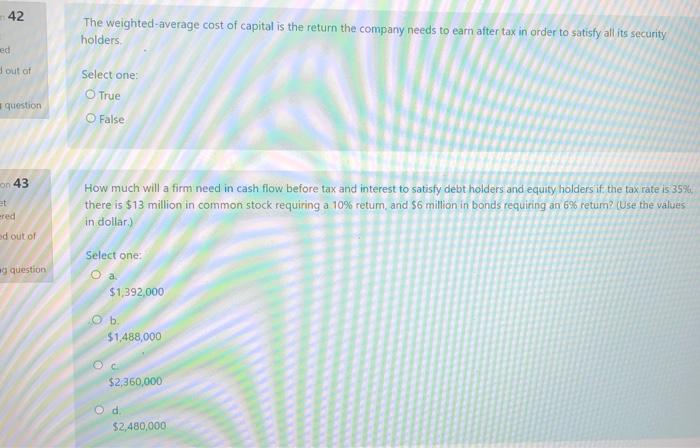

Solved 42 The Weighted Average Cost Of Capital Is The Return Chegg

https://media.cheggcdn.com/study/53f/53f08fff-b19a-4277-ac57-b4be7d4211e3/image

How Much Would You Earn After Tax On 50000 - Estimate your US federal income tax for 2023 2022 2021 2020 2019 2018 2017 2016 or 2015 using IRS formulas The calculator will calculate tax on your taxable income only Does not include income credits or additional taxes Does not include self employment tax for the self employed Also calculated is your net income the amount you