How Much Tax Will I Pay Employed Federal income tax breakdown For the 2024 tax year we estimate you will get back 0 00

Foreign Tax Credit This is a non refundable credit that reduces the double tax burden for taxpayers earning income outside the U S Children Child Tax Credit It is possible to claim up to 2 000 per child 1 400 of which is refundable The child tax credit starts to phase out once the income reaches 200 000 400 000 for joint filers Federal Income Tax 1099 Employees Independent contractors unlike W 2 employees will not have any federal tax deducted from their pay This means that because they are not considered employees they are responsible for their own federal payroll taxes also known as self employment tax

How Much Tax Will I Pay Employed

How Much Tax Will I Pay Employed

https://www.taxestalk.net/wp-content/uploads/what-is-self-employment-tax-rate-calculations-more-1.jpeg

How Much Tax Will I Owe Self Employed Accounting Firms In Luton L

https://taxtwerk.com/wp-content/uploads/2019/04/attractive-bandana-beautiful-1770366-e1556310169929-750x430.jpg

How Much Tax Will I Pay On 15000 Self Employed TaxesTalk

https://www.taxestalk.net/wp-content/uploads/how-much-tax-will-i-pay-on-15000-self-employed-uk-wallpaper.jpeg

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self employment tax capital gains tax and the net investment tax The provided information does not constitute financial tax or legal advice We strive to make the calculator perfectly accurate However users occasionally notify us If you work for yourself you need to pay the self employment tax which is equal to both the employee and employer portions of the FICA taxes 15 3 total Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay The result is that the FICA taxes you

Check the IRS website for the latest information about income taxes and your state tax website for state specific information Our calculator doesn t consider both 401k and IRA deductions due to As a 1099 earner you ll have to deal with self employment tax which is basically just how you pay FICA taxes The combined tax rate is 15 3 Normally the 15 3 rate is split half and half between employers and employees

More picture related to How Much Tax Will I Pay Employed

Employed And Self employed What Tax Will I Pay The Winchester

https://secureservercdn.net/166.62.112.107/04f.b9c.myftpupload.com/wp-content/uploads/2017/03/Im-employed-and-self-employed-what-tax-will-I-pay-3.png

How Much Tax You Pay Which

https://media.product.which.co.uk/prod/images/ar_2to1_1500x750/8dba57cad72f-how-much-tax-you-pay.jpg

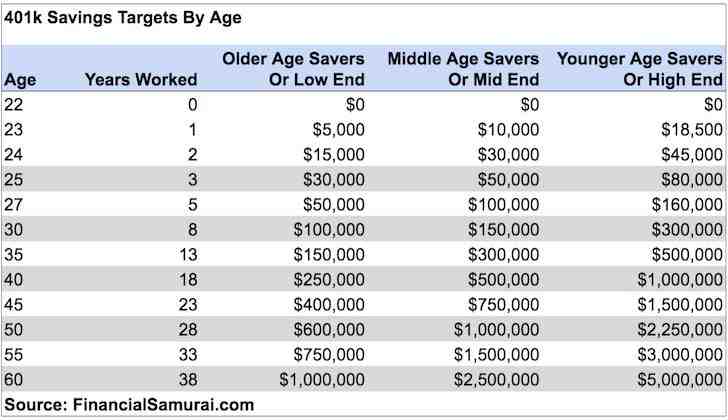

How Much Tax Will I Pay On My 401k Retirement News Daily

https://www.retirementnewsdailypress.com/wp-content/uploads/2021/12/How-much-tax-will-I-pay-on-my-401k.jpeg

The self employment tax rate is 15 3 This breaks out into 12 4 for Social Security tax and 2 9 for Medicare The self employment tax applies to your adjusted gross income If you are a high earner a 0 9 additional Medicare tax may also apply Step 5 Your net pay After calculating your total tax liability subtract deductions pre and post tax and any withholdings if applicable Tax year Employment status Filing status Gross income Rate 2025 2024 2023 2022 2021 2020 Employer Single Head of Household Up to 200 000 1 45 Married Jointly

[desc-10] [desc-11]

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

How Much Tax Will I Pay

https://www.zrivo.com/wp-content/uploads/2021/12/How-Much-Tax-Will-I-Pay.jpg

How Much Tax Will I Pay Employed - Check the IRS website for the latest information about income taxes and your state tax website for state specific information Our calculator doesn t consider both 401k and IRA deductions due to