How Much Do You Have To Earn A Month Before Paying Tax Whether it s a full time business or a casual side hustle you must file taxes if you earn 400 or more in self employment income Yes you read that right 400 There s a common misconception that you don t have to file 1099 taxes if you make less than 600 but that s not true The actual limit is 200 lower

As your income goes up the tax rate on the next layer of income is higher When your income jumps to a higher tax bracket you don t pay the higher rate on your entire income You pay the higher rate only on the part that s in the new tax bracket 2023 tax rates for a single taxpayer For a single taxpayer the rates are Married Filing Jointly 27 700 if both spouses are under age 65 29 200 if one spouse is under age 65 and one is age 65 or older 30 700 if both spouses are age 65 or older Married Filing Separately 5 for all ages Head of Household 20 800 if under age 65 22 650 if age 65 or older

How Much Do You Have To Earn A Month Before Paying Tax

How Much Do You Have To Earn A Month Before Paying Tax

https://www.gannett-cdn.com/-mm-/389f33b6050a2664d0a5c4c7964c4fab0747cd63/c=0-38-2024-1181/local/-/media/2015/10/26/USATODAY/USATODAY/635814567737908846-salary.jpg?width=2024&height=1143&fit=crop&format=pjpg&auto=webp

How Much Money Do You Have To Earn To Avoid Paying Taxes Invoice

https://billed.app/wp-content/uploads/2021/07/Cost-Of-Goods-Sold-8-2048x1152.png

How To Earn Money Chore Chart Editable Allowance Chart Etsy

https://i.etsystatic.com/29287963/r/il/96f45c/3594623092/il_fullxfull.3594623092_8j15.jpg

For instance single filers under 65 generally must file a tax if they earn more than 13 850 during the year Keep reading this article to find out if your circumstances require you to file a tax return this year How much do you have to make to file taxes in 2024 If your filing status is File a tax return if any of these apply Single under 65 Unearned income over 1 250 Earned income over 13 850 Gross income was more than the larger of 1 250 or Earned income up to 13 450 plus 400 Single age 65 and up

Depending on your age filing status and dependents for the 2023 tax year the gross income threshold for filing taxes is between 12 950 and 28 700 If you have self employment income you re required to report your income and file taxes if you make 400 or more The main factors that determine whether you need to file taxes include The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336

More picture related to How Much Do You Have To Earn A Month Before Paying Tax

This Has Been One Of My Favorite Ways To Make Little Bit Of Extra Money

https://i.pinimg.com/originals/3c/6b/84/3c6b84bb4e5b869355dd199fe80b75dd.png

How Much Can You Earn Before Paying Income Tax Evening Standard

https://static.standard.co.uk/2023/03/27/00/f01b91ef08d35c211f0a6de634c15922Y29udGVudHNlYXJjaGFwaSwxNjc5NzYwNTI3-2.34653039.jpg?width=968&auto=webp&quality=50&crop=968:645%2Csmart

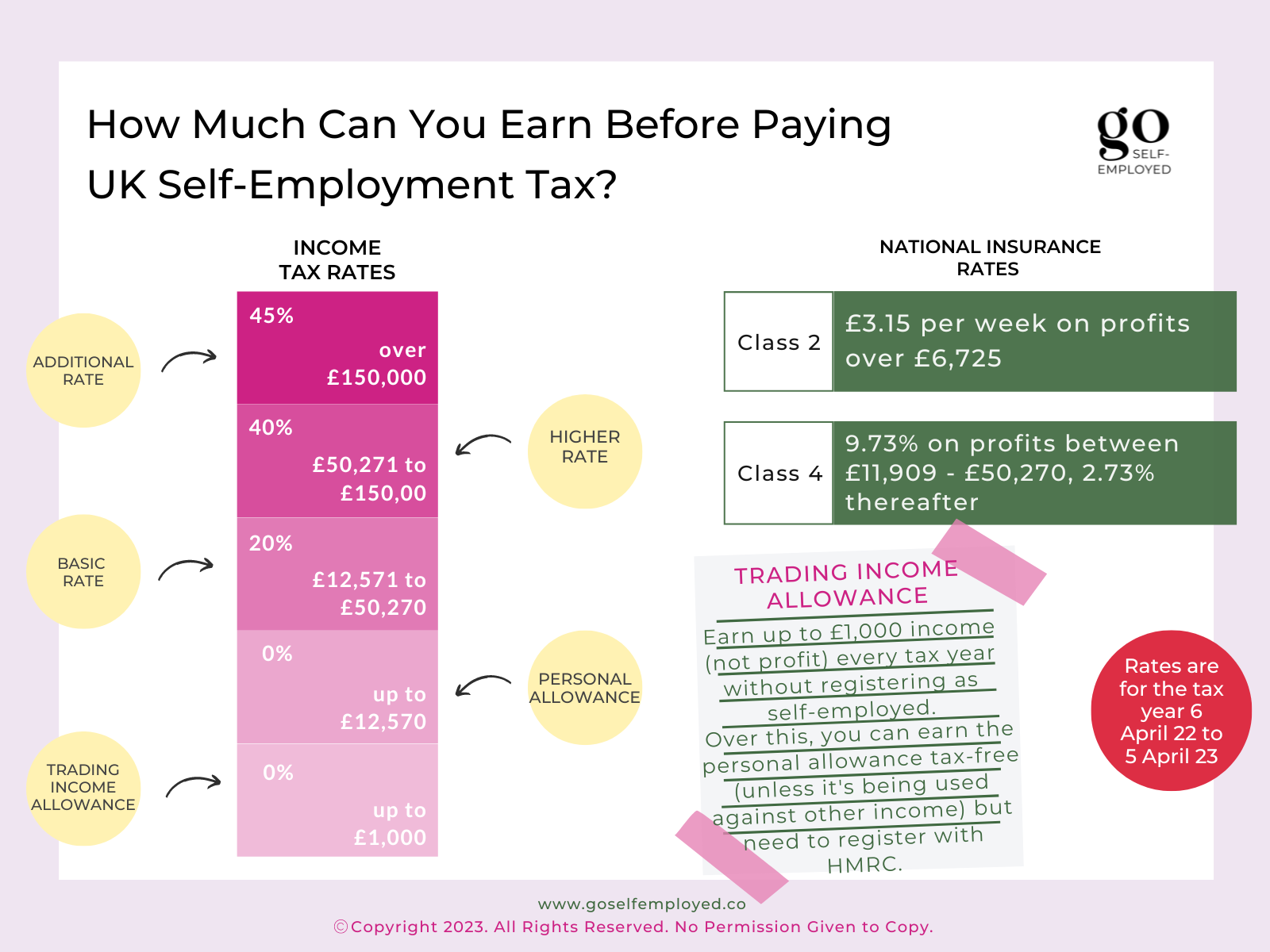

How Much Can You Earn Before Paying UK Self Employment Tax

https://goselfemployed.co/wp-content/uploads/2023/01/Earn-before-paying-tax.png

FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024 FS 2019 6 April 2019 The U S tax system operates on a pay as you go basis This means that taxpayers need to pay most of their tax during the year as the income is earned or received Taxpayers must generally pay at least 90 percent however see 2018 Penalty Relief below of their taxes throughout the year through withholding estimated

For 2021 those limits range from 21 430 if you re single with no kids to 57 414 if you re filing jointly and have three or more kids Also your investment income must be 10 000 or less for the year And the corresponding maximum amounts you can get with the EITC range from 1 502 to 6 728 When you have a major life change New job or other paid work Major income change Marriage Child birth or adoption Home purchase If you changed your tax withholding mid year Check your tax withholding at year end and adjust as needed with a new W 4 If you have more questions about your withholding ask your employer or tax advisor

Earn Before Paying Tax Ultimate Guide Accounting Firms

https://www.accountingfirms.co.uk/wp-content/uploads/2022/12/earn-before-paying-tax-1.png

4 Things You Need To Know Before Paying Your Tax Bill GOBankingRates

https://cdn.gobankingrates.com/wp-content/uploads/2021/02/iStock-1257889913-e1613147210623.jpg

How Much Do You Have To Earn A Month Before Paying Tax - For instance single filers under 65 generally must file a tax if they earn more than 13 850 during the year Keep reading this article to find out if your circumstances require you to file a tax return this year How much do you have to make to file taxes in 2024