How Much Is 100 000 A Year After Taxes FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

In the chart below you ll find the after tax take home pay for a 100 000 a year salary in the 25 largest US cities which we calculated using SmartAsset s paycheck calculator Shayanne Gal Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly They are used to fund social Security and Medicare For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax

How Much Is 100 000 A Year After Taxes

How Much Is 100 000 A Year After Taxes

https://i.ytimg.com/vi/-uAj70vDtGs/maxresdefault.jpg

How Much Did Jane Earn Before Taxes New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

44 000 A Year Is How Much An Hour

https://savvybudgetboss.com/wp-content/uploads/2022/04/40000-a-year-after-taxes.png

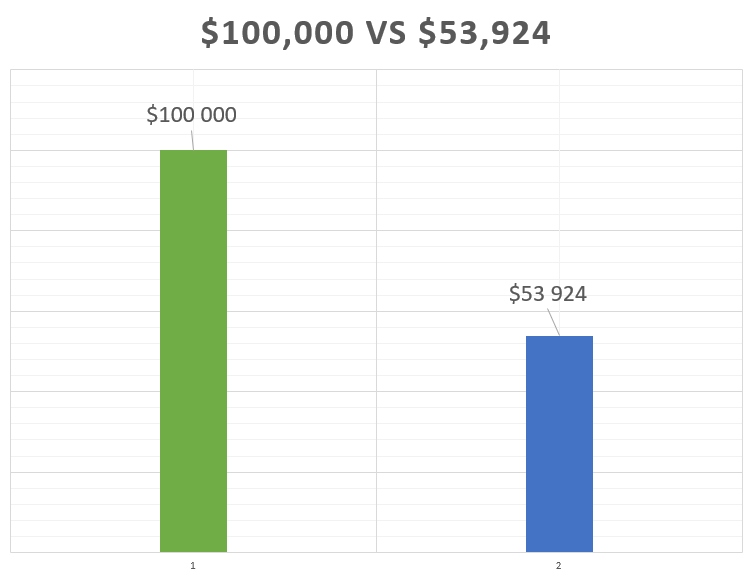

The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336 What is 78 509 00 as a gross salary An individual who receives 78 509 00 net salary after taxes is paid 100 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security Let s look at how to calculate the payroll deductions in the US How to calculate Tax Medicare and Social Security on a 100 000 00 salary

A 100 000 salary drops to an estimated 72 977 79 433 in take home after federal and state taxes State income tax picks off 5 11 of that six figure pay But Georgia doesn t have local income taxes The state does have a 4 sales tax and the total tax can be as high as 9 when local sales taxes are added The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

More picture related to How Much Is 100 000 A Year After Taxes

60 An Hour Is How Much A Year Before After Taxes

https://www.financiallunatic.com/wp-content/uploads/2022/04/Income-Tax.jpg

3 Ways To Make 100 000 A Year With A Digital Marketing Agency YouTube

https://i.ytimg.com/vi/c5EpHa8Adnk/maxresdefault.jpg

78K A Year Is How Much An Hour SidneyMoritz

https://www.springboard.com/blog/wp-content/uploads/2022/05/healthcare-.jpg

Use our take home pay calculator to determine your after tax income by entering your gross pay and additional details This school year is starting like the last one ended In chaos Aug 15 2024 Summary If you make 100 000 a year living in the region of California USA you will be taxed 29 959 That means that your net pay will be 70 041 per year or 5 837 per month Your average tax rate is 30 0 and your marginal tax rate is 42 6 This marginal tax rate means that your immediate additional income will be taxed at this rate

2014 52 005 2013 56 567 2012 50 015 Michigan collects a state income tax and in some cities there is a local income tax too As with federal taxes your employer withholds money from each of your paychecks to put toward your Michigan income taxes In this situation gross income of 100 000 would be reduced by the standard deduction of 12 400 That leaves taxable income of 87 600 The tax on that income is 15 103 50 Assuming you don t

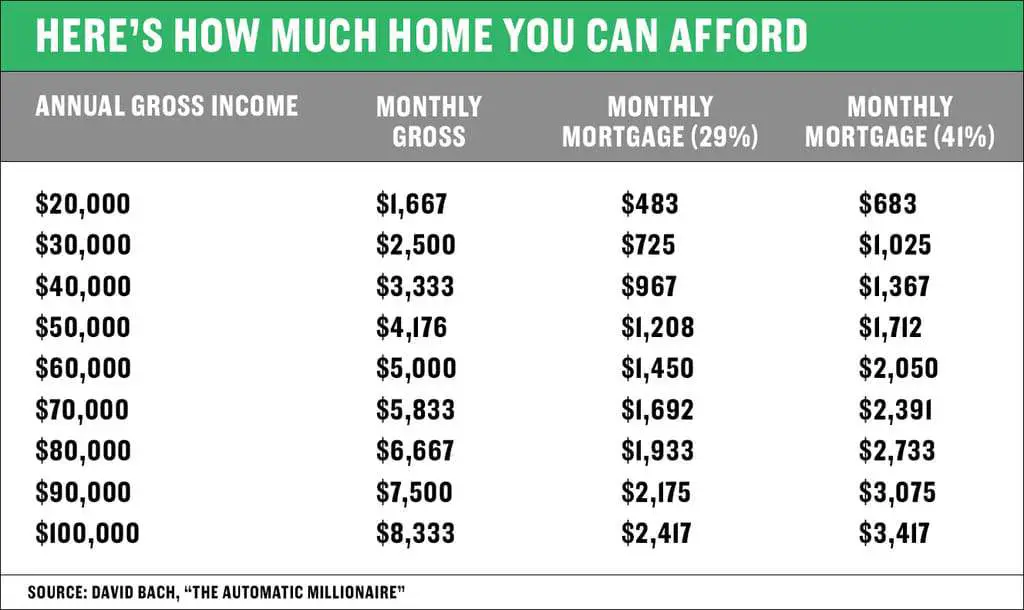

How Much Home Loan Can I Get On 70000 Salary UnderstandLoans

https://www.understandloans.net/wp-content/uploads/heres-how-to-figure-out-how-much-home-you-can-afford.jpeg

Top 10 Is 100 000 A Year Good That Will Change Your Life Nh m K nh

https://solberginvest.com/wp-content/uploads/2022/07/vs-median.png

How Much Is 100 000 A Year After Taxes - The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336