How Much Is 80 An Hour After Taxes If you make 80 an hour you would take home 124 800 a year after taxes Your pre tax salary was 166 400 But after paying 25 in taxes your after tax salary would be 124 800 a year The amount you pay in taxes depends on many different factors But assuming a 25 to 30 tax rate is reasonable

To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left hand table above In the Weekly hours field enter the number of hours you do each week excluding any overtime If you do any overtime enter the number of hours you do each month and the rate you get The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

How Much Is 80 An Hour After Taxes

How Much Is 80 An Hour After Taxes

https://qph.fs.quoracdn.net/main-qimg-2edec23e04a4c7bc23d96cdb19de9168

40000 A Year Is How Much An Hour After Taxes Can You Live

https://tightfinance.com/wp-content/uploads/2023/06/TIGHT-FINANCE-1-2.webp

How Much Does An Engagement Ring Setting Cost Cheapest Buying Save 62

https://i.shgcdn.com/afc56d34-755b-492c-bb95-9070617915bb/-/format/auto/-/preview/3000x3000/-/quality/lighter/

Step 3 enter an amount for dependents The old W4 used to ask for the number of dependents The new W4 asks for a dollar amount Here s how to calculate it If your total income will be 200k or less 400k if married multiply the number of children under 17 by 2 000 and other dependents by 500 Add up the total Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

How do I calculate hourly rate First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52 Next divide this number from the annual salary For example if an employee has a salary of 50 000 and works 40 hours per week the hourly rate is 50 000 2 080 40 x 52 24 04 Hourly Paycheck Calculator Use this calculator to help you determine your paycheck for hourly wages First enter your current payroll information and deductions Then enter the hours you expect

More picture related to How Much Is 80 An Hour After Taxes

Paul McCartney In Glastonbury BBC Audience Complains Beatles Legend

https://i3.wp.com/static.independent.co.uk/2022/06/22/15/GettyImages-51000356.jpg

Spotify Is Still Angry At Apple Engadget

https://s.yimg.com/os/creatr-uploaded-images/2020-08/e21fab70-e7b3-11ea-bfd7-1836169d9794

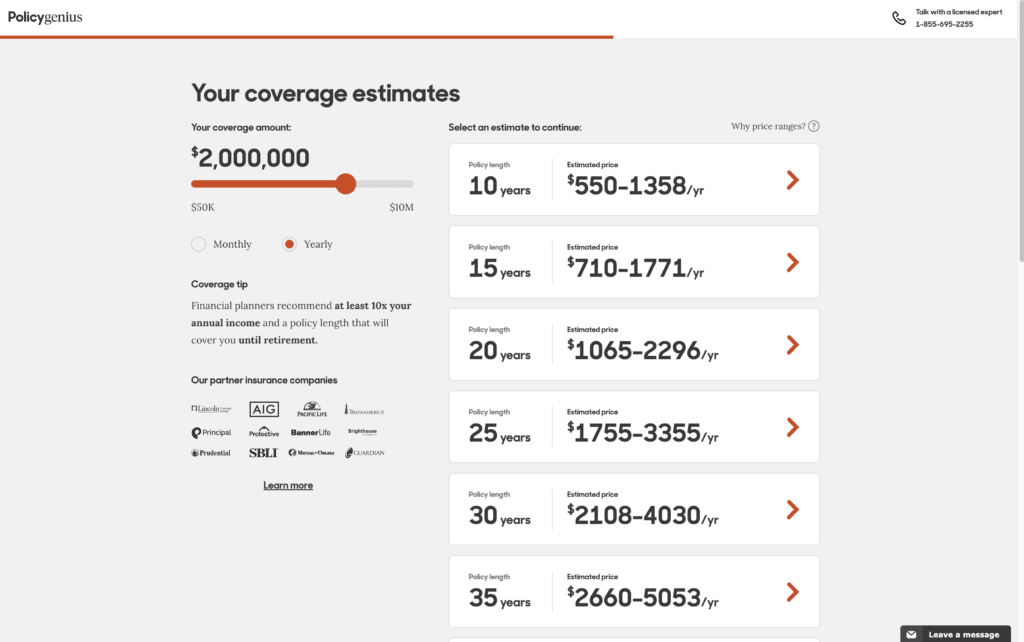

How Much Is 2 Million Life Insurance

https://www.goodfinancialcents.com/wp-content/uploads/2022/04/Cost-of-2-Million-Life-Insurane-with-Policy-Genius-Annual-pay-1024x642.png

Employers pay California unemployment tax on the first 7 000 SUI ETT and 145 600 SDI of an employee s wages New employers pay at a rate of 3 4 SUI Experienced employers pay at a rate of 1 5 6 2 SUI 0 0 0 1 ETT Unemployment tax in California should be paid quarterly via the Employment Development Department Taxes aren t determined by age so you will never age out of paying taxes Basically if you re 65 or older you have to file a return for tax year 2023 which is due in 2024 if your gross income is 15 700 or higher If you re married filing jointly and both 65 or older that amount is 30 700 If you re married filing jointly and only one of you is 65 or older that amount is 29 200

Enter Your Earnings Information Wages to convert Time period for those wages Hourly Weekly Bi Weekly Semi Monthly Monthly Quarterly Annually Hours worked per week Effective tax rate Above wages are Untaxed Before Tax After Tax Medicare tax is calculated as your gross earnings times 1 45 Unlike the Social Security tax there is no annual limit to the Medicare tax Starting in 2013 an additional Medicare tax of 0 9 is withheld on all gross earnings paid in excess of 200 000 in a calendar year

How Much Is Your Time Worth ShimSpine

https://www.shimspine.com/wp-content/uploads/2016/11/FamilyFunStandUpPaddling.jpg

13 Dollars An Hour 40 Hours A Week After Taxes Marx Langdon

https://qph.fs.quoracdn.net/main-qimg-e04739cbbcf836628ffc558f19035be9

How Much Is 80 An Hour After Taxes - Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major