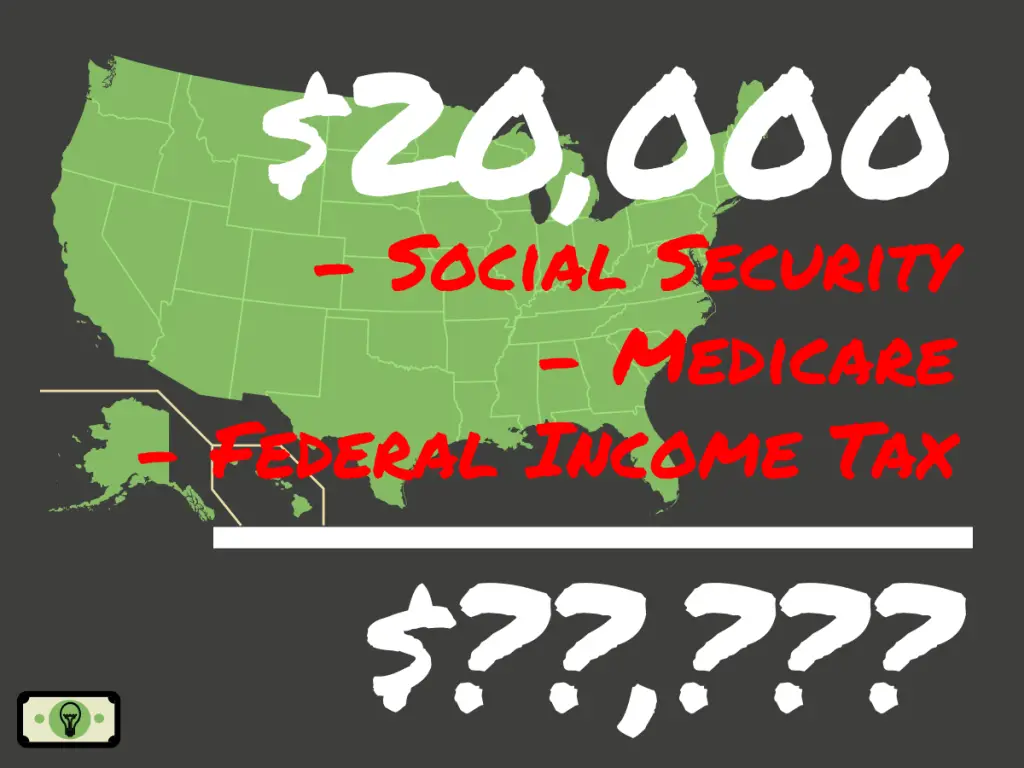

How Much Is 20000 After Tax In California The tax calculation below shows exactly how much California State Tax Federal Tax and Medicare you will pay when earning 20 000 00 per annum when living and paying your taxes in California The 20 000 00 California tax example uses standard assumptions for the tax calculation

California income tax rate 1 00 13 30 Median household income in California 91 905 U S Census Bureau Number of cities that have local income taxes How Your California Paycheck Works Your job probably pays you either an hourly wage or an annual salary 20k Salary After Tax in California 2024 This California salary after tax example is based on a 20 000 00 annual salary for the 2024 tax year in California using the State and Federal income tax rates published in the California tax tables The 20k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month week day and hour

How Much Is 20000 After Tax In California

How Much Is 20000 After Tax In California

https://ex-rate.com/wa-data/public/crcy/images/ZAR/TZS.jpg

80 000 Salary After Tax In Michigan Detailed Annual Tax Breakdown

https://i.ytimg.com/vi/ITR2t33xhmM/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYZSBlKGUwDw==&rs=AOn4CLDU-OrYptI00poikbOdRmhVuVu5eQ

How Much Is 20 000 A Year After Taxes filing Single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-20000-dollars-sm-2-1024x768.png

Calculate your potential tax liability or refund with our free tax calculator The calculator will estimate your 2023 2024 federal income taxes based on your income deductions and Summary If you make 55 000 a year living in the region of California USA you will be taxed 11 676 That means that your net pay will be 43 324 per year or 3 610 per month Your average tax rate is 21 2 and your marginal tax rate is 39 6 This marginal tax rate means that your immediate additional income will be taxed at this rate

Calculate your income taxes California paycheck calculator California property taxes Mortgage rates in California California retirement taxes Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable Because tax rules change from year to year your tax refund might change even if your salary and deductions don t change

More picture related to How Much Is 20000 After Tax In California

Hecht Group What Is The Commercial Property Tax Rate In California

https://img.hechtgroup.com/1666268219796.png

Fictional Paper Money Usa 20000 Dollars Gray Vector Image

https://cdn3.vectorstock.com/i/1000x1000/09/07/fictional-paper-money-usa-20000-dollars-gray-vector-32360907.jpg

State Corporate Income Tax Rates And Brackets For 2023 CashReview

https://files.taxfoundation.org/20230123172533/2023-state-corporate-income-tax-rates-and-brackets-see-state-corporate-tax-rates-by-state.png

2024 US Tax Calculation for 2025 Tax Return 20k Salary Example If you were looking for the 20k Salary After Tax Example for your 2024 Tax Return it s here Brace yourselves for a surprise Effective tax rate 11 67 Federal income tax 8 168 State taxes Marginal tax rate 5 85 Effective tax rate 4 88 New York state tax 3 413 Gross income 70 000 Total income tax

All features services support prices offers terms and conditions are subject to change without notice Use our Tax Bracket Calculator to understand what tax bracket you re in for your 2023 2024 federal income taxes Based on your annual taxable income and filing status your tax bracket determines your federal tax rate The tax calculation below shows exactly how much California State Tax Federal Tax and Medicare you will pay when earning 200 000 00 per annum when living and paying your taxes in California The 200 000 00 California tax example uses standard assumptions for the tax calculation

Sales Tax By State Here s How Much You re Really Paying Sales Tax

https://i.pinimg.com/originals/f6/99/3f/f6993f73fae9c87213464fd9ef538b8f.jpg

42000 After Tax Calculator How Much Is Salary After Tax 42k In UK

https://www.londonbusinessblog.co.uk/wp-content/uploads/2023/03/after-tax-in-uk-1.png

How Much Is 20000 After Tax In California - Calculate your potential tax liability or refund with our free tax calculator The calculator will estimate your 2023 2024 federal income taxes based on your income deductions and