How Much Is 65000 A Year Per Week After Tax In the year 2024 in the United States 65 000 a year gross salary after tax is 52 960 annual 3 999 monthly 919 69 weekly 183 94 daily and 22 99 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 65 000 a year after tax in the United States Yearly

FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024 How much is 65 000 a Week After Tax in the United States In the year 2024 in the United States 65 000 a week gross salary after tax is 2 087 170 annual 166 680 monthly 38 334 weekly 7 667 daily and 958 34 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 65 000 a

How Much Is 65000 A Year Per Week After Tax

How Much Is 65000 A Year Per Week After Tax

https://moneybliss.org/wp-content/uploads/2021/11/65000-a-year.jpg

65 000 A Year Is How Much An Hour An Hourly Perspective

https://michaelryanmoney.com/wp-content/uploads/2022/11/65000-a-Year-is-How-Much-an-Hour.jpg

How Much Does An Engagement Ring Setting Cost Cheapest Buying Save 62

https://i.shgcdn.com/afc56d34-755b-492c-bb95-9070617915bb/-/format/auto/-/preview/3000x3000/-/quality/lighter/

Use our US salary calculator to find out your net pay and how much tax you owe based on your gross income salaryafter tax Salary After Tax Home Calculators 26 Working weeks per year 52 Working days per week 5 Working hours per week 40 0 Show Taxes Monthly Gross Income 5 781 69 368 2 668 1 334 266 80 33 35 Tax Due An individual who receives 50 937 50 net salary after taxes is paid 65 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security per week per day and per hour etc years is how much an hour Answer is 33 56 assuming you work roughly 40 hours per week or you may want to know how much 65k a

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator Summary If you make 65 000 a year living in Australia you will be taxed 12 892 That means that your net pay will be 52 108 per year or 4 342 per month Your average tax rate is 19 8 and your marginal tax rate is 34 5 This marginal tax rate means that your immediate additional income will be taxed at this rate

More picture related to How Much Is 65000 A Year Per Week After Tax

Average Job Salaries 2021 Reddit

https://img.buzzfeed.com/buzzfeed-static/static/2021-12/16/16/asset/f3cbb960f29e/sub-buzz-7356-1639672459-1.jpg

Spending On Health Care In Oregon Soars 40 In Eight Years Report Says

https://oregoncapitalchronicle.com/wp-content/uploads/2023/08/money-cash-getty-2048x1402.jpg

The Circle Graph Shows How A Family Budgets Its Annual Income If The

https://us-static.z-dn.net/files/dd6/566da305e9aca635b53c10da268474ed.png

Enter how much you earn per year Pro rata Part time hours Add Overtime After tax personal contributions Carry forward Superannuation 52 weeks year 26 fortnights year Edit INCOME TAX Australian income is levied at progressive tax rates Tax bracket start at 0 known as the tax free rate and increases progressively up to 45 After Tax If your salary is 65 000 then after tax and national insurance you will be left with 46 750 This means that after tax you will take home 3 896 every month or 899 per week 179 80 per day and your hourly rate will be 31 25 if you re working 40 hours week Scroll down to see more details about your 65 000 salary

Residents of Connecticut are taxed at a variable tax rate that depends on their income If you file as Single or Married Filing Separately the tax rate is 3 00 on taxable income of 10 000 or less 5 00 for up to 50 000 5 50 for up to 100 000 6 00 for up to 200 000 6 50 for up to 250 000 6 90 for up to 500 000 and 6 99 for over 500 000 2015 60 413 2014 54 916 2013 53 937 On the state level you can claim allowances for Illinois state income taxes on Form IL W 4 Your employer will withhold money from each of your paychecks to go toward your Illinois state income taxes Illinois doesn t have any local income taxes

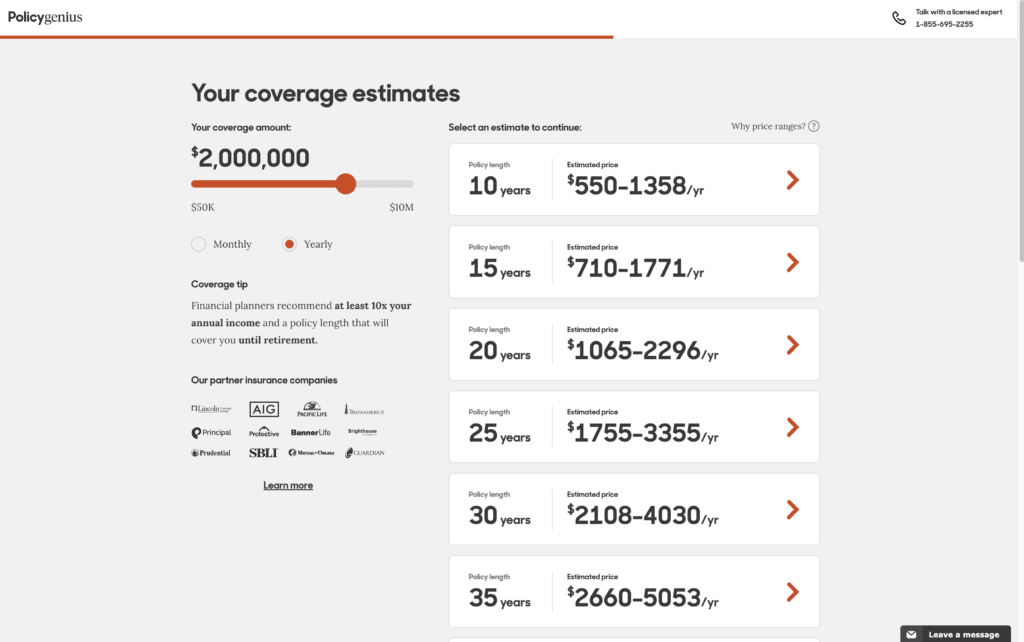

How Much Is 2 Million Life Insurance

https://www.goodfinancialcents.com/wp-content/uploads/2022/04/Cost-of-2-Million-Life-Insurane-with-Policy-Genius-Annual-pay-1024x642.png

Are You Job Hunting And Wondering About The Pay 60 000 A Year Is How

https://i.pinimg.com/originals/a6/ae/4a/a6ae4a631fe6cdbe1791be901d5d80c4.png

How Much Is 65000 A Year Per Week After Tax - Use our US salary calculator to find out your net pay and how much tax you owe based on your gross income salaryafter tax Salary After Tax Home Calculators 26 Working weeks per year 52 Working days per week 5 Working hours per week 40 0 Show Taxes Monthly Gross Income 5 781 69 368 2 668 1 334 266 80 33 35 Tax Due