How Much Is 12 Per Hour After Taxes Using The Hourly Wage Tax Calculator To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left hand table above In the Weekly hours field enter the number of hours you do each week excluding any overtime

Convert Your Hourly Wage To Salary Yearly salary 12 per hour is 24 960 per year Monthly salary 12 per hour is 1 920 per month Biweekly salary 12 per hour is 960 biweekly Weekly salary 12 per hour is 480 per week Daily salary 12 per hour is 96 per day Salary after taxes 12 hr is 18 720 a year after taxes Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis Select a state Paycheck FAQs Switch to salary calculator State Date State Federal taxes only

How Much Is 12 Per Hour After Taxes

How Much Is 12 Per Hour After Taxes

https://d.ibtimes.com/en/full/3198288/efforst-raise-us-minimum-wage-15-hour-have-not-advanced-congress-more-companies-are-still.jpg

How Much Does An Engagement Ring Setting Cost Cheapest Buying Save 62

https://i.shgcdn.com/afc56d34-755b-492c-bb95-9070617915bb/-/format/auto/-/preview/3000x3000/-/quality/lighter/

How Much Is 40 Inches Update Achievetampabay

https://i.ytimg.com/vi/OK9rmvDGPY8/maxresdefault.jpg

On a monthly basis before taxes 12 per hour equals 2 080 per month After estimated taxes the monthly take home pay is about 1 573 76 The before tax weekly salary at 12 per hour is 480 After taxes the weekly take home pay is approximately 363 17 For biweekly pay the pre tax salary at 12 per hour is 960 First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52 Next divide this number from the annual salary For example if an employee has a salary of 50 000 and works 40 hours per week the hourly rate is 50 000 2 080 40 x 52 24 04 How do I calculate taxes from paycheck

Last year the average tax refund was 3 167 or almost 3 less than the prior year according to IRS statistics By comparison the typical refund check jumped 15 5 to almost 3 300 in 2022 1 Pretax deductions withheld These are the deductions to be withheld from the employee s salary by their employer before the salary can be paid out including 401k the employee s share of the health insurance premium health savings account HSA deductions child support payments union and uniform dues etc 2 Deductions not withheld

More picture related to How Much Is 12 Per Hour After Taxes

How Much Money Do You Need To Live Comfortably UK Retirement News Daily

https://www.retirementnewsdailypress.com/wp-content/uploads/2021/12/How-much-money-do-you-need-to-live-comfortably-UK.jpeg

13 Dollars An Hour 40 Hours A Week After Taxes Marx Langdon

https://qph.fs.quoracdn.net/main-qimg-e04739cbbcf836628ffc558f19035be9

How Much Testing Is Enough Istqb

https://res.infoq.com/presentations/stack-exchange/en/slides/sl1.jpg

The net pay is the amount you will take home after taxes The best free online tool paycheck tax calculator calculates the take home net pay after deducting taxes from your gross hourly wages and salary in all states If you earn over 200 000 you can expect an extra tax of 9 of your wages known as the additional Medicare tax Your federal income tax withholdings are based on your income and filing status

FUTA is an annual tax an employer pays on the first 7 000 of each employee s wages The FUTA rate for 2023 is 6 0 but many employers are able to pay less for instance up to 5 4 each year due to tax credits Most employers will pay this tax annually with Form 940 Use this calculator to help you determine your paycheck for hourly wages First enter your current payroll information and deductions Then enter the hours you expect to work and how much you

How Much Is Your Time Worth ShimSpine

https://www.shimspine.com/wp-content/uploads/2016/11/FamilyFunStandUpPaddling.jpg

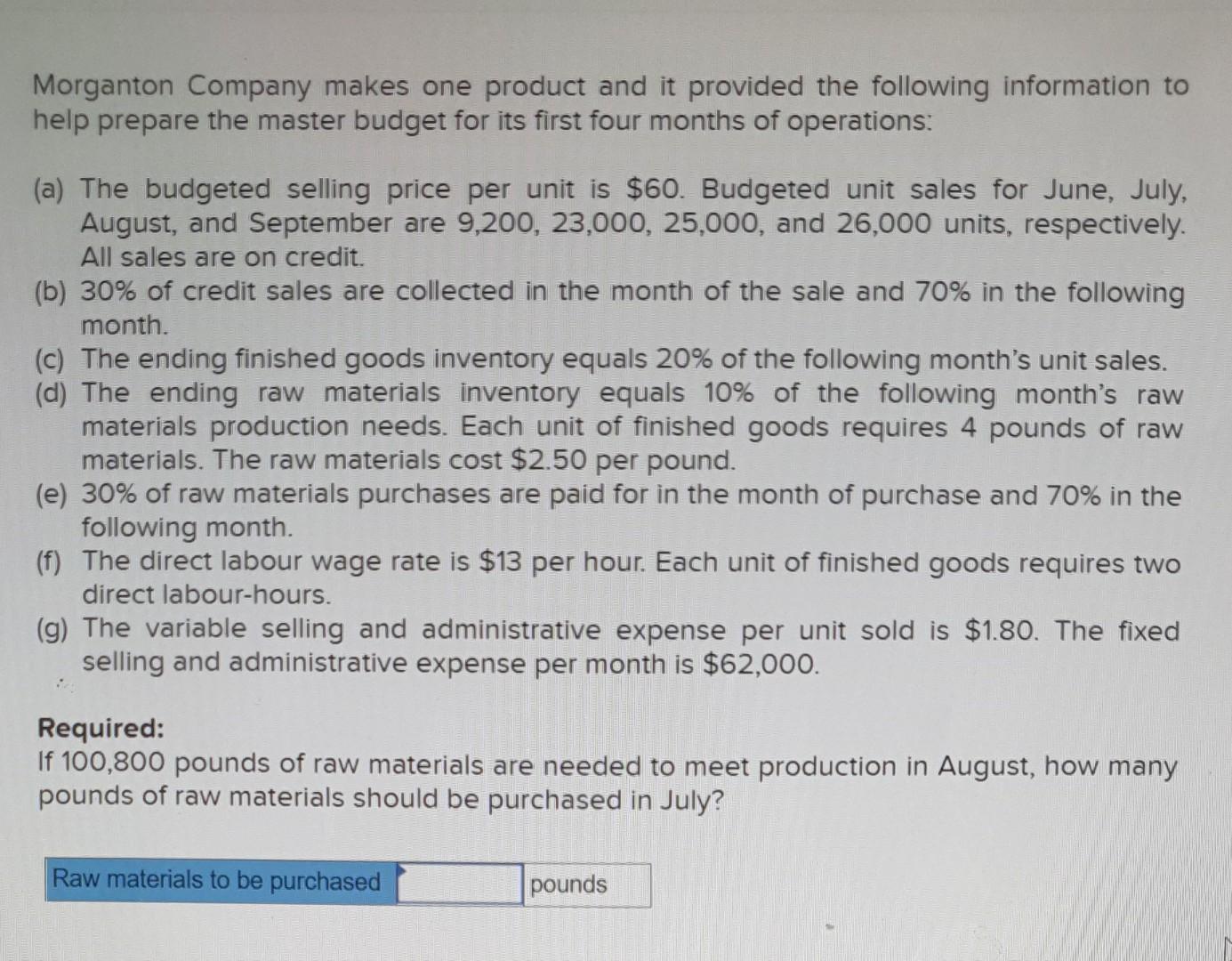

Solved Morganton Company Makes One Product And It Provided Chegg

https://media.cheggcdn.com/study/cc3/cc34bafd-7b4b-46fd-98ce-9c8565c28023/image

How Much Is 12 Per Hour After Taxes - Last year the average tax refund was 3 167 or almost 3 less than the prior year according to IRS statistics By comparison the typical refund check jumped 15 5 to almost 3 300 in 2022