How Much Is 65000 A Year After Taxes In California Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

Your employer withholds a 6 2 Social Security tax and a 1 45 Medicare tax from your earnings after each pay period Take note Individuals earning over 200 000 as well as joint filers over 250 000 and those married but filing separately with incomes above 125 000 also pay a 0 9 Medicare surtax The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336

How Much Is 65000 A Year After Taxes In California

How Much Is 65000 A Year After Taxes In California

https://moneybliss.org/wp-content/uploads/2021/11/65000-a-year.jpg

65000 A Year Is How Much An Hour Good Salary Or No Money Bliss

https://moneybliss.org/wp-content/uploads/2021/11/65000-a-year-1.jpg

65 000 After Tax CA 2022 Income Tax Calculator Canada

https://incomeaftertax.com/65000-after-tax-ca.jpg?15

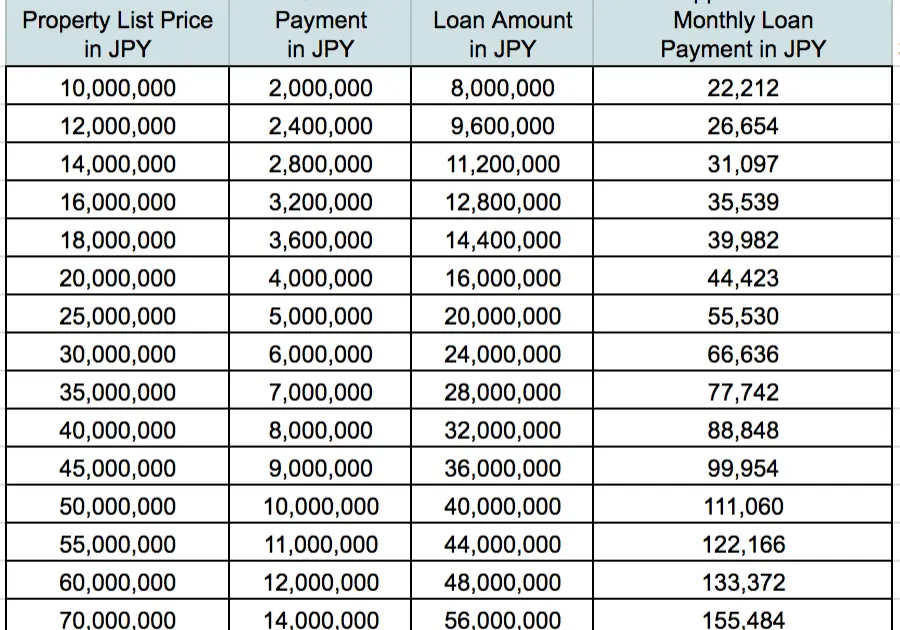

Filing 65 000 00 of earnings will result in 4 972 50 being taxed for FICA purposes California State Tax Filing 65 000 00 of earnings will result in 2 300 84 of your earnings being taxed as state tax calculation based on 2024 California State Tax Tables This results in roughly 13 414 of your earnings being taxed in total although California Income Tax Calculator 2023 2024 Learn More On TurboTax s Website If you make 70 000 a year living in California you will be taxed 10 448 Your average tax rate is 10 94 and your

FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024 65k Salary After Tax in California 2024 This California salary after tax example is based on a 65 000 00 annual salary for the 2024 tax year in California using the State and Federal income tax rates published in the California tax tables The 65k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month week day and hour

More picture related to How Much Is 65000 A Year After Taxes In California

65000 A Year Is How Much An Hour Full Financial Analysis Savoteur

https://savoteur.com/wp-content/uploads/2022/06/65000ishowmuchayear-768x461.jpg

How Much Tax Is Taken Out Of Paycheck In Texas TaxesTalk

https://www.taxestalk.net/wp-content/uploads/see-what-a-100k-salary-looks-like-after-taxes-in-your-state.jpeg

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Top 10 16 An Hour Is How Much A Year After Taxes That Will Change Your

https://www.investopedia.com/thmb/CZmdffwGUlSMqlDUrD6ye6BNS60=/1731x1098/filters:no_upscale():max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg

What is 53 886 50 as a gross salary An individual who receives 53 886 50 net salary after taxes is paid 65 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security Let s look at how to calculate the payroll deductions in the US How to calculate Tax Medicare and Social Security on a 65 000 00 salary Calculate your monthly take home pay in 2024 that s your 2024 monthly salary after tax with the Monthly California Salary Calculator A quick and efficient way to compare monthly salaries in California in 2024 review income tax deductions for monthly income in California and estimate your 2024 tax returns for your Monthly Salary in

65 000 00 Salary Income Tax Calculation for California This tax calculation produced using the CAS Tax Calculator is for a single filer earning 65 000 00 per year The California income tax example and payroll calculations are provided to illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year when filing a tax return in California for 65 000 00 with Given you file as a single taxpayer 65 000 will net you 50 451 34 after federal and California state income taxes This means you pay 14 548 66 in taxes on an annual salary of 65 000 dollars Your average tax rate will be 22 38 and your marginal rate will be 38 55 Income taxes depend on your filing status

How Much Income To Qualify For 400 000 Mortgage MortgageInfoGuide

https://www.mortgageinfoguide.com/wp-content/uploads/how-much-mortgage-can-i-afford-if-i-make-65000-a-year-hwmch.png

44 000 A Year Is How Much An Hour

https://savvybudgetboss.com/wp-content/uploads/2022/04/40000-a-year-after-taxes.png

How Much Is 65000 A Year After Taxes In California - For example let s look at a salaried employee who is paid 52 000 per year If this employee s pay frequency is weekly the calculation is 52 000 52 payrolls 1 000 gross pay If this employee s pay frequency is semi monthly the calculation is 52 000 24 payrolls 2 166 67 gross pay