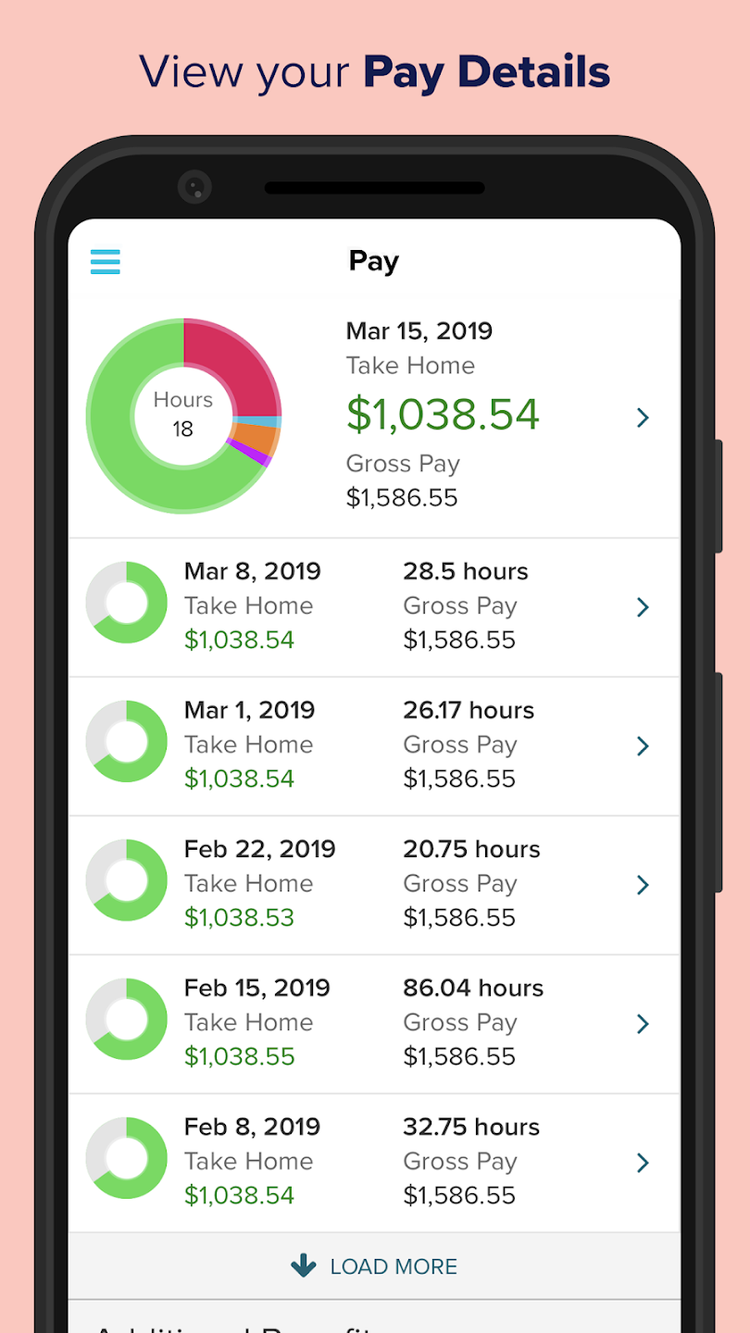

How Much Do Adp Employees Get Paid HR tools in the Essential plan include new hire onboarding and ADP employee access where employees can view pay history manage ADP retirement accounts and enroll in paperless pay state statements

How do I calculate hourly rate First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52 Next divide this number from the annual salary For example if an employee has a salary of 50 000 and works 40 hours per week the hourly rate is 50 000 2 080 40 x 52 24 04 Businesses with 1 49 employees lean on ADP for simplicity efficiency and value for their various payroll and HR needs How does on call pay work Non exempt employees who are on call receive their regular pay rate unless they work or wait to work more than 40 hours a week When that happens the Fair Labor Standards Act FLSA states that

How Much Do Adp Employees Get Paid

How Much Do Adp Employees Get Paid

https://m.foolcdn.com/media/affiliates/images/ADP_App_1Lm6Xtb.width-750.png

ADP Review 2022 | Pricing, Costs, & Fees

https://www.merchantmaverick.com/wp-content/uploads/2019/09/adp-logo.png

Payroll Software for Medium-Sized Businesses | ADP

https://www.adp.com/-/media/adp/reskin2022/images/whatweoffer/products/workforcenow/4122/compare_payrolltab_1200w_en.png?rev=1685caf5ca4d4a459aafeebce8f18446&hash=0722FC56C3B99036064F1123433DF3C0

Patriot software is similar to Roll by ADP in that it s a lower cost basic payroll option designed for small businesses with pricing starting at 17 per month plus 4 per employee One Absolutely Employees set up with direct deposit will see funds digitally deposited within 24 hours provided payroll is processed by 7 00 p m EST of the deadline date Roll is also the only payroll app that offers same day direct deposit or instant transfer for a per transaction fee Same day deposit is available for payroll processed by 2

The Federal Unemployment Tax Act FUTA authorizes the collection of federal unemployment insurance taxes For 2019 the FUTA tax rate is 6 The federal tax applies to the first 7 000 you pay to each employee as wages during the year State law determines each state s unemployment insurance tax rates The state s minimum wage will increase on January 1 2024 As a result employers must pay a salary of at least 1 280 per week beginning January 1 2024 to qualify for the exemption Computer software employees may be paid on an hourly or a salary basis in order to qualify for exemption from California s overtime requirements

More picture related to How Much Do Adp Employees Get Paid

ADP jobs report: Private payrolls grew by just 132,000 in August

https://image.cnbcfm.com/api/v1/image/107099993-16597388892022-08-05t223310z_604395340_rc2lqv9482ga_rtrmadp_0_usa-employment.jpeg?v=1659738999

Wisely - The Future of Pay | ADP

https://www.adp.com/-/media/adp/reskin2022/images/whatweoffer/products/wisely/wisely-overview-hero-660w-vid.jpg?rev=cc9fec4a489245a2a8e51220c351add2&h=833&w=1320&la=en&hash=EADEC43D1D26C1A6AAD9ADE661003422

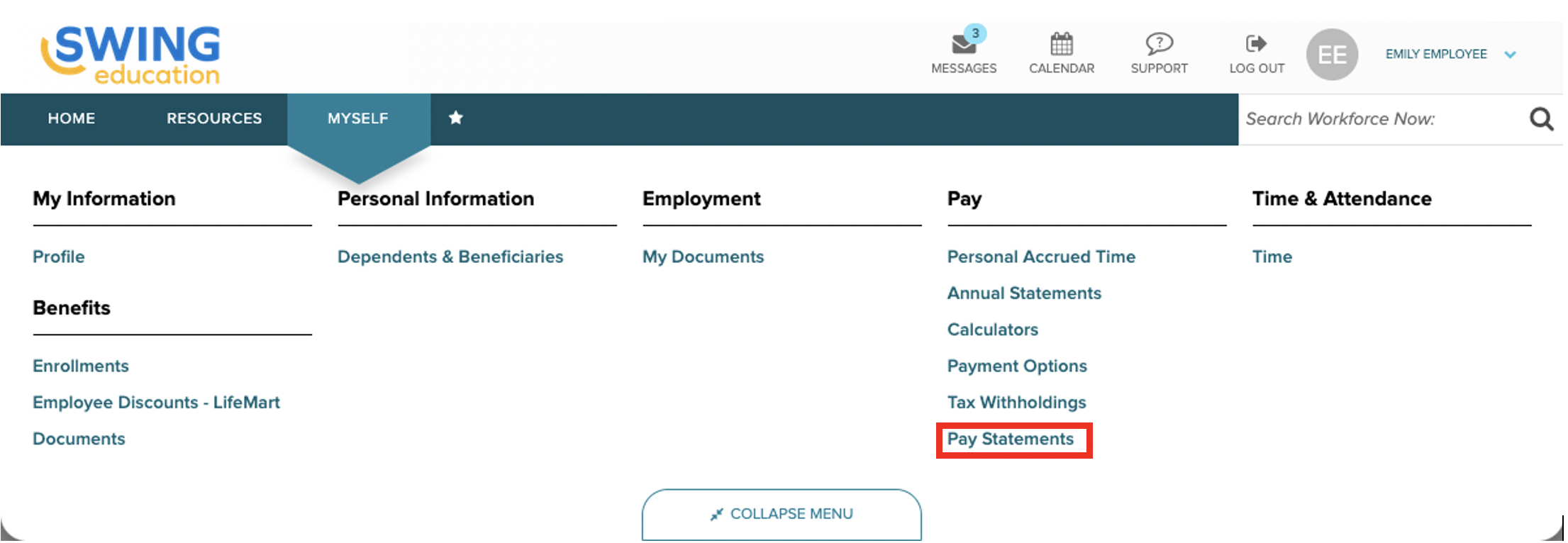

How Do I View My ADP Pay Statements? – Support Center

https://support.swingeducation.com/hc/article_attachments/360098365454/Screen_Shot_2020-11-24_at_6.14.00_AM.png

New rules allow emergency IRA withdrawals you define the emergency The rules changed this year courtesy of the 2022 legislation known as Secure 2 0 Now you can withdraw up to 1 000 to cover Long service leave rewards long serving employees with an extended period of paid time off typically between two and three months and kicks in between seven and 10 years with the exact

ADP Salaries ADP s salary ranges from 9 401 in total compensation per year for a Customer Service at the low end to 434 663 for a Business Development at the high end Levels fyi collects anonymous and verified salaries from current and former employees of ADP Last updated 8 11 2024 Instant offers the industry s leading employee pay platform that gives employees access to their hard earned wages when they want where they want and how they want all without the burden of fees Compliant in all 50 states we re putting employees back in control of their money through our powerful and easy to use earned wage access electronic tips and full paycard solutions We ve

Paycard by Wisely | ADP

https://www.adp.com/-/media/adp/reskin2022/images/whatweoffer/products/wisely/paycards/wiselypaycards_financialcontrolsidebyside_660w_en.jpg?rev=1a439b0d5f284d869834a1e61cca8813&h=1508&w=1320&la=en&hash=6837394D5131FCE33AC0F6D0461DCFBA

RUN Powered by ADP® Payroll Software | ADP

https://www.adp.com/-/media/adp/reskin2022/images/whatweoffer/products/run/hero_run.jpg?rev=8b08fa5ee87e4adcb3b0676e2e344caa&h=969&w=1320&la=en&hash=FCFA01C33EEB444B8AC2BA63DD941E0A

How Much Do Adp Employees Get Paid - A Non exempt employees must be paid for each hour worked Determining whether a meal period counts as hours worked depends on the circumstances Under the federal Fair Labor Standards Act FLSA an unpaid bona fide meal period Must generally be at least 30 minutes without interruption and