How Much Is 75k Bi Weekly After Taxes Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

Biweekly wage 2 Weekly wage For a wage earner who gets paid hourly we can calculate the biweekly salary from the formula above Remembering that the weekly wage is the hourly wage times the hours worked per week Biweekly wage 2 Hourly wage Hours per week We can also express the first formula in terms of the daily wage The table below details how Federal Income Tax is calculated in 2024 The Federal Income Tax calculation includes Standard deductions and Personal Income Tax Rates and Thresholds as detailed in the Federal Tax Tables published by the IRS in 2024 Federal Tax Calculation for 75k Salary Annual Income 2024 75 000 00

How Much Is 75k Bi Weekly After Taxes

How Much Is 75k Bi Weekly After Taxes

https://i.ytimg.com/vi/WDH2oQ-AL3k/maxresdefault.jpg

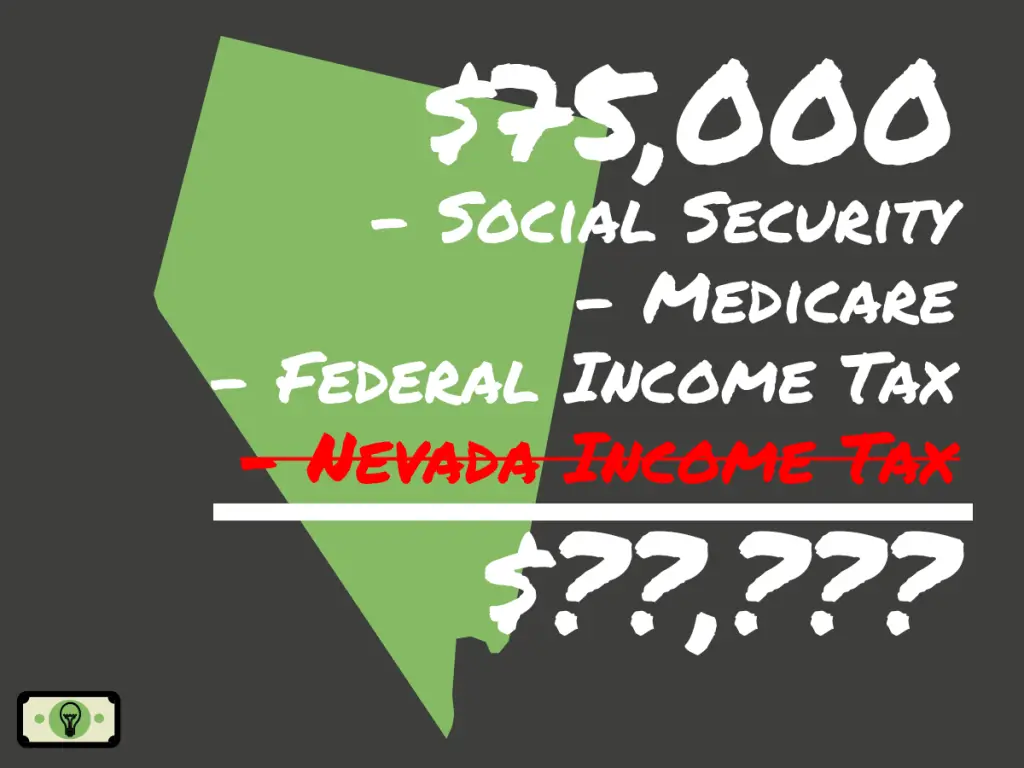

75K Dollars Salary After Taxes In Nevada single Smart Personal Finance

https://smartpersonalfinance.info/wp-content/uploads/2022/09/nv-75000-after-taxes-sm-1024x768.png

75 000 A Year Is How Much An Hour And Best Jobs To Give You 75K

https://radicalfire.com/wp-content/uploads/2022/09/75000-A-Year-Is-How-Much-An-Hour-and-Best-Jobs-To-Give-You-75K.jpg

Hourly wage calculator A yearly salary of 75 000 is 2 885 every 2 weeks So a biweekly salary of 2 885 in the US Convert year salary to biweekly paycheck on salary hourly If you make 75 000 a year living in the region of Texas USA you will be taxed 15 006 That means that your net pay will be 59 995 per year or 5 000 per month Your average tax rate is 20 0 and your marginal tax rate is 29 7 This marginal tax rate means that your immediate additional income will be taxed at this rate

In the year 2024 in the United States 75 000 a year gross salary after tax is 59 995 annual 4 521 monthly 1 040 weekly 207 97 daily and 26 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 75 000 a year after tax in the United States If you re interested in The easy way to calculate this is to divide the annual salary of 75 000 by 26 pay periods every other week for 52 weeks in the year That equals 2 885 biweekly Use the chart below to divide by a different number of weeks per year Some jobs like teachers have the option of selecting a higher pay during the school year and no pay during the

More picture related to How Much Is 75k Bi Weekly After Taxes

bonus getoutofdebt GOOD 10k 15k 25k 50k 75k debtfree

https://i.pinimg.com/736x/23/94/41/2394413ba850ba0d6b9b759348ee9ca2--skinny-wrap--months.jpg

Velocity Austin Baseball Weekly V 10 How To Save 75K Part II YouTube

https://i.ytimg.com/vi/_q5ZDk-dtco/maxresdefault.jpg

Bambi 51 9k 75k KASA HOME On Twitter I Love Them Too Much Https

https://pbs.twimg.com/media/Fa7lO5nX0AAbL2X?format=jpg&name=large

How much is 75k biweekly after taxes Calculating your take home pay after taxes can seem like a daunting task but with a basic understanding of the tax system and some simple calculations you can easily determine how much you will bring home from a biweekly salary of 75 000 If you make 75 000 a year you will make 5 769 23 a month before taxes assuming you are working full time Each month after taxes you will make approximately 4 326 92 A full time worker or employee works at least 40 hours a week If you work either more or fewer hours this amount will vary slightly

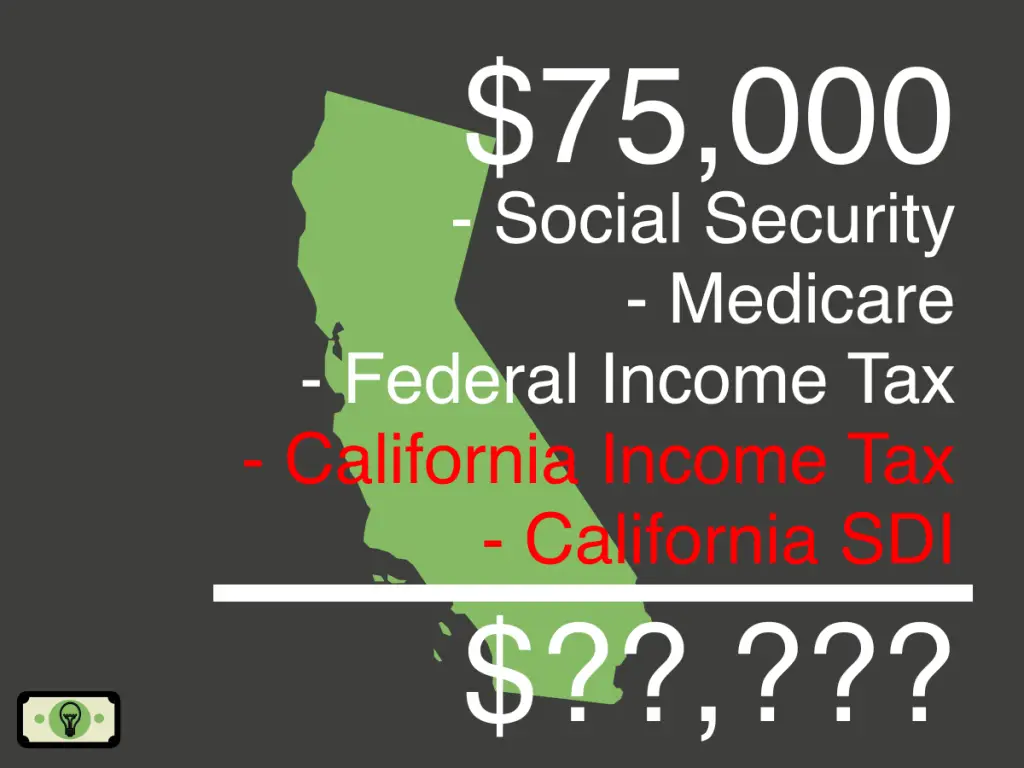

Consist of Social Security tax and Medicare tax Your employer will withhold 6 2 of your taxable income for Social Security tax from each of your paychecks and 1 45 in Medicare tax Your employer matches these amounts so the total contribution is double that Any earnings that single filers heads of household and qualifying widow er s have In this article we ll calculate estimates for a salary of 75 000 dollars a year for a taxpayer filing single We also have an article for 75 thousand dollars of combined earned income after taxes when declaring the filing status as married filing jointly 4 650 in social security tax 1 087 5 in medicare tax 8 760 in federal tax

75K Salary After Taxes In California single 2023 Smart Personal

https://smartpersonalfinance.info/wp-content/uploads/2022/08/ca-75000-after-taxes-2-sm-1024x768.png

75000 A Year Is How Much An Hour Good Salary Money Bliss

https://moneybliss.org/wp-content/uploads/2021/11/75000-a-year.jpg

How Much Is 75k Bi Weekly After Taxes - If you make 75 000 a year living in the region of Texas USA you will be taxed 15 006 That means that your net pay will be 59 995 per year or 5 000 per month Your average tax rate is 20 0 and your marginal tax rate is 29 7 This marginal tax rate means that your immediate additional income will be taxed at this rate