How Much Do I Take Home On 55k FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

Take Home Pay for 2024 46 176 50 We hope you found this salary example useful and now feel your can work out taxes on 55k salary if you did it would be great if you could share it and let others know about iCalculator We depend on word of mouth to help us grow and keep the US Tax Calculator free to use Calculate your take home pay per paycheck for salary and hourly jobs after federal state local taxes Updated for 2024 tax year on Jul 06 2024 The self employed are taxed twice as much as regular employees The formula is Gross income Federal payroll tax rate Federal payroll tax liability Step 3 State income tax liability

How Much Do I Take Home On 55k

How Much Do I Take Home On 55k

https://i.ytimg.com/vi/rco30Dm05QE/maxresdefault.jpg

How Much Do I Have To Pay For Someone To Sit With Me Like This Fandom

https://static.wikia.nocookie.net/5da5b4d3-07f5-4634-8112-9afc08e09767

How Much Do I Get Per Stream On Spotify 2021 Edition IGroove

https://www.igroovemusic.com/wp-content/uploads/2021/06/iGroove_Magazin_Blog_Spotify_PPS-2048x1024.jpg

How to use the Take Home Calculator To use the tax calculator enter your annual salary or the one you would like in the salary box above If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side by side comparison of a normal month and a bonus month Find out the benefit of that overtime The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator Whether your pay is weekly bi weekly monthly or yearly this calculator can help you figure out your after tax income once you enter your gross pay and additional details Use our take home pay

More picture related to How Much Do I Take Home On 55k

How Much Do I Need To Start Investing ADR Wealth Superannuation

https://www.adrwealth.com.au/wp-content/uploads/2021/03/Untitled-design173.png

How Much Do I Get YouTube

https://i.ytimg.com/vi/GN_Q0IATvAg/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYZSBlKGUwDw==&rs=AOn4CLDNV5hR2ZngZ2C1o1bDRQBPvQfOmg

How Your Financial Motivations Impact Your Financial Decision Making

https://www.newretirement.com/retirement/wp-content/uploads/2023/09/iStock-1503492843.jpg

The Tax and Take home example below for an annual salary of 55 000 00 is basically like a line by line payslip example Month 2024 days in month Income Tax Deferred Student loan interest deduction Cafeteria Other Exemptions Taxable Income Federal tax State Tax Social Security Medicare Take home January 31 4 671 23 0 00 0 00 55 000 After Tax Explained This is a break down of how your after tax take home pay is calculated on your 55 000 yearly income If you earn 55 000 in a year you will take home 40 950 leaving you with a net income of 3 412 every month Now let s see more details about how we ve gotten this monthly take home sum of 3 412 after extracting your tax and NI from your yearly

An hourly calculator lets you enter the hours you worked and amount earned per hour and calculate your net pay paycheck amount after taxes You will see what federal and state taxes were deducted based on the information entered You can use this tool to see how changing your paycheck affects your tax results 2013 46 992 If you file in Georgia as a single person you will get taxed 1 of your taxable income under 750 If you earn more than that then you ll be taxed 2 on income between 750 and 2 250 The marginal rate rises to 3 on income between 2 250 and 3 750 4 on income between 3 750 and 5 250 5 on income between 5 250 and

Closing Costs How Much Do I Really Need YouTube

https://i.ytimg.com/vi/qSl46ZlnFOw/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgZShlMA8=&rs=AOn4CLAut9u_cBVc2NvCHErxVTCFNqatFg

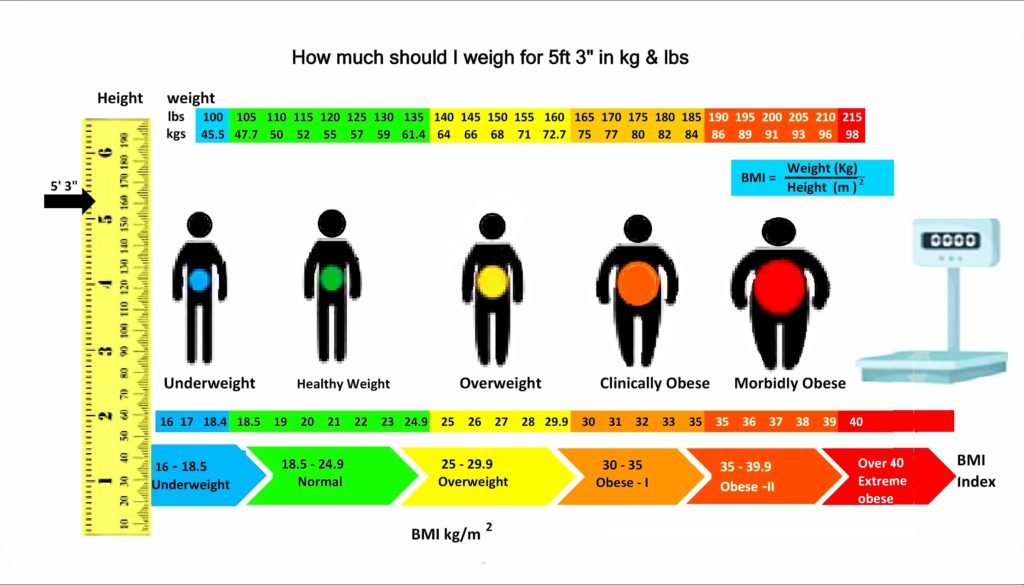

How Much Should I Weigh For My Height Age Nutrilove co in

https://www.nutrilove.co.in/wp-content/uploads/2020/02/How-much-should-i-weigh-for-5ft-3in-5-1-1024x585-min.jpg

How Much Do I Take Home On 55k - The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator