How Much Is 30k A Year After Taxes The 30k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Oklahoma is used for calculating state taxes due or you may want to know how much 30k a year is per month after taxes Answer is 2 095 30 in this example remember you can edit these figures to produce your own

There is no income limit on Medicare taxes 1 45 of each of your paychecks is withheld for Medicare taxes and your employer contributes another 1 45 If you make more than a certain amount you ll be on the hook for an extra 0 9 in Medicare taxes Here s a breakdown of these amounts for the current tax year Tax Year 2025 2026 If you live in California and earn a gross annual salary of 72 280 or 6 023 per month your monthly take This translates to approximately 4 715 per month after taxes and contributions Since salaries can vary significantly across the US we have compiled the average salary for each state in the table below

How Much Is 30k A Year After Taxes

How Much Is 30k A Year After Taxes

https://media.notthebee.com/articles/62e7d421e260b62e7d421e260d.jpg

30000 A Year Is How Much An Hour Good Salary Of No Money Bliss

https://moneybliss.org/wp-content/uploads/2021/09/30000-a-year.jpg

Planning A Wedding Expect To Spend About 30K In The Phoenix Area

https://www.gannett-cdn.com/-mm-/b4c888884a7d8ebf171e5d6f6fa411bb5d3bfc15/c=0-164-2091-1346/local/-/media/2016/04/07/Phoenix/Phoenix/635956378287483501-ThinkstockPhotos-173745505.jpg?width=660&height=374&fit=crop&format=pjpg&auto=webp

If you re trying to support a 4 person family on a 30k a year salary it might be tough Especially if you live in a high cost of living area Yet if you re single and live in the suburbs then 30k a year is decent If you like to splurge on things then consider sharing your housing expense with a roommate to make your income stretch Taxes are calculated using progressive tax brackets Income is taxed in portions corresponding to each bracket For example first 11 000 taxed at 10 next portion at 12 etc ensuring accurate calculation for different salary ranges

On a 30K annual income you pay 8 680 for social security and 2030 for medicare So the FICA taxes amount to 10 710 of your annual income When earning a salary of 30 000 a year you will have a net income of 25 987 a year after federal taxes This comes to a monthly net income of 2 166 Depending on the state you live or work in you US Income Tax Calculator is an online tool that can help you calculate the salary after tax in the US 2025 Get accurate Income Tax calculations in the US Home Tax Calculators Blog Calculators I m Dainius Me kauskis also known as Danny Me a data analyst with a background in web development spanning over 14 years My decade long

More picture related to How Much Is 30k A Year After Taxes

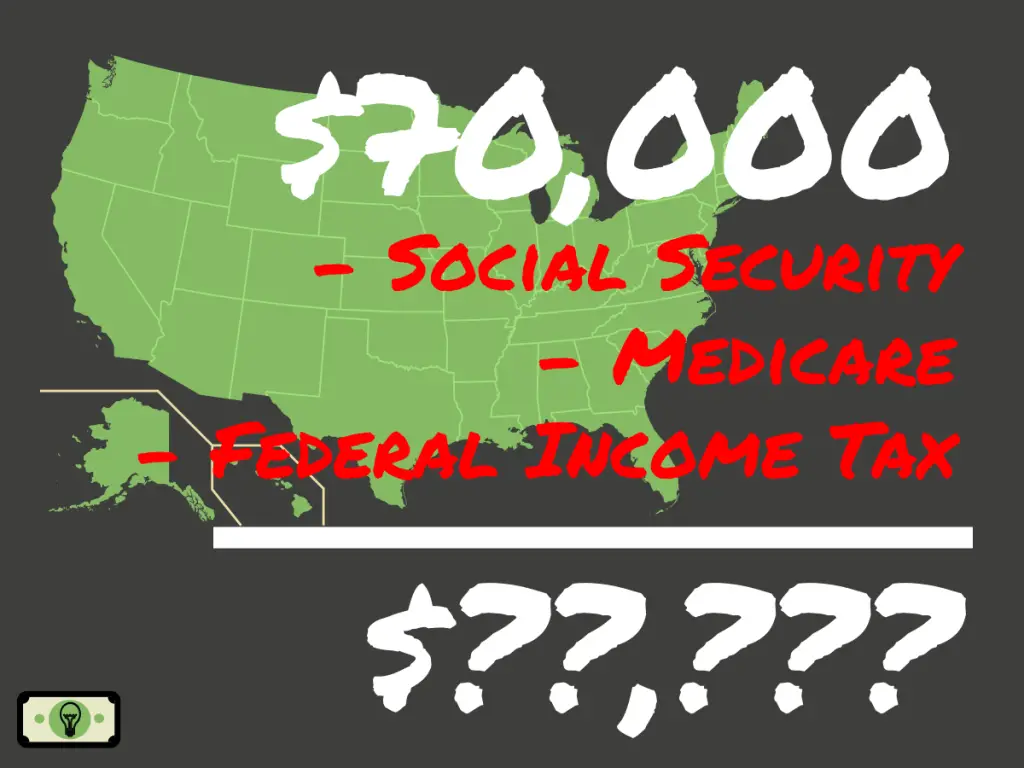

How Much Is 70 000 A Year After Taxes filing Single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-70000-dollars-sm-2-1024x768.png

How Much Money We Make On YouTube With 30k Subs YouTube

https://i.ytimg.com/vi/llMUHzC1JYs/maxresdefault.jpg

Imgflip

https://i.imgflip.com/5q9rxq.png

How much is 30 000 a Month After Tax in the United States In the year 2025 in the United States 30 000 a month gross salary after tax is 248 545 annual 19 398 monthly 4 461 weekly 892 23 daily and 111 53 hourly gross based on the information provided in the calculator above Given that the first tax bracket is 10 you will pay 10 tax on 11 600 of your income This comes to 1 160 Given that the second tax bracket is 12 once we have taken the previously taxed 11 600 away from 25 400 we are left with a total taxable amount of 13 800 After taking 12 tax from that 13 800 we are left with 1 656 of tax

[desc-10] [desc-11]

30000 After Tax Calculator How Much Is Salary After Tax 30k In UK

https://www.londonbusinessblog.co.uk/wp-content/uploads/2023/02/after-tax-30000-uk-800x445.jpg

How To Pay Zero Personal Tax And Earn 30k A Year YouTube

https://i.ytimg.com/vi/C0tXReIfQ20/maxresdefault.jpg

How Much Is 30k A Year After Taxes - Taxes are calculated using progressive tax brackets Income is taxed in portions corresponding to each bracket For example first 11 000 taxed at 10 next portion at 12 etc ensuring accurate calculation for different salary ranges