How Much Do Etf Managers Make Most exchange traded funds ETFs are passively managed vehicles that track an underlying index But about 2 of the funds in the 3 9 billion ETF industry are actively managed offering many of the advantages of mutual funds but with the convenience of ETFs Video Market Outlook Aug 28 2022 Told Ya Mark Meldrum

How an ETF makes money An ETF makes money by adding assets to the fund and riding upside momentum in the price action of the underlying stocks or financial assets comprising the fund The fund manager banks on the assets showing annual growth for their investors attracting capital flows into the fund which they use to buy more stocks and Some ETFs also make money by lending out the underlying shares in the fund to short sellers Depending on how in demand the shares are this can generate a significant amount of revenue Some ETFs share this revenue as dividends to investors but most keep revenue from lending shares as profits for the fund manager and firm

How Much Do Etf Managers Make

How Much Do Etf Managers Make

https://media.marketrealist.com/brand-img/omrZiZmAr/0x0/bitcoin-1-1634570771066.jpg

How Much Do Finance Managers Make At Car Dealerships

https://caspian-wp-content.s3.eu-west-1.amazonaws.com/uploads/2021/07/shutterstock_1770339281-scaled.jpg

18luck

https://s3-us-east-2.amazonaws.com/maryville/wp-content/uploads/2021/08/12095820/operations-manager-1.jpg

The portfolio manager is ultimately responsible for making the decisions on investments to include in the fund s portfolio An ETF manager engages in ongoing research and equity or other asset You could create the equivalent of an ETF on your own by mimicking the holdings in an existing ETF For example the Dirextion NASDAQ 100 Equal Weighted Index ETF QQQE mirrors the NASDAQ 100

However there are also many actively managed ETFs which do not track published indexes Unlike a mutual fund which is priced and settled once a day at its net asset value NAV an ETF is listed on an exchange and can be bought or sold throughout the trading day CPA Financial Planner or Investment Manager 1222 2GY3 Investment and But rather than breaking down costs for mutual funds versus ETFs investors should look to a fund s strategy to assess a good expense ratio Broad market index ETFs that track the S P 500

More picture related to How Much Do Etf Managers Make

Web Developer Salary How Much Do They Make Thinkful

https://s3.amazonaws.com/tf-nightingale/2020/04/Outcomes-Salaries_20200409_WebDevelopment_Blog_Header-1.png

ETF Vs Index Fund What s The Difference

https://s.hdnux.com/photos/01/32/73/65/23838042/3/rawImage.jpg

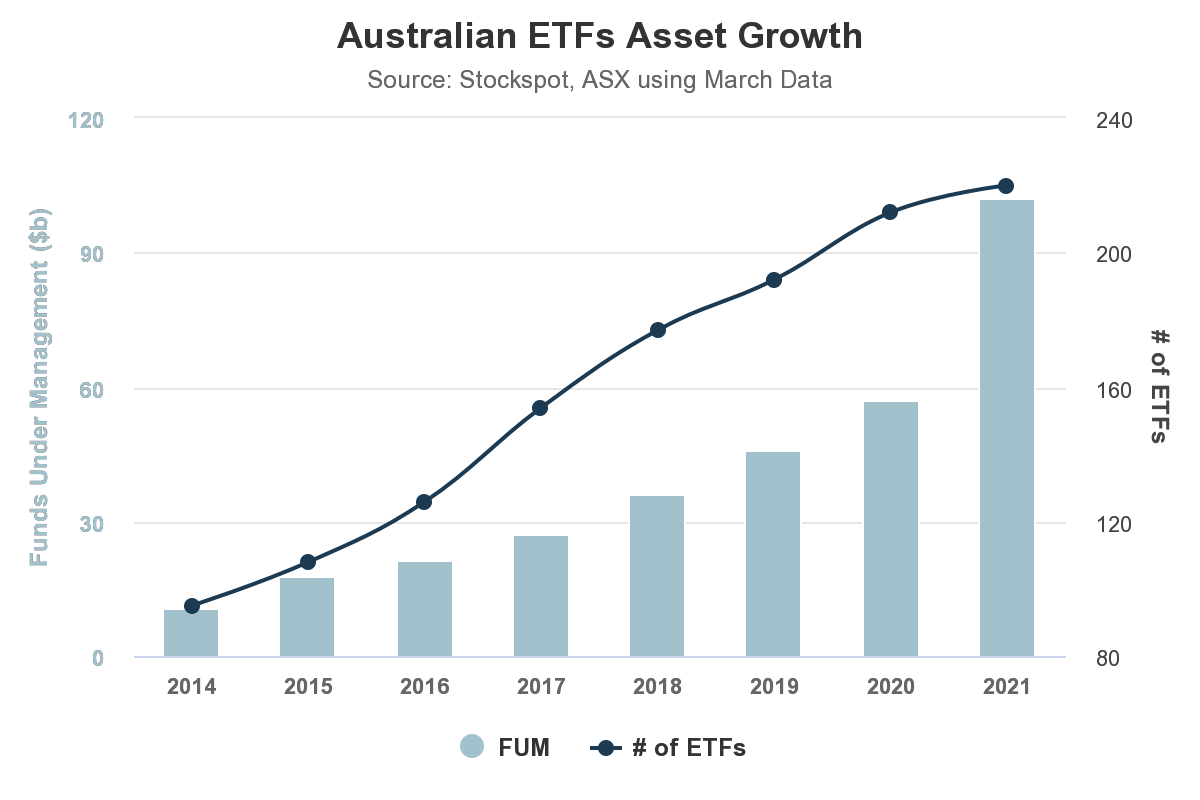

What Are ETFs Exchange Traded Funds Stockspot

https://www.stockspot.com.au/static/publicwebsite/images/charts/Australian_ETF_Asset_Growth_2021.png

Other leading ETF providers are State Street and Vanguard while the largest individual ETF is the SPDR S P 500 ETF managed by State Street with assets reaching around 427 billion U S dollars ETFs have two prices the market price per share and the net asset value or NAV per share which is the value of the underlying securities in the fund These prices can diverge If the share

NOW PLAYING What Is An ETF And How Do They Work There are nearly 2 000 ETFs in the U S according to the Investment Company Institute They held a combined 3 68 trillion in assets as of That makes justifying an underperforming active manager very very difficult sure but it also makes it very difficult to justify paying say 0 09 for an S P 500 ETF SPDR S P 500 ETF Trust

Qu Es Un ETF De Bitcoin ETF Bitcoin Al Detalle

https://fxmedia.s3.eu-west-1.amazonaws.com/featured_images/6255612f724f41649762607.jpeg

How One Active Bond ETF Manager Is Beating His Benchmark

https://image.cnbcfm.com/api/v1/image/106968784-2ED1-ETF-110121-SEG2.jpg?v=1635792185&w=1920&h=1080

How Much Do Etf Managers Make - As of 2023 the average ETF expense ratio was 0 15 for index equity ETFs and 0 11 for index bond ETFs according to a research report from the Investment Company Institute The average expense ratio for mutual funds was 0 42 for equity mutual funds and 0 37 for bond mutual funds