How Much Will My Pay Be After Tax To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents Plug in your expected income deductions and credits and the calculator will quickly estimate your 2023 2024 federal taxes Taxable income 86 150 Effective tax rate 16 6 Estimated federal

How Much Will My Pay Be After Tax

How Much Will My Pay Be After Tax

https://g.foolcdn.com/editorial/images/443451/pay-stub.jpg

How Much Will My Puppy Weigh Full Grown Calculator Justagric

https://justagric.com/wp-content/uploads/2022/04/how-much-will-my-puppy-weigh-full-grown-calculator.jpg

How Much Will My Loan Cost Andes State Bank

https://www.andesstatebank.com/assets/images/NoCrop_900x1200/9349bfa13bdc43a29c7bfa6f7414b1cd.jpg

If you re an employee generally your employer must withhold certain taxes such as federal tax withholdings social security and Medicare taxes from your paycheck In addition you may The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

Self employed individuals earning up to 200 000 are subject to a combined Social Security and Medicare tax rate of 15 3 In comparison those earning over 200 000 are subject to a combined rate of 16 2 Updated on Dec 05 2023 Free tool to calculate your hourly and salary income after taxes deductions and exemptions Calculate Your Take Home Pay Salary Calculator Results If you are living in California and earning a gross annual salary of 72 020 or 6 002 per month the total amount of taxes and contributions that will be deducted from your salary is 16 442

More picture related to How Much Will My Pay Be After Tax

How Much Does A French Bulldog Weigh

https://knowhowcommunity.org/wp-content/uploads/2022/08/how-much-does-a-french-bulldog-weigh.jpg

How Much Will My Ssi Disability Benefits Be Disability Talk

https://www.disabilitytalk.net/wp-content/uploads/how-much-social-security-will-i-get-when-my-ssdi-becomes.jpeg

SEASON 2 EPISODE 13 How Much Will My Baby Cry When Sleep Training

https://mysleepingbaby.com/wp-content/uploads/2021/11/How-much-will-my-baby-cry-when-sleep-training-WP.png

If you make 55 000 a year living in the region of New York USA you will be taxed 11 959 That means that your net pay will be 43 041 per year or 3 587 per month Your average tax rate is 21 7 and your marginal tax rate is 36 0 This marginal tax rate means that your immediate additional income will be taxed at this rate To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year This number is the gross pay per pay period Subtract any deductions and payroll taxes from the gross pay to get net pay Don t want to calculate this by hand The PaycheckCity salary calculator will do the calculating for you

Unlimited companies employees and payroll runs for 1 low price All 50 states including local taxes and multi state calculations Federal forms W 2 940 and 941 Use PaycheckCity s free paycheck calculators withholding calculators and tax calculators for all your paycheck and payroll needs You can use our Income Tax Calculator to estimate how much you ll owe or whether you ll qualify for a refund Simply enter your taxable income filing status and the state you reside in to

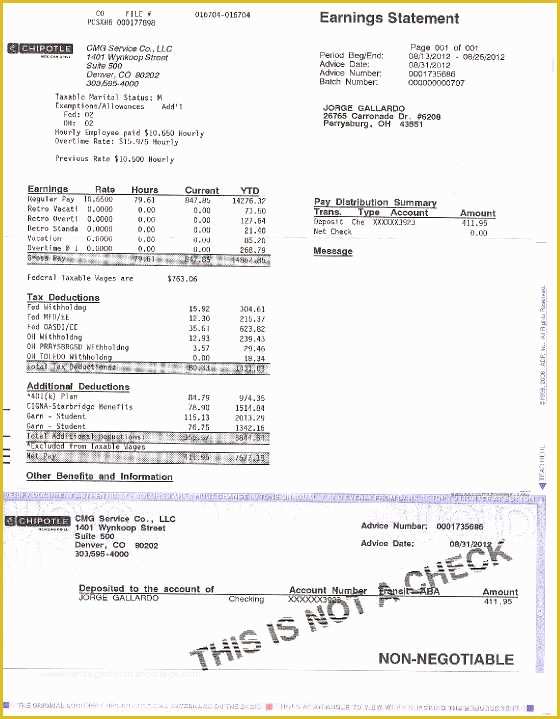

Free Download Pay Stub Rawasl

https://www.heritagechristiancollege.com/wp-content/uploads/2019/05/adp-paycheck-stub-template-free-of-adp-paycheck-stub-template-employer-and-pay-me-back-of-adp-paycheck-stub-template-free.jpg

How Much Will My Llc Pay In Taxes TaxesTalk

https://www.taxestalk.net/wp-content/uploads/pin-on-graphics-insider.jpeg

How Much Will My Pay Be After Tax - To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left hand table above In the Weekly hours field enter the number of hours you do each week excluding any overtime If you do any overtime enter the number of hours you do each month and the rate you get