How Much Is 75000 After Taxes In Illinois Overview of Illinois Taxes Illinois has a flat income tax of 4 95 which means everyone s income in Illinois is taxed at the same rate by the state No Illinois cities charge a local income tax on top of the state income tax though

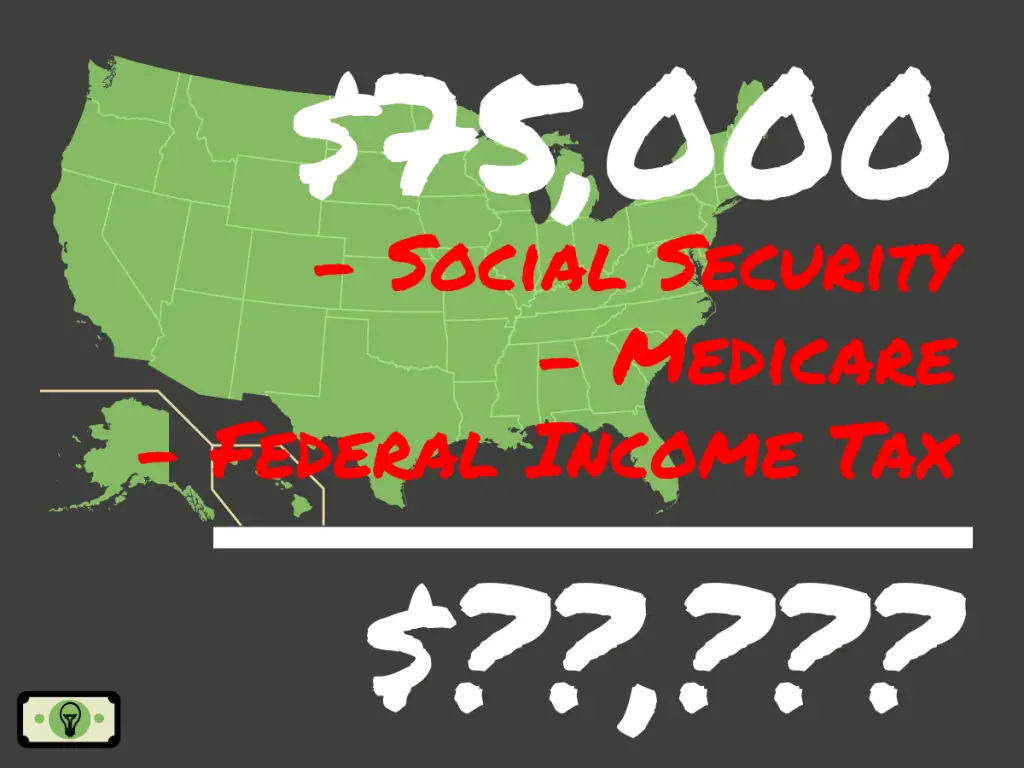

The taxes that are taken into account in the calculation consist of your Federal Tax Illinois State Tax Social Security and Medicare costs that you will be paying when earning 75 000 00 Our Illinois State Tax Calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 75 000 00 and The tax calculation below shows exactly how much Illinois State Tax Federal Tax and Medicare you will pay when earning 75 000 00 per annum when living and paying your taxes in Illinois The 75 000 00 Illinois tax example uses standard assumptions for the tax calculation

How Much Is 75000 After Taxes In Illinois

How Much Is 75000 After Taxes In Illinois

https://www.moneyforthemamas.com/wp-content/uploads/2022/06/dave-ramsey-recommended-budget-percentages-for-70000-salary.jpg

Basketball 75 000 Dollars A Day

https://4.bp.blogspot.com/-7i9vV1RK5G4/ToX_b13QMyI/AAAAAAAAAB8/6lSHxv1GgiQ/s1600/Pile-of-Money.jpg

If You Make 75 000 A Year Or Less You ll Be Taxed At A Much Higher

https://s.yimg.com/ny/api/res/1.2/CN7qPYzFH4KYvc1DnMs8GA--/YXBwaWQ9aGlnaGxhbmRlcjt3PTk2MDtoPTY0MA--/https://media.zenfs.com/en-US/homerun/hello_giggles_454/4d900872d570d2da8371627f7502c2d0

This Illinois salary after tax example is based on a 75 000 00 annual salary for the 2025 tax year in Illinois using the State and Federal income tax rates published in the Illinois tax tables The 75k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month week day and hour Before Tax vs After Tax Income In the U S the concept of personal income or salary usually references the before tax amount called gross pay For instance it is the form of income required on mortgage applications is used to determine tax brackets and is used when comparing salaries

After tax a salary of 75 000 in Illinois will be approximately 56 282 per year or 4 690 per month Here are some answers to related questions What tax bracket is 75000 a year 75 000 falls into the 22 tax bracket How much is 80000 salary after Calculate your federal and state taxes with this Illinois Income Tax Calculator Get accurate annual net pay estimations based on 75 000 income and filing status

More picture related to How Much Is 75000 After Taxes In Illinois

75000 A Year Is How Much An Hour Good Salary Money Bliss

https://moneybliss.org/wp-content/uploads/2021/11/75000-a-year.jpg

Is 75 000 A Year A Good Salary Frugalvana

https://frugalvana.com/wp-content/uploads/2022/10/Is-75000-A-Year-a-Good-Salary.jpg

How Much Is 1 Tb Of Storage Storables

https://storables.com/wp-content/uploads/2023/06/how-much-is-1-tb-of-storage-1688016896.jpg

What is a 75k after tax 75000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2025 tax return and tax refund calculations 57 407 07 net salary is 75 000 00 gross salary The result is that the FICA taxes you pay are still only 6 2 for Social Security and 1 45 for Medicare How Your Paycheck Works Deductions Federal income tax and FICA tax withholding are mandatory so there s no way around them unless your earnings are very low However they re not the only factors that count when calculating your

[desc-10] [desc-11]

How Much Is 75 000 A Year After Taxes filing Single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-75000-dollars-sm-2-1024x768.png

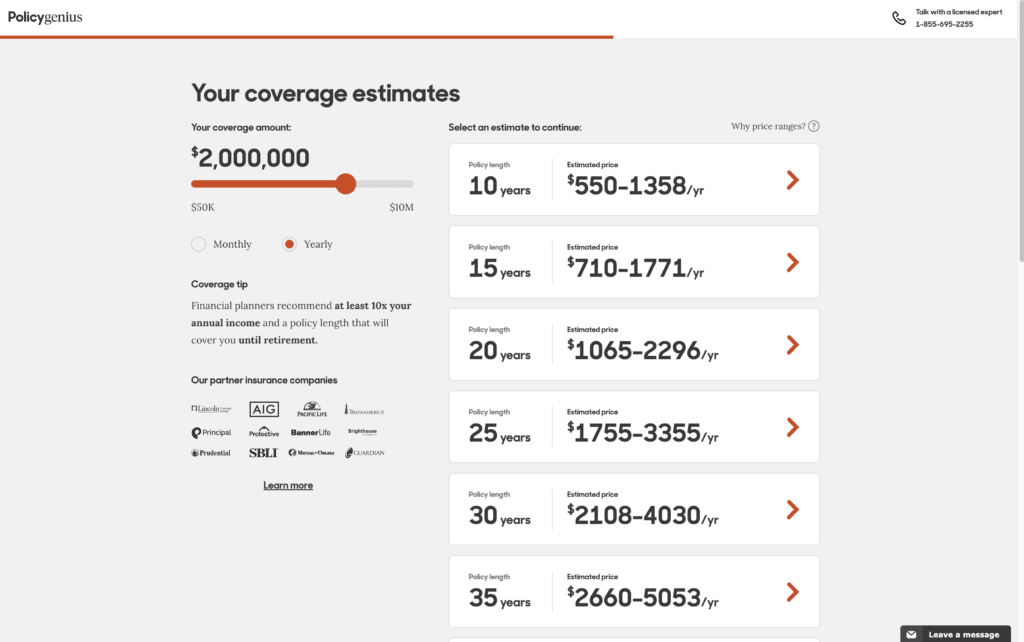

How Much Is 2 Million Life Insurance

https://www.goodfinancialcents.com/wp-content/uploads/2022/04/Cost-of-2-Million-Life-Insurane-with-Policy-Genius-Annual-pay-1024x642.png

How Much Is 75000 After Taxes In Illinois - [desc-14]