How Much Would I Take Home After Tax 55000 FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

How to use the Take Home Calculator To use the tax calculator enter your annual salary or the one you would like in the salary box above If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side by side comparison of a normal month and a bonus month Find out the benefit of that overtime Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly They are used to fund social Security and Medicare For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax

How Much Would I Take Home After Tax 55000

How Much Would I Take Home After Tax 55000

http://static1.squarespace.com/static/5d8c6cef28ac7b58bd17ab1e/5d8c6cef28ac7b58bd17ab6e/6278d296671629771cda751e/1652598045612/unsplash-image-utWyPB8_FU8.jpg?format=1500w

How Much Is 55 000 A Year After Taxes filing Single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-55000-dollars-sm-2-1024x768.png

Suppose That The Local Government Of Corpus Christi Decides To

https://us-static.z-dn.net/files/d4f/7244bcb4c2e6ff215391444bf44b1aa2.png

The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336 55 000 After Tax If your salary is 55 000 then after tax and national insurance you will be left with 40 950 This means that after tax you will take home 3 412 every month or 788 per week 157 60 per day and your hourly rate will be 26 45 if you re working 40 hours week Scroll down to see more details about your 55 000

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator Whether your pay is weekly bi weekly monthly or yearly this calculator can help you figure out your after tax income once you enter your gross pay and additional details Use our take home pay

More picture related to How Much Would I Take Home After Tax 55000

How Much Will I Take Home If I Earn 55000 YouTube

https://i.ytimg.com/vi/6khlBdTaVQ0/maxresdefault.jpg

50 000 After Tax 2023 2024 Income Tax UK

https://www.income-tax.co.uk/images/50000-after-tax-salary-uk-2020.png

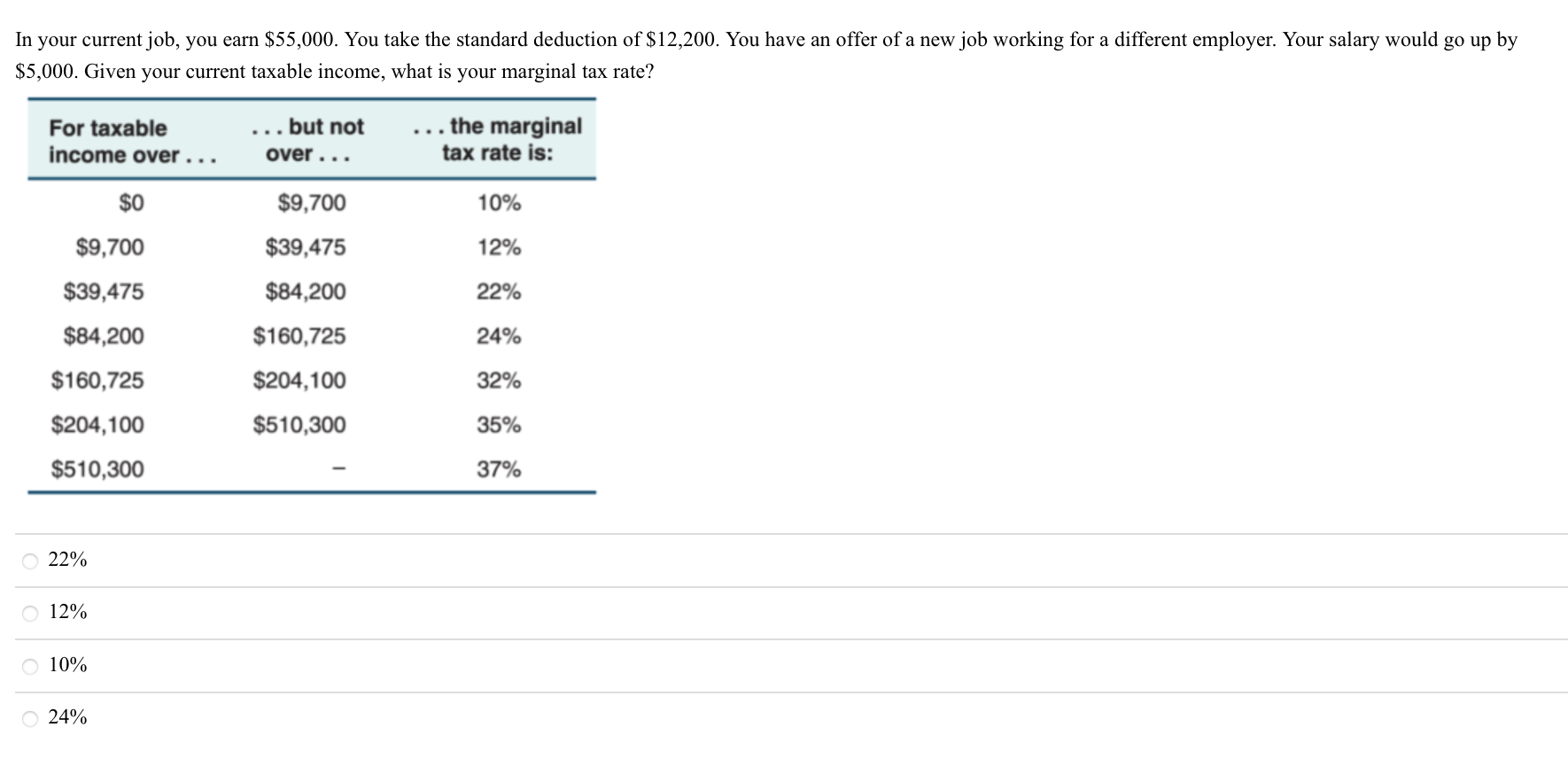

Solved In Your Current Job You Earn 55 000 You Take The Chegg

https://media.cheggcdn.com/media/fbe/fbef0580-4659-494b-b1d2-e746a890164d/phpyP2U27

If you earn 55 000 per year after tax and national insurance contributions you will have a net income of 3 412 45 per month for the tax year 2023 2024 This figure does not take into account any pension contributions Average salary data collected from gov uk Figures shown are full time after tax and national insurance If your salary is 55 000 then after tax and national insurance your take home net will be 42 457 40 This means that after tax your monthly take home will be 3 538 12 or 816 49 per week 163 30 per day and your hourly rate will be 20 41 if you re working 40 hours week Advanced options

In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you On a 55 000 salary your take home pay will be 41 703 40 after tax and National Insurance This equates to 3 475 28 per month and 801 99 per week If you work 5 days per week this is 160 40 per day or 20 05 per hour at 40 hours per week Take home pay does not consider pension contributions

Assume A Company s Income Statement For Year 12 Is As Follows AnswerData

https://answerdata.org/wp-content/uploads/2021/10/54d54cb69d67.png

Profit And Loss Account

https://valq.com/wp-content/uploads/8-types-of-profit-and-loss-income-statements-d.png

How Much Would I Take Home After Tax 55000 - The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336