How Much Is 25 Per Hour After Taxes The Hourly Wage Tax Calculator uses tax information from the tax year 2023 to show you take home pay See where that hard earned money goes Federal Income Tax Social Security and other deductions More information about the calculations performed is available on the about page Hourly Wage

It s a question many people ask themselves and understandably so 25 an hour translates to approximately 50 000 to 52 000 annually if you work a standard full time workweek of 8 hours per day five days per week However this is your gross salary and your take home pay will be less after taxes and other deductions are taken out How do I calculate salary to hourly wage Multiply the hourly wage by the number of hours worked per week Then multiply that number by the total number of weeks in a year 52 For example if an employee makes 25 per hour and works 40 hours per week the annual salary is 25 x 40 x 52 52 000

How Much Is 25 Per Hour After Taxes

How Much Is 25 Per Hour After Taxes

https://abmalliance.org/wp-content/uploads/2023/10/Untitled.png

How Much Money Do You Need To Live Comfortably UK Retirement News Daily

https://www.retirementnewsdailypress.com/wp-content/uploads/2021/12/How-much-money-do-you-need-to-live-comfortably-UK.jpeg

What Is BBVA Immediate Cash And How Much Is The Commission American Post

https://www.americanpost.news/wp-content/uploads/2022/02/What-is-BBVA-Immediate-Cash-and-how-much-is-the.jpg

To calculate the yearly salary for an hourly wage of 25 simply multiply 25 by 40 the number of hours in a full time workweek and then by 52 the total weeks in a year Working full time at 25 per hour would result in a yearly income of 52 000 Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the U S home This is one of the reasons why independent contractors tend to be paid more hourly than regular employees for the same job 25 91 150 to 190 150 151 900 to 231 450 130 150 to

Step 3 enter an amount for dependents The old W4 used to ask for the number of dependents The new W4 asks for a dollar amount Here s how to calculate it If your total income will be 200k or less 400k if married multiply the number of children under 17 by 2 000 and other dependents by 500 Add up the total The best free online tool paycheck tax calculator calculates the take home net pay after deducting taxes from your gross hourly wages and salary in all states

More picture related to How Much Is 25 Per Hour After Taxes

New Employment Laws And Minimum Wage Changes In 2023

https://blog.employerflexible.com/hubfs/1409266327000-180274674.webp#keepProtocol

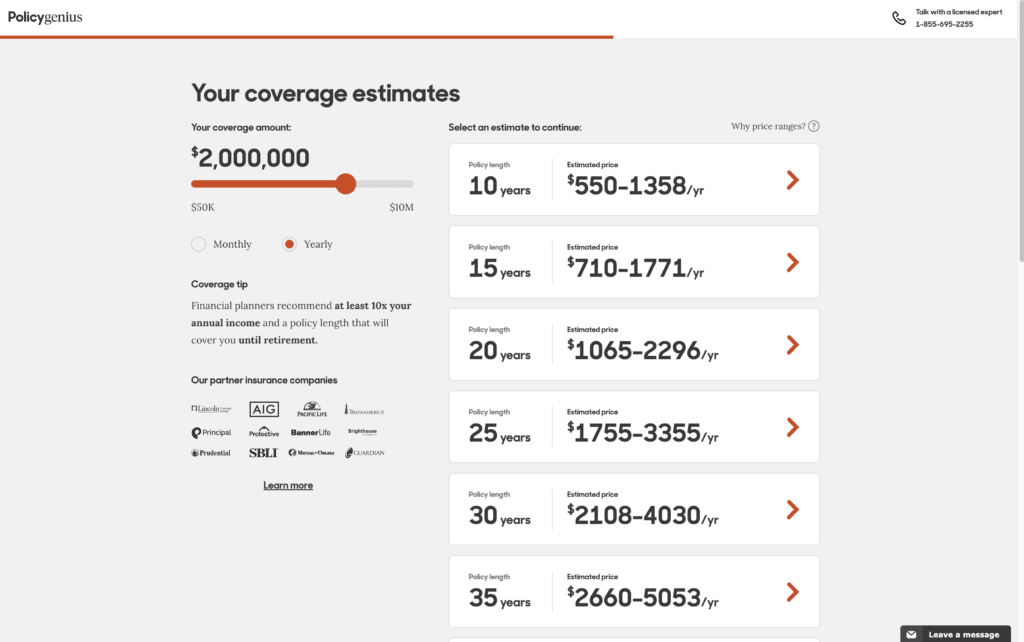

How Much Is 2 Million Life Insurance

https://www.goodfinancialcents.com/wp-content/uploads/2022/04/Cost-of-2-Million-Life-Insurane-with-Policy-Genius-Annual-pay-1024x642.png

How Much Is Your Time Worth ShimSpine

https://www.shimspine.com/wp-content/uploads/2016/11/FamilyFunStandUpPaddling.jpg

To answer 25 an hour is how much a week divide the annual sum by 52 resulting in a weekly income of 760 72 25 an Hour is How Much a Day When examining a 25 an hour after tax income the corresponding daily earnings can be determined Take home NET daily income 152 14 assuming a 5 day work week Hourly Paycheck Calculator Use this calculator to help you determine your paycheck for hourly wages First enter your current payroll information and deductions Then enter the hours you expect

Employers pay California unemployment tax on the first 7 000 SUI ETT and 145 600 SDI of an employee s wages New employers pay at a rate of 3 4 SUI Experienced employers pay at a rate of 1 5 6 2 SUI 0 0 0 1 ETT Unemployment tax in California should be paid quarterly via the Employment Development Department In this case your hourly pay is 25 dollars You worked 25 hours per week for 5 days per week We re going to use equations typical for all hourly to salary calculators To calculate your salary after taxes Determine the gross salary Express the tax rate as a fraction dividing it by 100 for example 10 10 100 0 1

13 Dollars An Hour 40 Hours A Week After Taxes Marx Langdon

https://qph.fs.quoracdn.net/main-qimg-e04739cbbcf836628ffc558f19035be9

The Minimum Wage Crisis Today s Economy

https://sites.psu.edu/civicissue2019/files/2019/02/cwsd.php-23fxcjs.jpeg

How Much Is 25 Per Hour After Taxes - An hourly wage of 25 5 per hour equals a yearly salary of 53 040 before taxes assuming a 40 hour work week After accounting for an estimated 26 37 tax rate the yearly after tax salary is approximately 39 052 03 On a monthly basis before taxes 25 5 per hour equals 4 420 per month