How Much Is My Take Home Pay On 55000 So if you elect to save 10 of your income in your company s 401 k plan 10 of your pay will come out of each paycheck If you increase your contributions your paychecks will get smaller However making pre tax contributions will also decrease the amount of your pay that is subject to income tax

How much are your employees wages after taxes This powerful tool does all the gross to net calculations to estimate take home pay in all 50 states For more information see our salary paycheck calculator guide Looking for managed Payroll and benefits for your business Get a free quote If your employer calculates you monthly salary in this way the below calculator illustrates the amounts you should expect to pay in Federal Tax State Tax Medicare Social Security and so on The Tax and Take home example below for an annual salary of 55 000 00 is basically like a line by line payslip example

How Much Is My Take Home Pay On 55000

How Much Is My Take Home Pay On 55000

https://media1.moneywise.com/a/2762/take-home-pay-from-a-100000-salary_facebook_thumb_1200x628_v20220926135744.jpg

Take Home Pay THP Pengertian Hingga Komponennya

https://klikpajak.id/wp-content/uploads/2022/08/take-home-pay-942x628.jpg

What Will Your New Take Home Pay Be From July 2022 With The New

https://nicksweb.co.uk/wp-content/uploads/2022/03/take-home-pay-calculator-web-app-image.jpg

Net income or your take home pay is the amount of pay you ll actually receive including overtime pay and after taxes withholdings and deductions To calculate net income you ll subtract federal taxes deductions and withholdings from your gross pay Tax deductions can differ by state however everyone is subject to federal tax If you live in California and earn a gross annual salary of 72 280 or 6 023 per month your monthly take home pay will be 4 715 This results in an effective tax rate of 22 as estimated by our US salary calculator Click Calculate to apply your changes

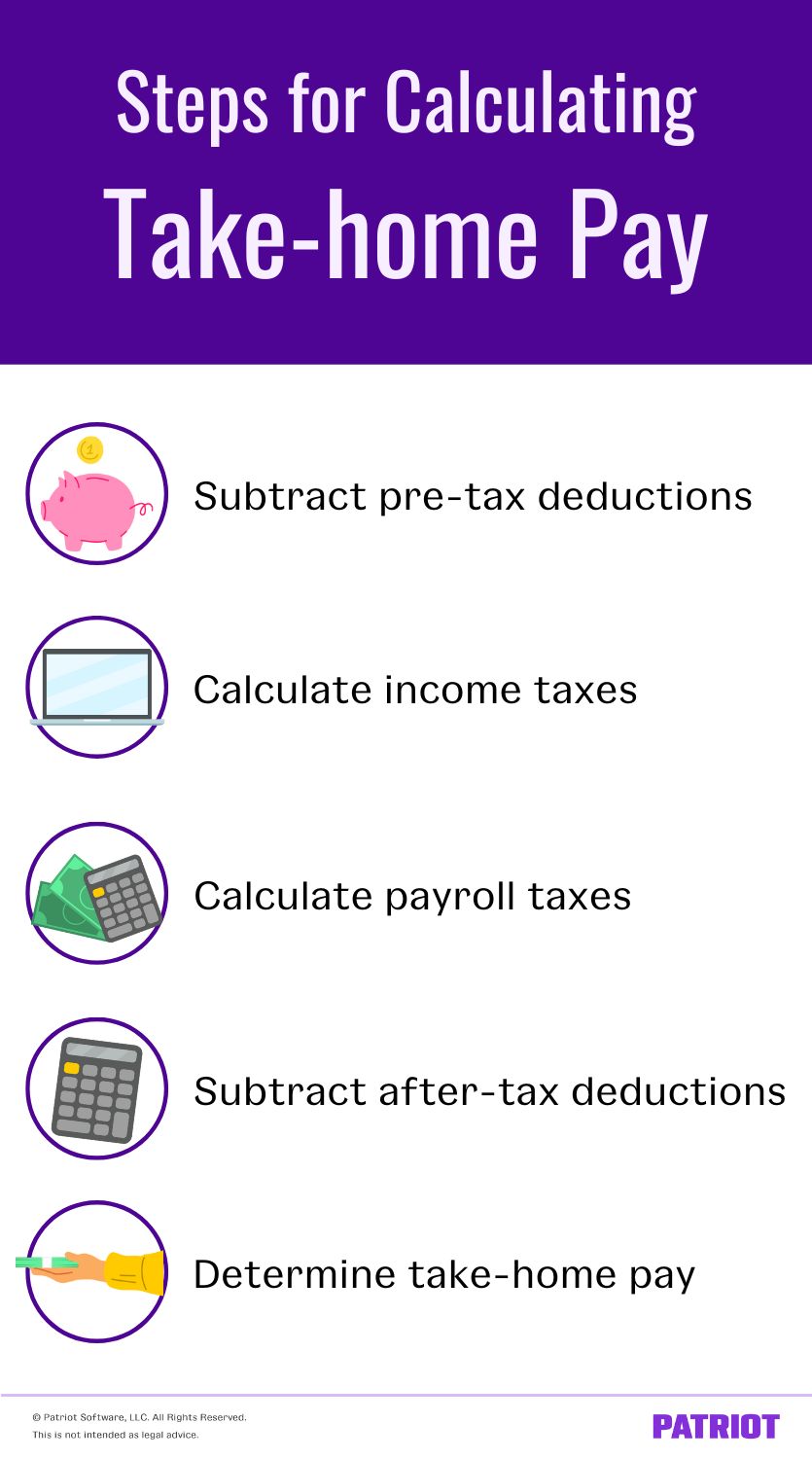

Paycheck Calculator Calculate your take home pay per paycheck for salary and hourly jobs after federal state local taxes Updated for 2025 tax year on Feb 14 2025 Understanding Your Take Home Pay Before Tax vs After Tax Income When planning your finances it s crucial to distinguish between before tax income gross pay and after tax income net pay Gross pay represents the total salary before any deductions such as federal and state taxes are applied This is the figure typically used in salary comparisons mortgage applications and for

More picture related to How Much Is My Take Home Pay On 55000

Sample Lesson Know Your Take Home Pay Printable Pdf Download Doc

https://www.pdffiller.com/preview/575/612/575612802/large.png

What Is My Take Home Income NerdWallet

https://assets.nerdwallet.com/blog/wp-content/uploads/2017/04/What-Is-My-Take-Home-Income.jpg

Take home Pay Definition Steps To Calculate Extra Partner For

https://www.patriotsoftware.com/wp-content/uploads/2022/09/take-home-pay.jpg

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator Your take home pay is the difference between your gross pay and what you get paid after taxes are taken out How much you re actually taxed depends on various factors such as your marital status

[desc-10] [desc-11]

Apa Itu Take Home Pay THP Ini Pengertian Dan Cara Menghitungnya

https://cdn-web.ruangguru.com/landing-pages/assets/hs/take home pay adalah.jpg

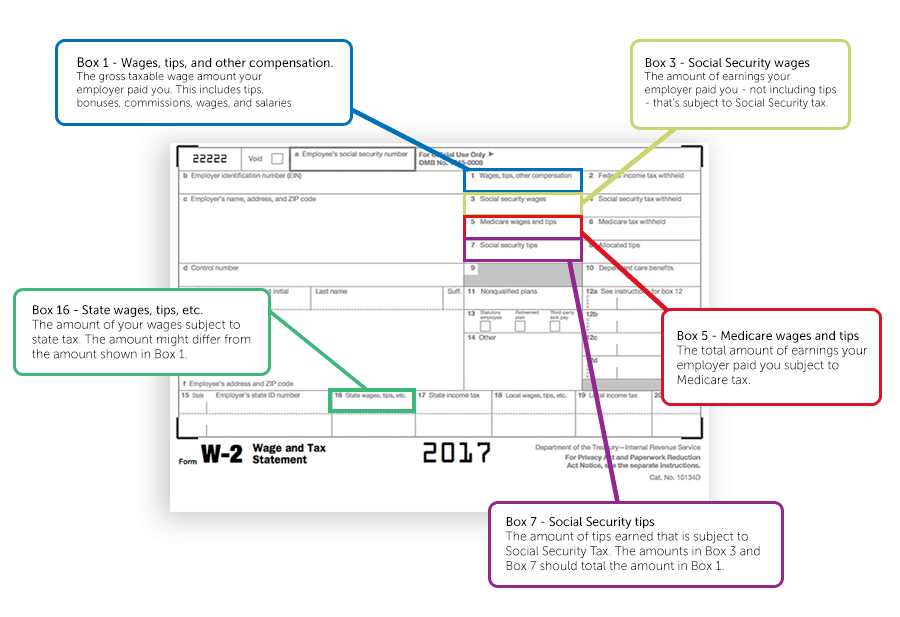

W 2 Vs Last Pay Stub What s The Difference 2024

https://apspayroll.com/wp-content/uploads/2022/11/w2-last-pay-stub-difference.png

How Much Is My Take Home Pay On 55000 - Paycheck Calculator Calculate your take home pay per paycheck for salary and hourly jobs after federal state local taxes Updated for 2025 tax year on Feb 14 2025