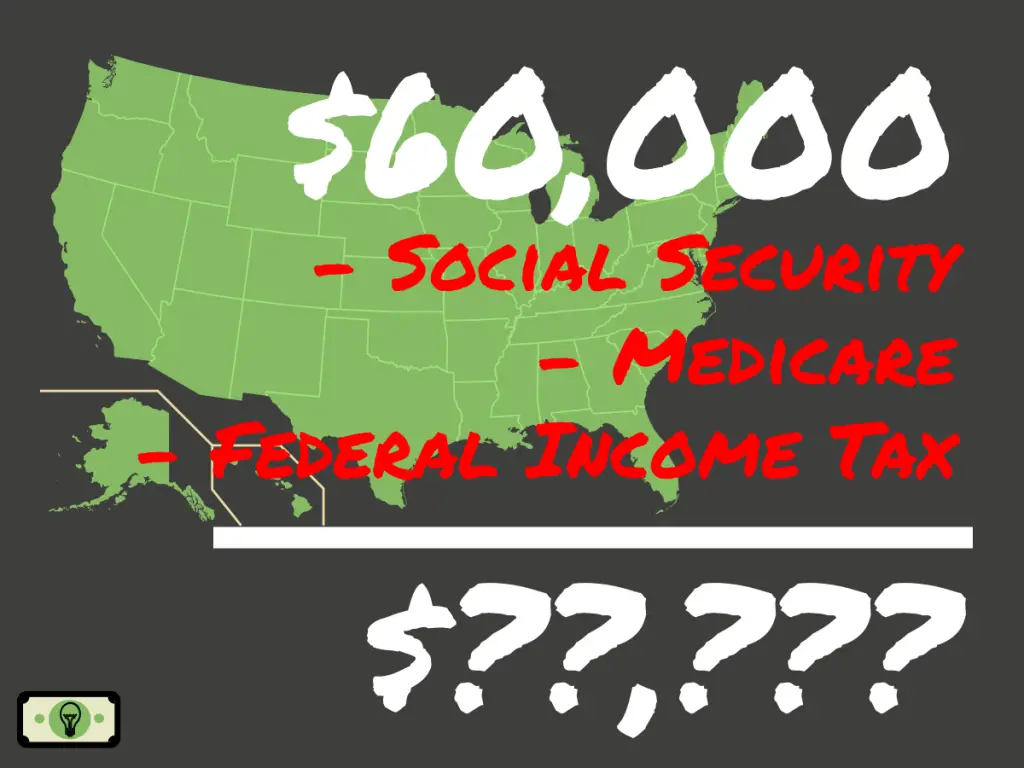

How Much Is 60000 Monthly After Taxes The result is that the FICA taxes you pay are still only 6 2 for Social Security and 1 45 for Medicare How Your Paycheck Works Deductions Federal income tax and FICA tax withholding are mandatory so there s no way around them unless your earnings are very low However they re not the only factors that count when calculating your

Before reviewing the exact calculations in the 60 000 00 after tax salary example it is important to first understand the setting we used in the US Tax calculator to produce this salary example Answer is 30 98 assuming you work roughly 40 hours per week or you may want to know how much 60k a year is per month after taxes Answer In the year 2025 in the United States 60 000 a year gross salary after tax is 49 442 annual 3 738 monthly 859 61 weekly 171 92 daily and 21 49 hourly gross based on the information provided in the calculator above

How Much Is 60000 Monthly After Taxes

How Much Is 60000 Monthly After Taxes

https://michaelryanmoney.com/wp-content/uploads/2022/11/60000-a-Year-is-How-Much-an-Hour2.jpg

Everything You Should Know About Filing Taxes Together

https://www.newlywedsonabudget.com/wp-content/uploads/2023/01/166948654_m.jpg

How Much Is 60 000 A Year After Taxes filing Single 2023 SPFi

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-60000-dollars-sm-2-1024x768.png

When analyzing a 60 000 a month after tax salary the associated hourly earnings can be calculated Take home NET hourly income 212 09 assuming a 40 hour work week To answer 60 000 a month is how much an hour divide the annual amount by 2 080 52 weeks 40 hours resulting in an hourly income of 212 09 Tax Year 2025 2026 If you live in California and earn a gross annual salary of 72 280 or 6 023 per month your monthly take home pay will be 4 715 This results in an effective tax rate of 22 as estimated by our US salary calculator

Calculate your net pay after taxes federal taxes state taxes and FICA deductions instantly Paycheck Tax Calculator twice a month your tax withholding may be slightly higher per paycheck compared to weekly or biweekly This is because the taxes are spread across fewer paychecks 24 per year Gross pay per month 60 000 12 After taxes deductions insurance etc I take home about 825 weekly which works out to 43 000 excluding retirement savings after this it s more like 38 000 YMMV due to many factors I don t have children and not married so I pay a lot more taxes than a parent would but also don t have the associated expenses of higher insurance

More picture related to How Much Is 60000 Monthly After Taxes

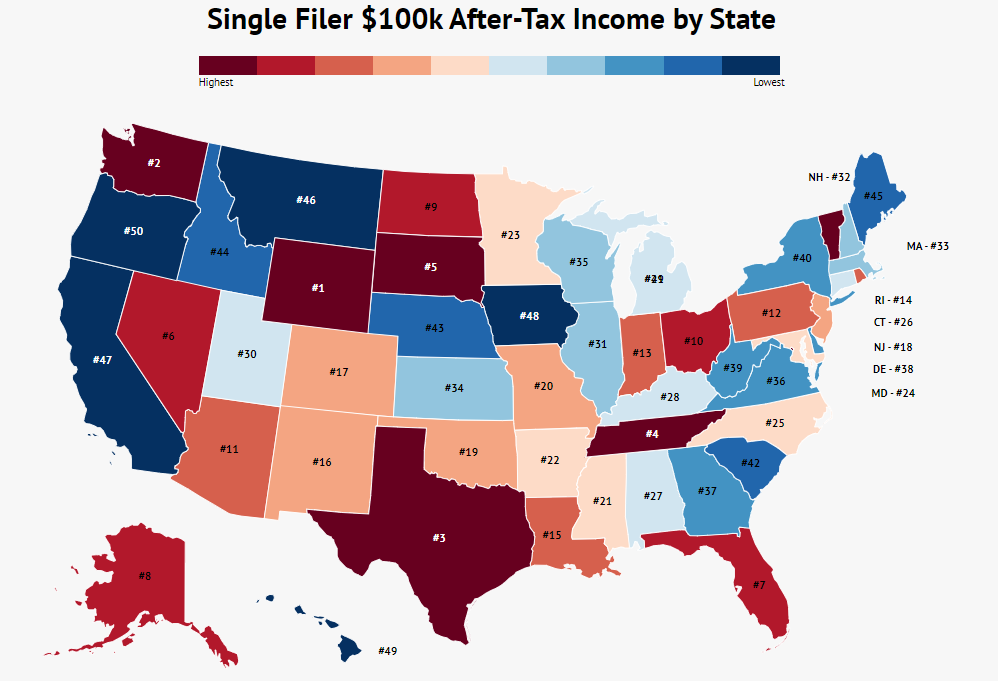

100k After Tax Income By State 2023 Zippia

https://www.zippia.com/wp-content/uploads/2023/03/single-filer-after-tax-income.png

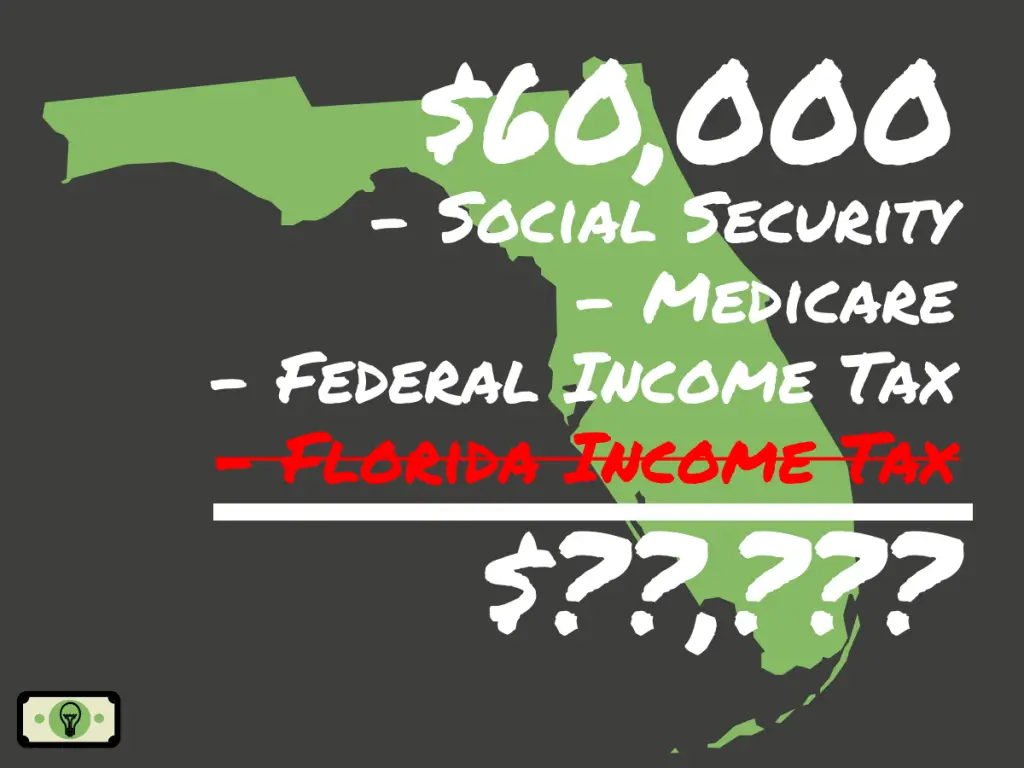

60 000 Dollars Salary After Taxes In Florida single 2023 SPFi

https://smartpersonalfinance.info/wp-content/uploads/2022/09/fl-60000-after-taxes-sm-1024x768.png

8 Money Moves People Who Make Less Than 60 000 Year Should Make This

https://i.pinimg.com/originals/a7/71/d8/a771d8caa21297578ff5e0a37c223094.jpg

Remember to account for self employment taxes 15 3 in US and business expenses which aren t part of gross income calculations How accurate are these calculations Results are estimates excluding tax specifics and deductions Actual paychecks may vary based on local tax laws benefits enrollment and other payroll factors An annual salary of 60 000 is equivalent to approximately 3 517 50 per month after taxes This estimate assumes a standard workweek of 40 hours and 52 weeks in a year resulting in 2 080 work hours annually To calculate the monthly pay after taxes we can follow these steps

[desc-10] [desc-11]

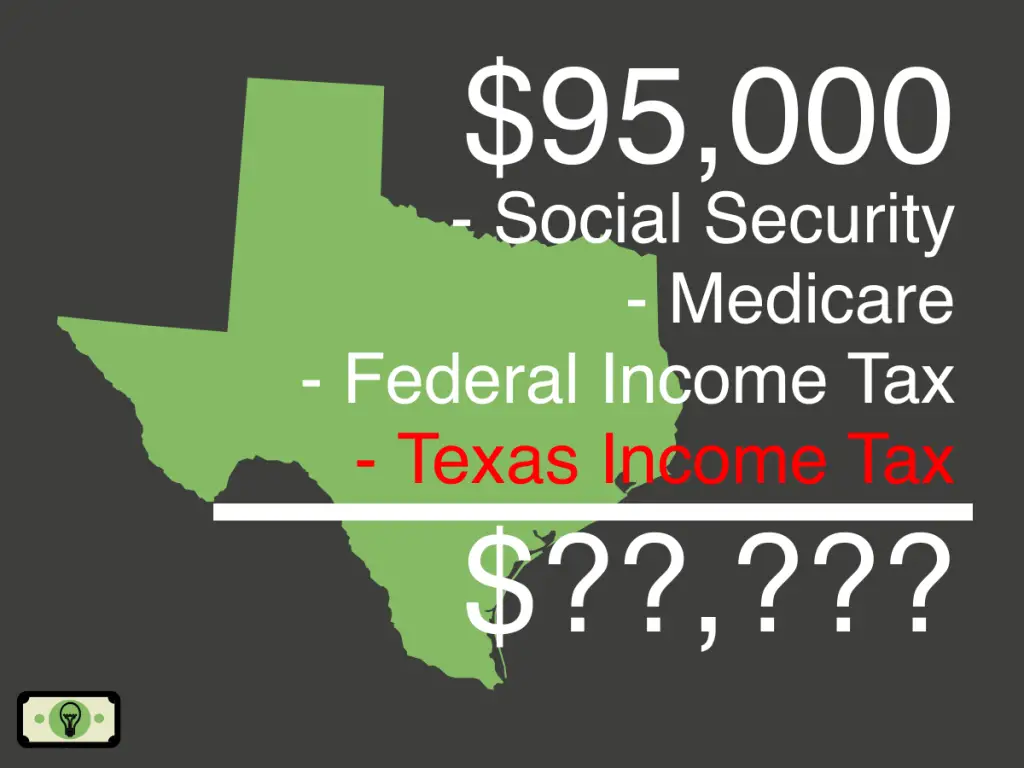

95K Salary After Taxes In Texas single 2013 Smart Personal Finance

https://smartpersonalfinance.info/wp-content/uploads/2022/08/tx-95000-after-taxes-sm-1024x768.png

/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg)

Annual Income After Taxes AndreyKhana

https://www.investopedia.com/thmb/uFc4kI6IuMx2N8iYCE-cQziNwwg=/1101x1101/smart/filters:no_upscale()/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg

How Much Is 60000 Monthly After Taxes - [desc-14]