How Much Tax Do I Pay On 60k Salary Age Enter the age you were on Jan 1 2024 Your age can have an effect on certain tax rules or deductions For example people aged 65 or older get a higher standard deduction 401 k

FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024 Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income This is the amount you have left over after you pay your Federal taxes Net Income Taxable Income Estimated Tax This does not account for state and local taxes

How Much Tax Do I Pay On 60k Salary

How Much Tax Do I Pay On 60k Salary

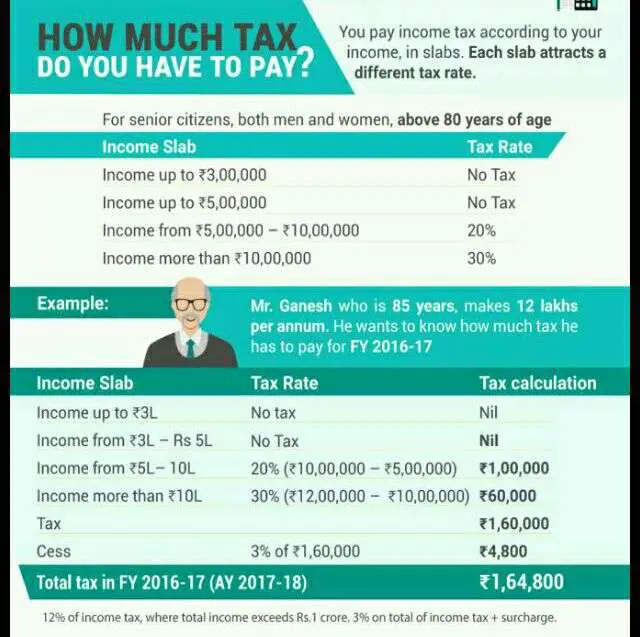

https://www.taxestalk.net/wp-content/uploads/nrinvestments-how-much-tax-do-you-have-to-pay.jpeg

How Much Tax Do You Pay On Overtime In South Africa Greater Good SA

https://gg.myggsa.co.za/1661758842261.png

How To Save Tax On F o Income How Much Tax Do I Pay On F O Income

https://i.ytimg.com/vi/KglOMlq7dJk/maxresdefault.jpg

37 609 351 or more 731 201 or more 365 601 or more 690 351 or more Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary Federal tax state tax Medicare as well as Social Security tax allowances are all taken into account and are kept up to date with 2024 25 rates The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336

What is a 60k after tax 60000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2021 tax return and tax refund calculations 46 567 50 net salary is 60 000 00 gross salary Use this tool to Estimate your federal income tax withholding See how your refund take home pay or tax due are affected by withholding amount Choose an estimated withholding amount that works for you Results are as accurate as the information you enter

More picture related to How Much Tax Do I Pay On 60k Salary

60k A Year Is How Much An Hour Full Financial Breakdown

https://www.moneyforthemamas.com/wp-content/uploads/2022/05/dave-ramsey-recommended-budget-percentages-60k-salary.jpg

How Much Home Mortgage Can I Afford MortgageInfoGuide

https://www.mortgageinfoguide.com/wp-content/uploads/heres-how-to-figure-out-how-much-home-you-can-afford.jpeg

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator The Tax Calculator uses tax information from the tax year 2023 to show you take home pay See where that hard earned money goes with Federal Income Tax Social Security and other deductions More information about the calculations performed is available on the page This is your total annual salary before any deductions have been made If

The tax brackets consist of the following marginal rates 10 15 25 28 33 35 and 39 6 Note From 2018 the new bracket rates are 10 12 22 24 32 35 and 37 Use our Salary Tax Calculator to get a full breakdown of your federal and state tax burden given your annual income and location FREE 2024 Salary Tax Calculator Federal income tax 7 660 State taxes Marginal tax rate5 85 Effective tax rate 4 88 New York state tax 3 413 Gross income 70 000 Total income tax 11 074 After Tax Income 58 926

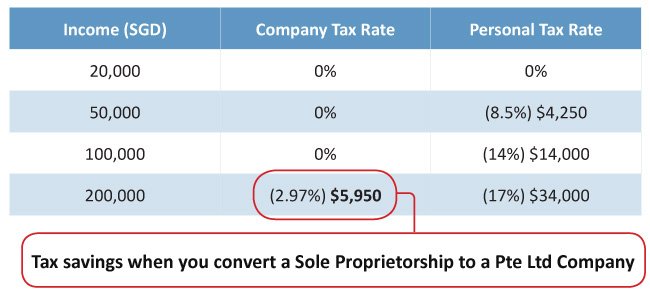

How Much Taxes Does A Sole Proprietor Pay SolarProGuide

https://www.solarproguide.com/wp-content/uploads/how-much-tax-do-i-pay-as-a-sole-trader-tax-walls.jpeg

How Much Tax Do I Pay TaxesTalk

https://www.taxestalk.net/wp-content/uploads/how-much-tax-do-i-pay-on-60000-income-tax-walls.jpeg

How Much Tax Do I Pay On 60k Salary - Use this tool to Estimate your federal income tax withholding See how your refund take home pay or tax due are affected by withholding amount Choose an estimated withholding amount that works for you Results are as accurate as the information you enter