How Much Do Hedge Fund Managers Make On Wall Street Ronda Churchill Bloomberg Getty Images The 25 highest paid hedge fund managers made a record 32 billion in 2020 up more than 50 over 2019 according to Institutional Investor s Rich List

14 Who is the biggest hedge fund in the world 15 How do hedge fund managers make billions 16 Is the hedge fund industry dying 17 Do you need a college degree to start a hedge fund 18 What do hedge fund managers do all day 19 The 15 top paid hedge fund managers for 2021 including their personal investment gains and share of fund performance fees on Bloomberg s list are 1 Ken Griffin CEO of Citadel 2 5 billion

How Much Do Hedge Fund Managers Make On Wall Street

How Much Do Hedge Fund Managers Make On Wall Street

https://i.ytimg.com/vi/8NYuAIkWaR4/maxresdefault.jpg

Hedge Fund Billionaire Ray Dalio Gets Billions More To Retire The New

https://static01.nyt.com/images/2023/02/17/multimedia/00dalio-qvwb/00dalio-qvwb-videoSixteenByNine3000.jpg

Why Do Hedge Fund Managers Make So Much YouTube

https://i.ytimg.com/vi/HMX1tyQuLf8/maxresdefault.jpg

The wealthiest new hedge fund billionaire joining the ranks of The Forbes 400 is Philippe Laffont with a net worth of 6 5 billion Laffont is one of the so called Tiger Cubs having This article is for subscribers only Bloomberg s ranking of hedge fund manager income shows the top 15 individuals made about 15 8 billion last year Also read Unknown Hedge Fund Manager Made

Here are some of the base salaries of finance professionals who fulfil a hedge fund manager role 1 Portfolio manager National average salary 41 761 per year Primary duties Portfolio managers manage a portfolio of investments often in a specific niche or industry Griffin sits atop a mostly American affair with nine of the ten wealthiest hedge fund managers hailing from the U S including Simons Dalio David Tepper estimated net worth 18 5 billion

More picture related to How Much Do Hedge Fund Managers Make On Wall Street

New Constructs Rates Top Hedge Fund Holdings New Constructs

https://www.newconstructs.com/wp-content/uploads/2015/02/2956114402_450e0fe7df_z.jpg

What Do Hedge Fund Managers Actually Manage

https://www.businessinsider.in/thumb/msid-49045732,width-640,resizemode-4,imgsize-1043430/20-moore-macro-managers-fund-ltd-has-20-91-billion-assets-and-is-based-in-the-us-.jpg

What Is A Hedge Fund Manager

https://dr5dymrsxhdzh.cloudfront.net/blog/images/a0bd0ca30/2021/03/businessmen-picture-id669812148.jpg

They have a combined personal wealth of 20 5bn By Emily Nicolle and Friday 21 May 2021 at 04 09 For the City the last 12 months proved to be a record year in minting new billionaires as Britain created more wealthy businesspeople during the pandemic than at any other time in the last three decades This year s Sunday Times Rich List Jan 16 2024 02 40pm EST What Does 2024 Hold In Store For Sustainability Private Equity Jan 12 2024 02 58pm EST Is Emmanuel Macron s Appointment Of Gabriel Attal A Mistake Jan 11 2024 09 13am

A typical hedge fund compensation is what s known as a 2 20 fee structure Under this scenario the hedge fund manager earns 2 of the assets in the portfolio as a management fee plus 20 of the fund s profits as a performance fee For example if a hedge fund has 100 million in assets and had earned 10 in a given year the hedge fund Evan Tarver Updated February 28 2023 Reviewed by David Kindness A hedge fund is an investment vehicle and business structure that aggregates capital from multiple investors and invests in

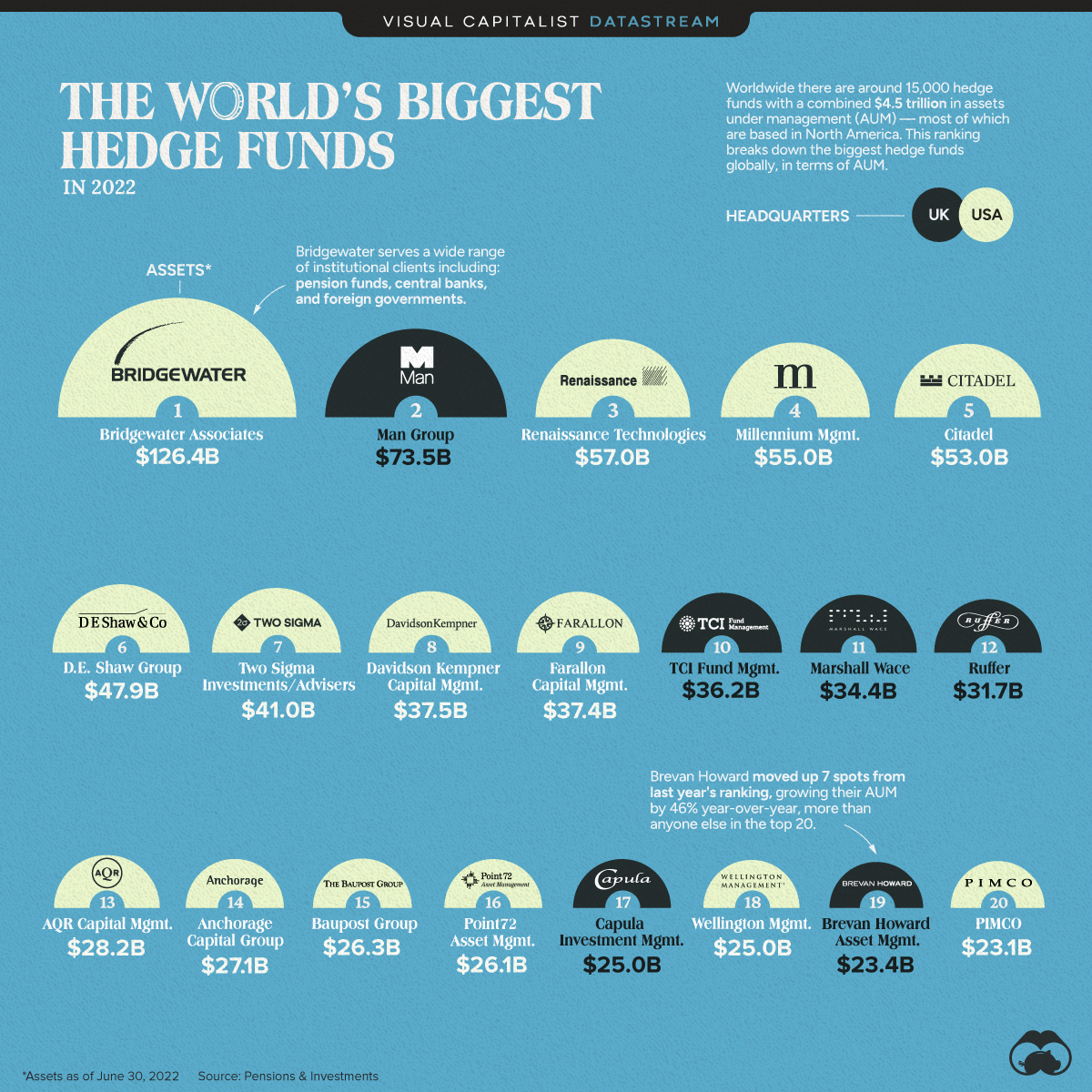

Ranked The World s 20 Biggest Hedge Funds

https://www.visualcapitalist.com/wp-content/uploads/2022/12/HedgeFunds_MAINNov30.jpg

How Much Does A Hedge Fund Manager Earn No Job Dragon

https://atozmarkets.com/wp-content/uploads/amicus/2020/04/successful-trader.png

How Much Do Hedge Fund Managers Make On Wall Street - Hedge funds differ from mutual funds and asset management firms because the latter tend to target relative returns e g beat the S P by 5 and they follow more traditional strategies such as buying and holding undervalued stocks Read more about hedge funds vs mutual funds By contrast most hedge funds target absolute returns rather than relative returns