How Much Tax Do I Pay Being Employed FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

Here s how you d calculate your self employment taxes Determine your self employment tax base Multiply your net earnings by 92 35 0 9235 to get your tax base 50 000 x 92 35 46 175 For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax If your monthly paycheck is 6000 372 goes to Social Security and 87 goes to Medicare leaving you with 6000 372 87 5541

How Much Tax Do I Pay Being Employed

How Much Tax Do I Pay Being Employed

https://www.gosimpletax.com/wp-content/uploads/side-hustle-earn-extra-money-making-side-job-side-HCGKHNC-min-scaled-1024x682.jpg

How Much Tax Do I Pay TaxesTalk

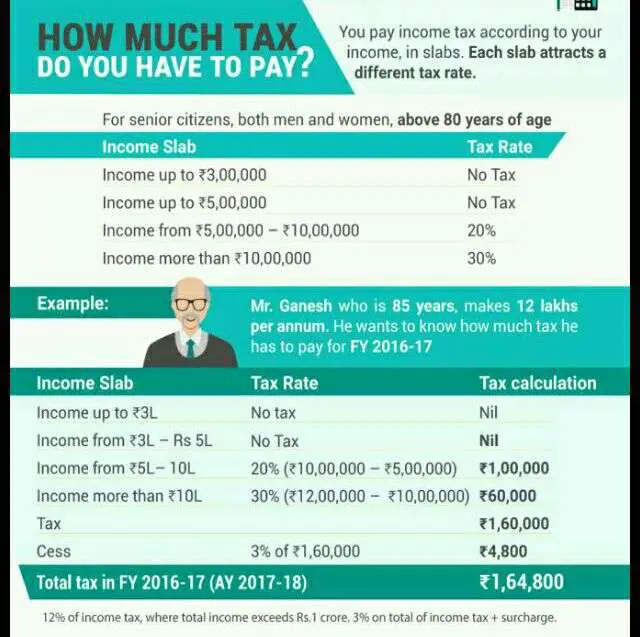

https://www.taxestalk.net/wp-content/uploads/nrinvestments-how-much-tax-do-you-have-to-pay.jpeg

How Much Tax Do I Have To Pay On Rental Income

https://morrisinvest.com/wp-content/uploads/2020/05/How-Much-Tax-Do-I-Have-to-Pay-on-Rental-Income.jpg

The self employment tax is 15 3 which is 12 4 for Social Security and 2 9 for Medicare Generally it applies to self employment earnings of 400 or more A 1099 tax calculator takes into account your income expenses and deductions to determine your tax liability By inputting your 1099 income along with any business expenses and deductions the calculator can provide an estimate of how much you owe in taxes Additionally a 1099 tax calculator can help you plan for future tax payments by

As your income goes up the tax rate on the next layer of income is higher When your income jumps to a higher tax bracket you don t pay the higher rate on your entire income You pay the higher rate only on the part that s in the new tax bracket 2023 tax rates for a single taxpayer For a single taxpayer the rates are When you work on a 1099 contract basis the IRS considers you to be self employed That means that in addition to income tax you ll need to pay self employment tax As of 2022 the self employment tax is 15 3 of the first 147 000 in net profits plus 2 9 of anything earned over that amount

More picture related to How Much Tax Do I Pay Being Employed

How Much Tax Do You Pay On Overtime In South Africa Greater Good SA

https://gg.myggsa.co.za/1661758842261.png

How Much Income Tax Do I Pay Use Our Calculator To Find Out GoodTo

https://cdn.mos.cms.futurecdn.net/sWGDyGD7ETtXVn6692vGyD-1200-80.jpg

How Much Tax Do I Need To Pay Taxwise Australia

https://taxwiseaustralia-14459.kxcdn.com/wp-content/uploads/2019/01/How-Much-Tax-Do-I-Need-To-Pay.png

Self employed individuals generally must pay self employment SE tax as well as income tax SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves If this is your first year being self employed you will need to estimate the amount of income you expect to earn for the year If you estimated your Age Enter the age you were on Jan 1 2024 Your age can have an effect on certain tax rules or deductions For example people aged 65 or older get a higher standard deduction 401 k

1 Review earnings to determine if you re required to file self employment taxes 2 Gather documentation for expenses and deductions 3 Use the self employment tax calculator to estimate your refund 4 Complete the self employment tax forms by the filing deadline Get started Estimate your US federal income tax for 2023 2022 2021 2020 2019 2018 2017 2016 or 2015 using IRS formulas The calculator will calculate tax on your taxable income only Does not include income credits or additional taxes Does not include self employment tax for the self employed Also calculated is your net income the amount you

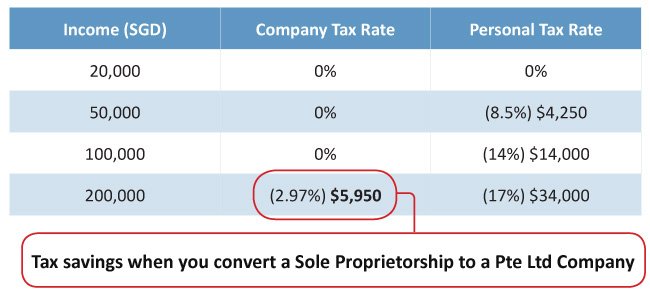

How Much Taxes Does A Sole Proprietor Pay SolarProGuide

https://www.solarproguide.com/wp-content/uploads/how-much-tax-do-i-pay-as-a-sole-trader-tax-walls.jpeg

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

How Much Tax Do I Pay Being Employed - The self employment tax rate for 2023 2024 is 15 3 of your net earnings It s made up of 12 4 for Social Security and 2 9 for Medicare 1 These taxes are often called the FICA tax which stands for Federal Insurance Contributions Act You ve probably seen FICA as a line item on a paystub at some point and wondered Who the heck is FICA