How Much Is 55k Biweekly After Taxes FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

Use our US salary calculator to find out your net pay and how much tax you owe based on your gross income salaryafter tax Salary After Tax Home Calculators Jobs 12 Biweekly payments per year 26 Working weeks per year 52 Working days per week 5 Working hours per week 40 0 Gross Income 69 368 5 781 2 668 1 334 Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly They are used to fund social Security and Medicare For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax

How Much Is 55k Biweekly After Taxes

How Much Is 55k Biweekly After Taxes

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2018/01/mortgage-rates-january-2-GettyImages-588954686-1920x1152.jpg

Biweekly Pay Schedule Template Inspirational List Of Synonyms And

https://i.pinimg.com/originals/73/e5/19/73e519320e03e1a2db0330e552482dd1.jpg

I Have Almost 55k Followers On Instagram And No Brands Have Contacted

https://harshadkale.com/wp-content/uploads/2022/04/main-qimg-9f8a23ad1450a8845349140bfe11316a-lq.jpg

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator The table below details how Federal Income Tax is calculated in 2024 The Federal Income Tax calculation includes Standard deductions and Personal Income Tax Rates and Thresholds as detailed in the Federal Tax Tables published by the IRS in 2024 Federal Tax Calculation for 55k Salary Annual Income 2024 55 000 00

Whether your pay is weekly bi weekly monthly or yearly this calculator can help you figure out your after tax income once you enter your gross pay and additional details Use our take home pay Pays once each week usually on Fridays Relatively costly for employers with 52 weeks a year resulting in higher payroll processing costs which is the main reason why it is less common than Bi Weekly or Semi Monthly Bi Weekly Pays every two weeks which comes out to 26 times a year for most years Semi Monthly

More picture related to How Much Is 55k Biweekly After Taxes

How Much Is 55k Salary After Taxes YouTube

https://i.ytimg.com/vi/zYXPf-6oogc/maxresdefault.jpg

55K A Year Is How Much An Hour Digital Finance Plug

https://www.digitalfinanceplug.com/wp-content/uploads/2022/10/55k-Salary-696x488.jpeg

55000 A Year Is How Much An Hour Good Salary Or No Money Bliss

https://moneybliss.org/wp-content/uploads/2021/11/55000-a-year-1-683x1024.jpg

The FICA tax withholding from each of your paychecks is your way of paying into the Social Security and Medicare systems that you ll benefit from in your retirement years Every pay period your employer will withhold 6 2 of your earnings for Social Security taxes and 1 45 of your earnings for Medicare taxes 2015 60 413 2014 54 916 2013 53 937 On the state level you can claim allowances for Illinois state income taxes on Form IL W 4 Your employer will withhold money from each of your paychecks to go toward your Illinois state income taxes Illinois doesn t have any local income taxes

This tax illustration is therefore an example of a tax bill for a single resident of California with no children filing their tax return for the 2024 tax year Monthly Salary breakdown for 55 000 00 In the tax overview above we show the illustration for a monthly take home pay as a straight 1 12th of your annual income 55 000 a year is 2 115 38 biweekly before taxes and approximately 1 586 54 after taxes Paying a tax rate of 25 and working full time at 40 hours a week you would earn 1 586 54 after taxes To calculate how much you make biweekly before taxes you would multiply the hourly wage for 55 000 a year 26 44 by 80 hours to get 2 115 38

Is 55k A Year Good

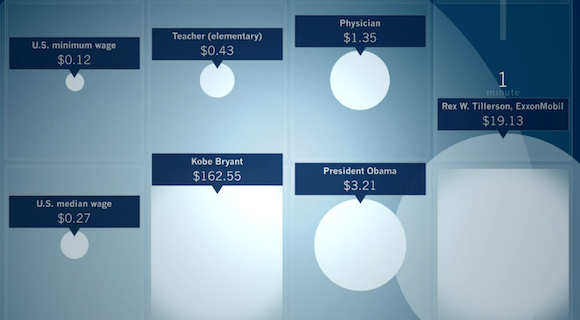

https://famuse.co/wp-content/uploads/2022/06/famuse-How-do-I-calculate-my-pay-per-minute.png

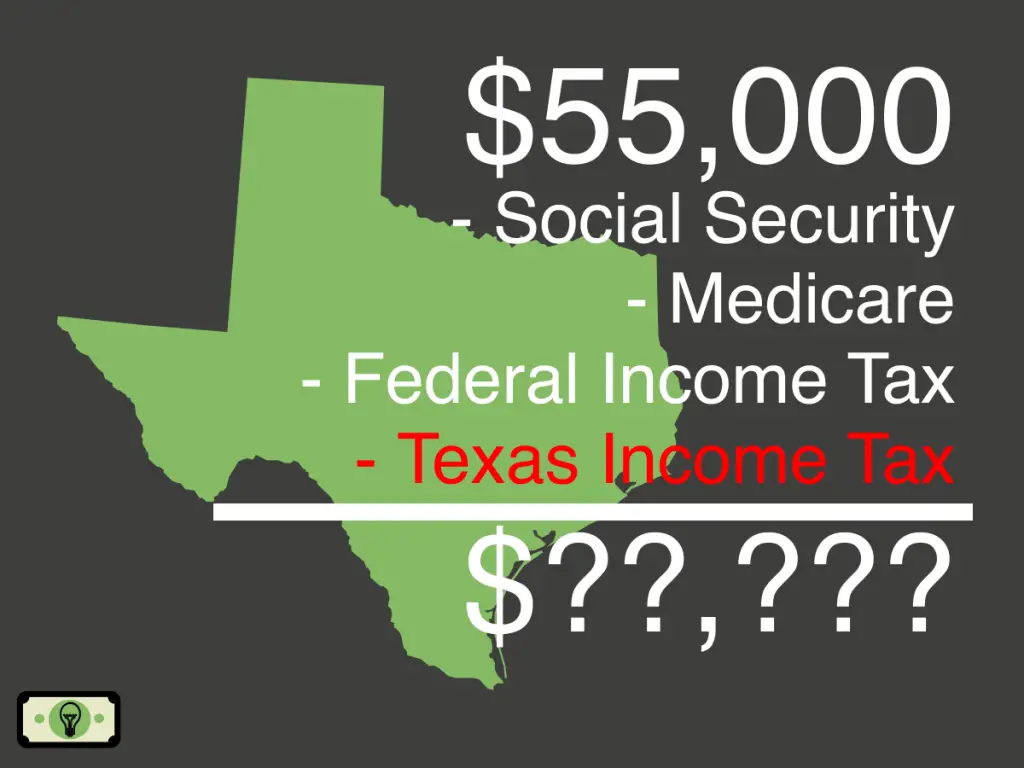

55K Salary After Taxes In Texas single 2013 Smart Personal Finance

https://smartpersonalfinance.info/wp-content/uploads/2022/08/tx-55000-after-taxes-sm-1024x768.png

How Much Is 55k Biweekly After Taxes - Whether your pay is weekly bi weekly monthly or yearly this calculator can help you figure out your after tax income once you enter your gross pay and additional details Use our take home pay