How Much Will I Bring Home On 50000 FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336 Calculate your take home pay per paycheck for salary and hourly jobs after federal state local taxes Updated for 2024 tax year on Jul 06 2024 The self employed are taxed twice as much as regular employees The formula is Gross income Federal payroll tax rate Federal payroll tax liability Step 3 State income tax liability

How Much Will I Bring Home On 50000

How Much Will I Bring Home On 50000

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

House You Can Afford Based On Salary Housejulllg

https://i2.wp.com/sc.cnbcfm.com/applications/cnbc.com/resources/files/2017/01/18/chart_1_noheadlineaa_1024.jpg

What Kind Of Bug Did I Bring Home On This Plant R plantclinic

https://i.redd.it/octr75xppsn61.jpg

Step 3 enter an amount for dependents The old W4 used to ask for the number of dependents The new W4 asks for a dollar amount Here s how to calculate it If your total income will be 200k or less 400k if married multiply the number of children under 17 by 2 000 and other dependents by 500 Add up the total The aim of this 50 000 00 salary example is to provide you detailed information on how income tax is calculated for Federal Tax and State Tax We achieve this in the following steps The salary example begins with an overview of your 50 000 00 salary and deductions for income tax Medicare Social Security Retirement plans and so forth

Whether your pay is weekly bi weekly monthly or yearly this calculator can help you figure out your after tax income once you enter your gross pay and additional details Use our take home pay In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you

More picture related to How Much Will I Bring Home On 50000

How Camp Helped Me Live A Balanced Life

https://www.americasfinestsummercamps.com/wp-contents/uploads/2015/10/rdspsUTMrlXdz4jrAyADor2vbjs_17dBJcY6PO6UCDw.jpeg

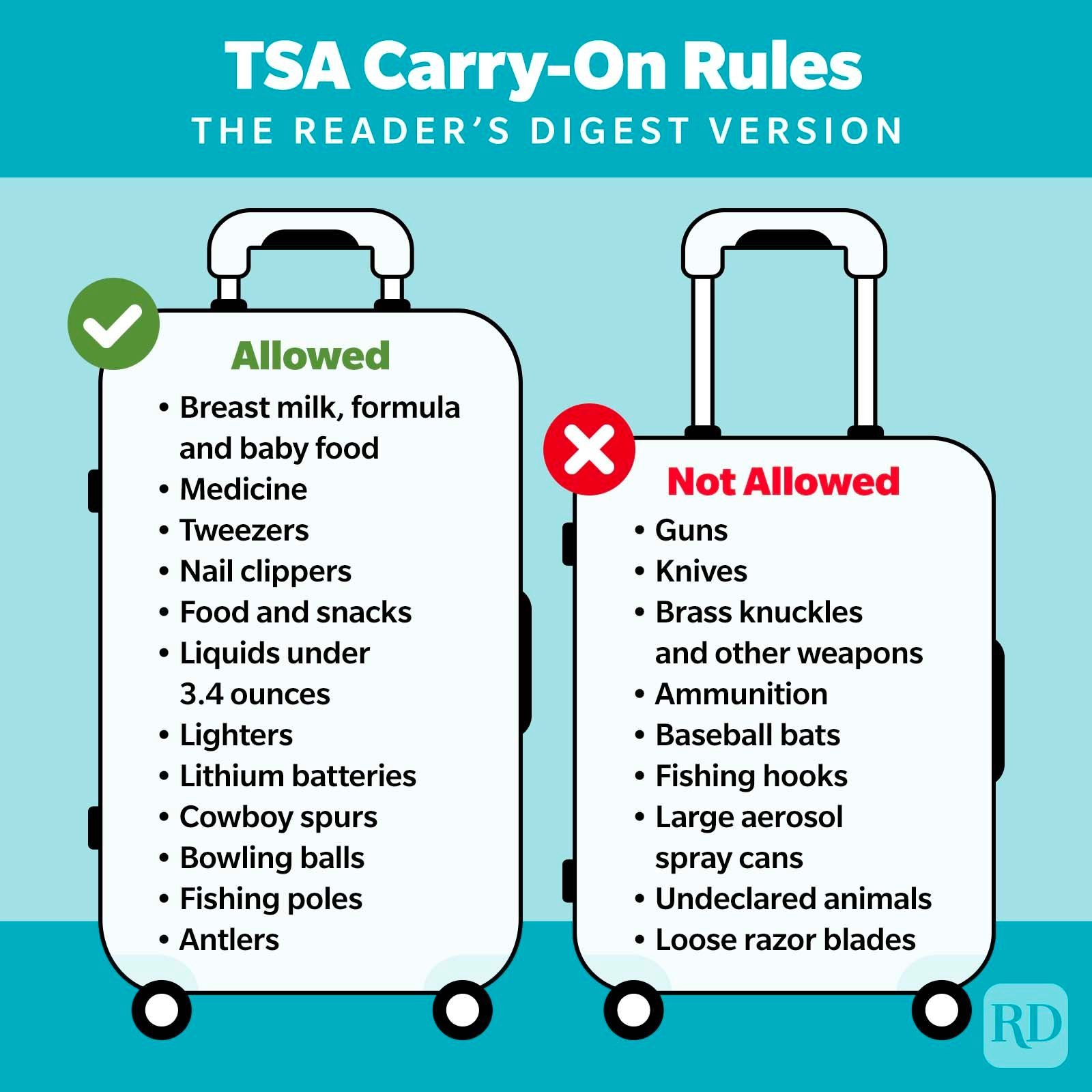

TSA Carry On Rules Items You Can And Can t Take On A Flight In 2023

https://www.rd.com/wp-content/uploads/2022/08/TSA-Carry-On-Rules-Infographic-GettyImages-1370947042.jpg?w=1600

Unstop Competitions Quizzes Hackathons Scholarships And

https://d8it4huxumps7.cloudfront.net/uploads/images/64ddb2aa12da7_how_to_answer_what_do_you_bring_to_the_company_1.jpg

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator 2014 42 786 2013 44 879 2012 41 086 Regardless of their filing status Kentuckians are taxed at a flat rate of 4 5 The state previously had progressive tax rates ranging from 2 to 6 but changed to a flat rate system during a tax reform in early 2018 You also have to pay local income taxes which Kentucky calls occupational taxes

2014 46 784 2013 46 337 2012 41 553 Every taxpayer in North Carolina will pay 4 75 of their taxable income in state taxes North Carolina has not always had a flat income tax rate though In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes 1 Check your tax code you may be owed 1 000s free tax code calculator 2 Transfer unused allowance to your spouse marriage tax allowance 3 Reduce tax if you wear wore a uniform uniform tax rebate 4 Up to 2 000 yr free per child to help with childcare costs tax free childcare 5

Bruce Springsteen Song Bring It On Home To Me Lyrics

https://www.traditionalmusic.co.uk/springsteen/png/bring-it-on-home-to-me-springsteen.png

Living Large On 50 000 A Year Get Ahead On A 50 000 Budget Action

https://actionecon.com/wp-content/uploads/2015/07/Living-Large-On-50000-A-Year-50000-Budget.jpg

How Much Will I Bring Home On 50000 - Take home pay 50 000 State income tax paid for single person 0 Marginal state income tax 2 Effective state income tax 0 Jordan Rosenfeld contributed to the reporting of this article