How Much Of My Paycheck Goes To Taxes Texas As your income goes up the tax rate on the next layer of income is higher When your income jumps to a higher tax bracket you don t pay the higher rate on your entire income You pay the higher rate only on the part that s in the new tax bracket 2023 tax rates for a single taxpayer For a single taxpayer the rates are

If you re an employee generally your employer must withhold certain taxes such as federal tax withholdings social security and Medicare taxes from your paycheck In addition you may Your paycheck could be slightly bigger in 2024 due to federal income tax bracket adjustments experts say However you should still review your federal and state withholdings throughout the year

How Much Of My Paycheck Goes To Taxes Texas

How Much Of My Paycheck Goes To Taxes Texas

https://i.pinimg.com/originals/9d/6c/42/9d6c422ef94480c9e65b62c8d3c0d4ae.jpg

Indiana Paycheck Taxes

https://www.patriotsoftware.com/wp-content/uploads/2021/08/how_much_employer_pays_payroll_tax-01.png

Where Does All Your Money Go Your Paycheck Explained

https://www.gannett-cdn.com/-mm-/1f66555fb4d7f329693b5f08f4e67628057c309f/c=0-26-2118-1223/local/-/media/2016/10/31/USATODAY/USATODAY/636135136112978940-paycheck.jpg?width=3200&height=1680&fit=crop

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year This number is the gross pay per pay period Subtract any deductions and payroll taxes from the gross pay to get net pay Don t want to calculate this by hand The PaycheckCity salary calculator will do the calculating for you Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

The actual amount of federal income tax that s deducted from your paycheck is based on your income and information from your W 4 such as whether you file as a single person or with your spouse and whether you re claiming any dependents The calculation also takes into account the tax brackets your income falls into How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000

More picture related to How Much Of My Paycheck Goes To Taxes Texas

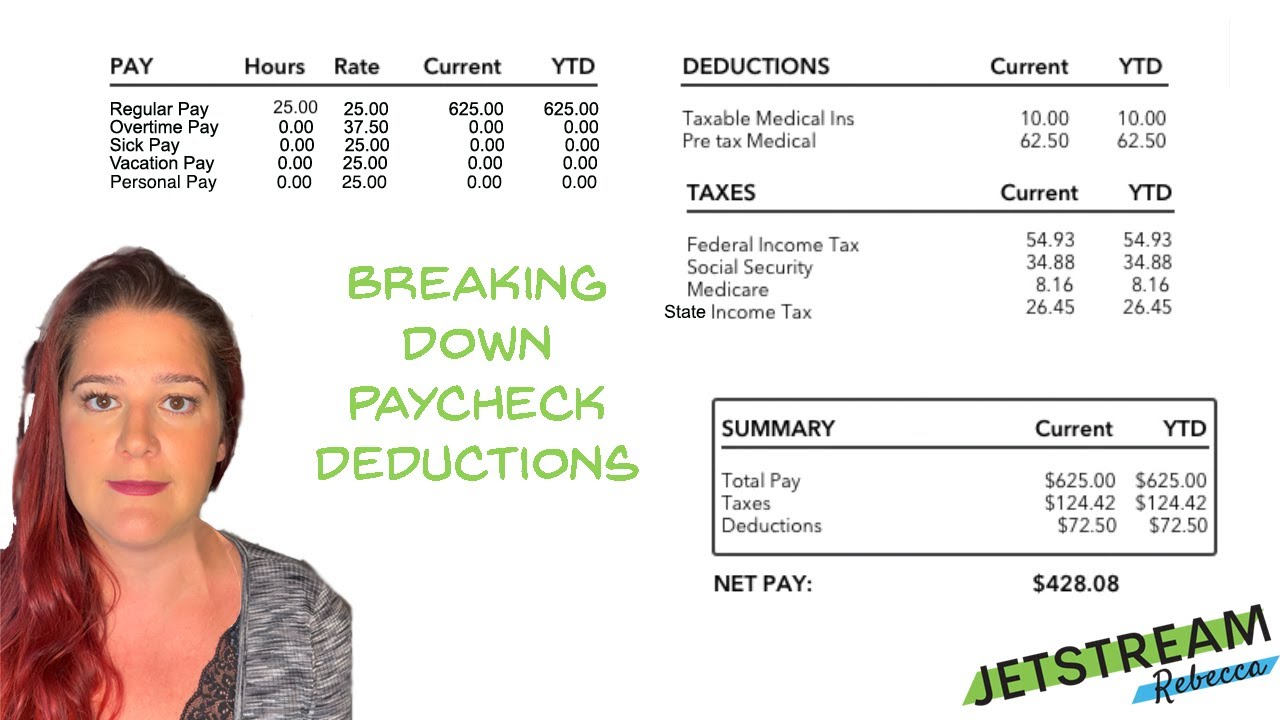

What Is Taken Out Of My Paycheck Paycheck Deductions Payroll Taxes

https://i.ytimg.com/vi/uDz023pfmhY/maxresdefault.jpg

How Much Of My Paycheck Goes To Taxes

https://media1.moneywise.com/a/8841/how-much-of-my-paycheck-goes-to-taxes_facebook_thumb_1200x628_v20200220123204.jpg

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

https://cloudfront-us-east-1.images.arcpublishing.com/morningstar/FMENQYIIVBCKDIIIWAAPXQI5RM.png

Social Security taxes are the 6 2 taken out of your paycheck each month up to 168 600 the 2024 taxable maximum while FICA refers to the combination of Social Security and Medicare taxes Thanks to inflation adjustments to 2024 federal income tax brackets more of your wages may be subject to lower tax rates than they were last year

For tax year 2021 the expanded child tax credit was 3 600 for children 5 and under and 3 000 for children ages 6 to 17 That s no longer the case Federal income taxes are paid in tiers For a single filer the first 10 275 you earn is taxed at 10 The next 31 500 you earn the amount from 10 276 to 41 775 is taxed at 15 Only the

How Much Does Government Take From My Paycheck Federal Paycheck

https://www.surepayroll.com/contentassets/2b05e761f6c24fcb8150cb0efd6aa690/how-much-federal-taxes-is-taken-out-of-my-paycheck.jpg

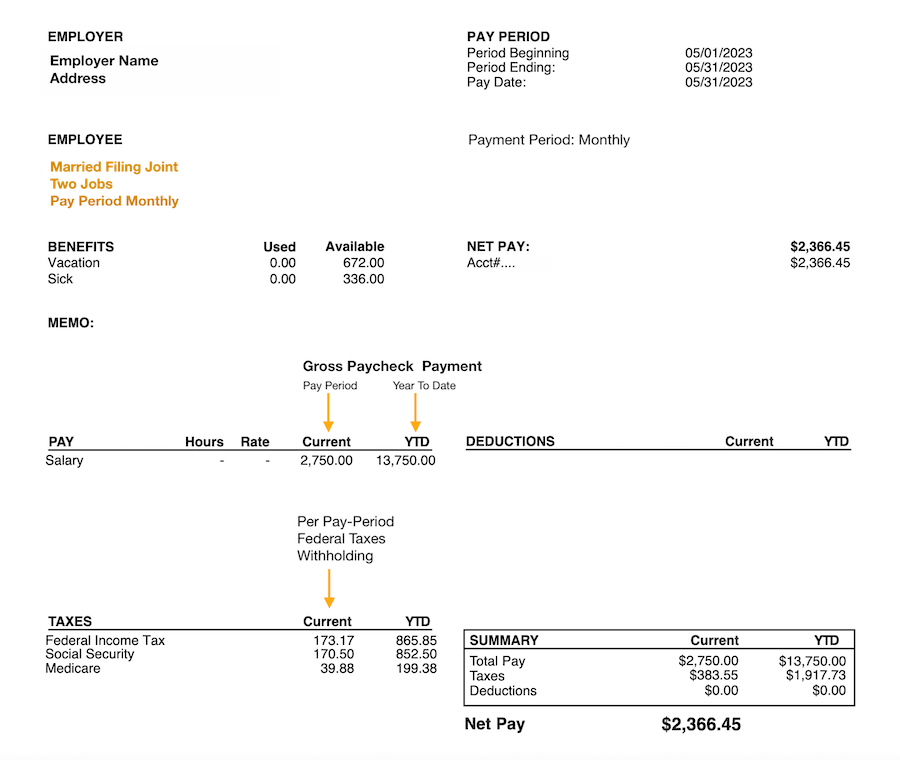

Paycheck Tax Withholding Calculator For W 4 Tax Planning

https://www.efile.com/image/paycheck-2-jobs-mfj.png

How Much Of My Paycheck Goes To Taxes Texas - The actual amount of federal income tax that s deducted from your paycheck is based on your income and information from your W 4 such as whether you file as a single person or with your spouse and whether you re claiming any dependents The calculation also takes into account the tax brackets your income falls into