How Much Is 90k A Year Bi Weekly After Taxes To calculate annual salary to biweekly salary we use this formula Yearly salary 52 weeks 2 Time Full Time 40H week Monthly wage 90 000 yearly is 7 500 monthly Biweekly wage 90 000 yearly is 3 462 biweekly Weekly wage

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major Considerations in this Indiana State tax calculation Indiana calculates state and county taxes based on a flat percentage of Taxable Income Indiana applies 3 15 against your State Taxable income of 90 000 00 Marion county applies 0 0202 against your State Taxable income of 90 000 00

How Much Is 90k A Year Bi Weekly After Taxes

How Much Is 90k A Year Bi Weekly After Taxes

https://i.ytimg.com/vi/wfuSO6E2ZS4/maxresdefault.jpg

How Much House Can I Get Preapproved For If I Make 75K A Year

https://i.ytimg.com/vi/YIRgd_YzoeY/maxresdefault.jpg

Is 60k A Good Salary FIND OUT HERE YouTube

https://i.ytimg.com/vi/S6uDNZ6i5EY/maxresdefault.jpg

If your effective income tax rate was 25 then you would subtract 25 from each of these figures to estimate your biweekly paycheck Annual Income Biweekly pay 48 weeks Biweekly pay 50 weeks Biweekly pay 52 weeks 10 000 416 67 400 00 384 62 In this article we ll calculate estimates for a salary of 90 000 dollars a year for a taxpayer filing single We also have an article for 90 thousand dollars of combined earned income after taxes when declaring the filing status as married filing jointly 5 580 in social security tax 1 305 in medicare tax 12 060 in federal tax

POPULAR FORMS INSTRUCTIONS Form 1040 Individual Tax Return Form 1040 Instructions Instructions for Form 1040 Form W 9 Request for Taxpayer Identification Number TIN and Certification If you make 90 000 a year you would take home 32 45 an hour after taxes Your pre tax hourly wage was 43 27 But after paying 25 in taxes your after tax hourly wage would be 32 45 a year The amount you pay in taxes depends on many different factors But assuming a 25 to 30 tax rate is reasonable

More picture related to How Much Is 90k A Year Bi Weekly After Taxes

Kennedy 2025 Merchandise Jasmine Ogden

https://2024rfkjr.com/wp-content/uploads/2023/06/11986-504-1024x1024.jpg

2025 Schedule Calendar Alma M Hermansen

https://www.2024calendar.net/wp-content/uploads/2022/08/2024-calendar-templates-images-tipsographic-1.png

Biweekly Payroll Calendar 2025 Larry D Bryant

https://assets-global.website-files.com/5e6aa7798a5728055c457ebb/63a4b20e2be9e66ce3457fa0_WhatsApp Image 2022-12-21 at 5.08.15 PM.jpeg

It is essential to understand the income tax rate for a salary of 90 000 per year This helps you determine how much you pay as tax and what you earn after tax on a 90 000 salary The marginal tax rate on a salary income of USD 90 000 in the case of Idaho is 35 7 This is the tax rate applied to each level of income or tax bracket Let s say you work the traditional 40 hr workweek 90 000 52 weeks a year 1 731 a week 40 hours 43 27 an hour If you work 50 hrs a week which would be more typical for a salaried worker 90 000 52 weeks a year 1 731 a week 50 hrs 34 62 an hour

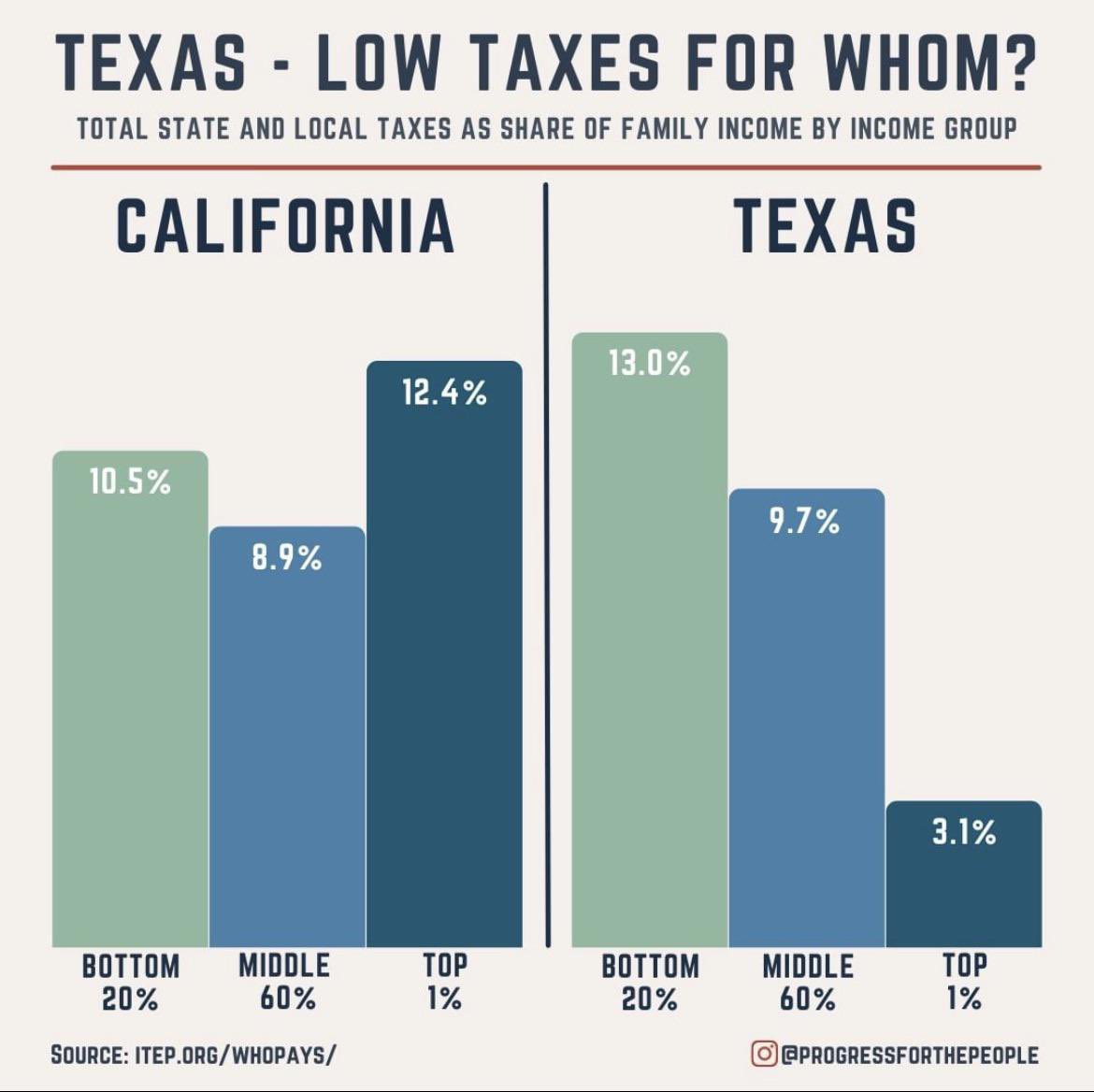

Divide weeks by 2 in order to covert them into biweekly pay periods If all time off is paid you would multiply your biweekly pay by 26 to convert it to the equivalent annual salary If you have 2 unpaid weeks off you would take off 1 biweekly pay period If you work 50 weeks a year are paid ever other week then multiply those biweekly pay If you make 90 000 a year living in the region of Texas USA you will be taxed 19 453 That means that your net pay will be 70 547 per year or 5 879 per month Your average tax rate is 21 6 and your marginal tax rate is 29 7 This marginal tax rate means that your immediate additional income will be taxed at this rate

Bi Weekly 2024 Tiff Shandra

https://moneybliss.org/wp-content/uploads/2022/11/biweekly-Money-Saving-Challenge-9-683x1024.jpg

Tax Free Texas 2025 Berny Kissie

https://brokeassstuart.com/wp-content/pictsnShit/2022/09/texas-v-ca-taxes.jpg

How Much Is 90k A Year Bi Weekly After Taxes - In the year 2024 in the United States 95 000 a year gross salary after tax is 74 065 annual 5 566 monthly 1 280 weekly 256 04 daily and 32 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 95 000 a year after tax in the United States Yearly