How Much Is 55 000 A Year Bi Weekly After Taxes Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

The 12 month period for income taxes begins on January 1st and ends on December 31st of the same calendar year The federal income tax rates differ from state income tax rates Federal taxes are progressive higher rates on higher income levels At the same time states have an advanced tax system or a flat tax rate on all income The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

How Much Is 55 000 A Year Bi Weekly After Taxes

How Much Is 55 000 A Year Bi Weekly After Taxes

https://i.pinimg.com/originals/6a/ed/64/6aed641b7cf0e51af5d9a05f820fa916.jpg

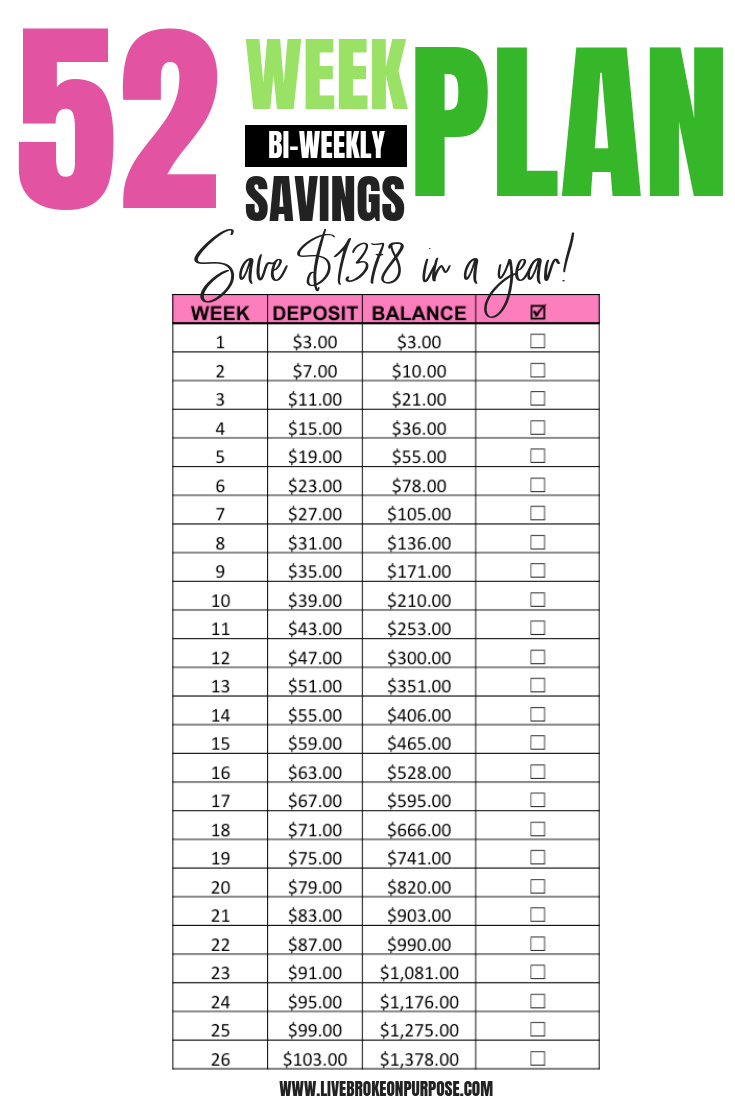

Six Money Challenges To Try This Year Broke On Purpose

https://livebrokeonpurpose.com/wp-content/uploads/2015/12/BI-WEEKLY-SAVINGS-PLAN.png

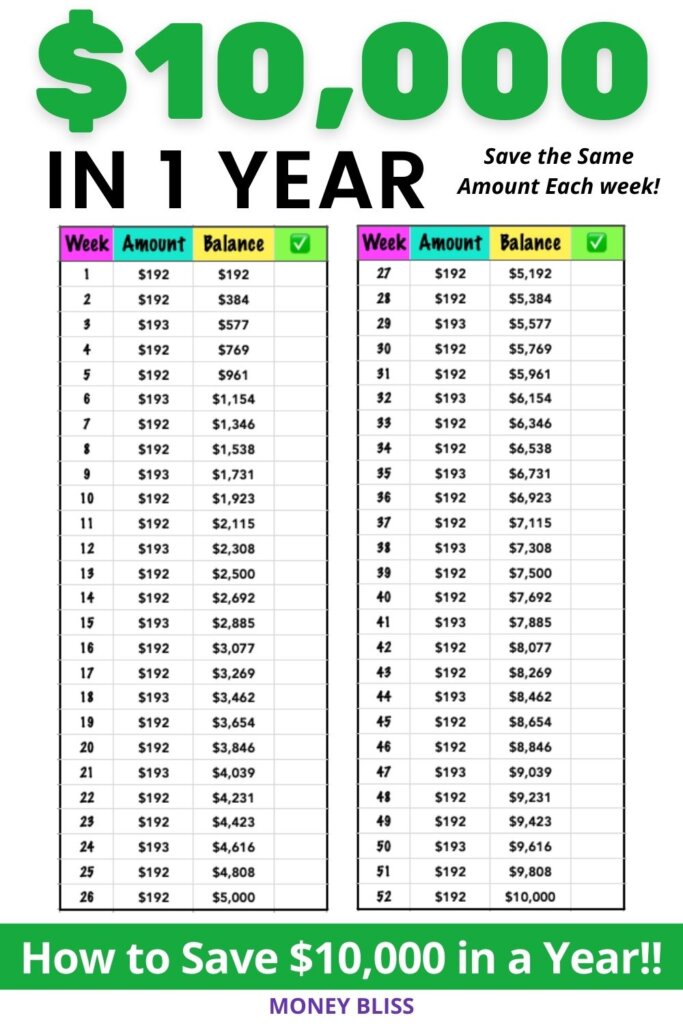

How To Save 10 000 In A Year Simple Guide For Saving Money Money Bliss

https://moneybliss.org/wp-content/uploads/2021/11/How-to-Save-10000-in-a-year-2-683x1024.jpg

2015 60 413 2014 54 916 2013 53 937 On the state level you can claim allowances for Illinois state income taxes on Form IL W 4 Your employer will withhold money from each of your paychecks to go toward your Illinois state income taxes Illinois doesn t have any local income taxes The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336

2013 46 337 2012 41 553 Every taxpayer in North Carolina will pay 4 75 of their taxable income in state taxes North Carolina has not always had a flat income tax rate though In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes Whether your pay is weekly bi weekly monthly or yearly this calculator can help you figure out your after tax income once you enter your gross pay and additional details Use our take home pay

More picture related to How Much Is 55 000 A Year Bi Weekly After Taxes

5000 Money Saving Challenge Printable Save 5000 In 26 Weeks Etsy Israel

https://i.etsystatic.com/31451928/r/il/36c16f/3378323641/il_fullxfull.3378323641_gp4m.jpg

How To Save 10K In 1 Year Uk The Math That Explains Why Net Worth

https://lh3.googleusercontent.com/proxy/JEpmXEeR_DgkqXxVhvXLbfuj53JMo9FoecEHm52VNkXhKpY2UZVj9uwYADrZWJkcj9ErLJ3pLE0oQAE2QVbuwRgAwmO3N36BF3acRTaGmdJ-TEsmSpIhpGByUSma7g5x1EFC11lM-NOCVavzqxT9BFOyIzPE=s0-d

Bi Weekly Savings Plan Save 5000 In A Year Fast Meraadi

https://meraadi.com/wp-content/uploads/2019/02/bi-weekly-money-saving-challenge-2.png

Age Enter the age you were on Jan 1 2024 Your age can have an effect on certain tax rules or deductions For example people aged 65 or older get a higher standard deduction 401 k 37 609 351 or more 731 201 or more 365 601 or more 690 351 or more Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary Federal tax state tax Medicare as well as Social Security tax allowances are all taken into account and are kept up to date with 2024 25 rates

What is 46 176 50 as a gross salary An individual who receives 46 176 50 net salary after taxes is paid 55 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security Let s look at how to calculate the payroll deductions in the US How to calculate Tax Medicare and Social Security on a 55 000 00 salary Biweekly pay hours per pay period hourly wage For example let s calculate your biweekly pay if you work 40 hours per week and earn 20 per hour hours per pay period hours per week 2 80 biweekly pay 80 20 1 600 You ll need to keep in mind that this is your gross income or rather your income before taxes and deductions

Biweekly Pay Schedule Calculator CasparSayful

https://i.pinimg.com/originals/72/b5/ba/72b5ba086f45a22dc36552a3fefd8160.jpg

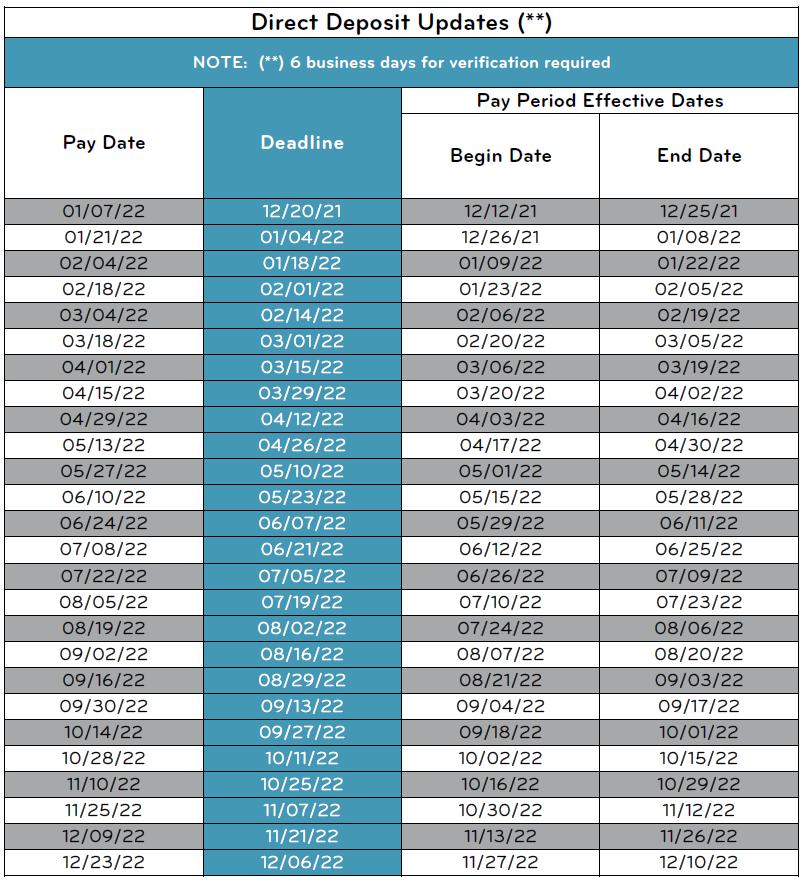

2022 Biweekly Calendar May Calendar 2022

https://www.sco.idaho.gov/Pages/img/Biweekly Calendars 2022/Biweekly Direct Deposit Updates Calendar Year 2022.PNG

How Much Is 55 000 A Year Bi Weekly After Taxes - 2013 46 337 2012 41 553 Every taxpayer in North Carolina will pay 4 75 of their taxable income in state taxes North Carolina has not always had a flat income tax rate though In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes