How Much Can You Earn Per Week Before Paying Tax And National Insurance If your profits are between 6 725 and 12 570 a year your contributions are treated as having been paid to protect your National Insurance record You may be able to pay voluntary

IR 2024 04 Jan 8 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline For 2023 24 this threshold is aligned with the personal allowance for income tax and is therefore 242 a week or 1 048 a month The actual amount of Class 1 NIC you pay depends on what you earn up to the upper earnings limit which is 967 per week or 4 189 per month for 2023 24

How Much Can You Earn Per Week Before Paying Tax And National Insurance

How Much Can You Earn Per Week Before Paying Tax And National Insurance

https://b2962890.smushcdn.com/2962890/wp-content/uploads/How-Much-Can-You-Earn-Before-Paying-Tax-Canada-768x512.jpg?lossy=1&strip=1&webp=1

Paying Tax And National Insurance Due Under Your PSA Wellway

https://www.wellwayconnect.co.uk/wp-content/uploads/2021/11/Paying_tax_and_National_Insurance_due_under_your_PSA-1080x675.jpg

How Much Can You Earn From A Hobby Before Paying Tax

https://www.freshbooks.com/wp-content/uploads/2022/12/How-Much-Can-You-Earn-From-a-Hobby-Before-Paying-Tax.jpg

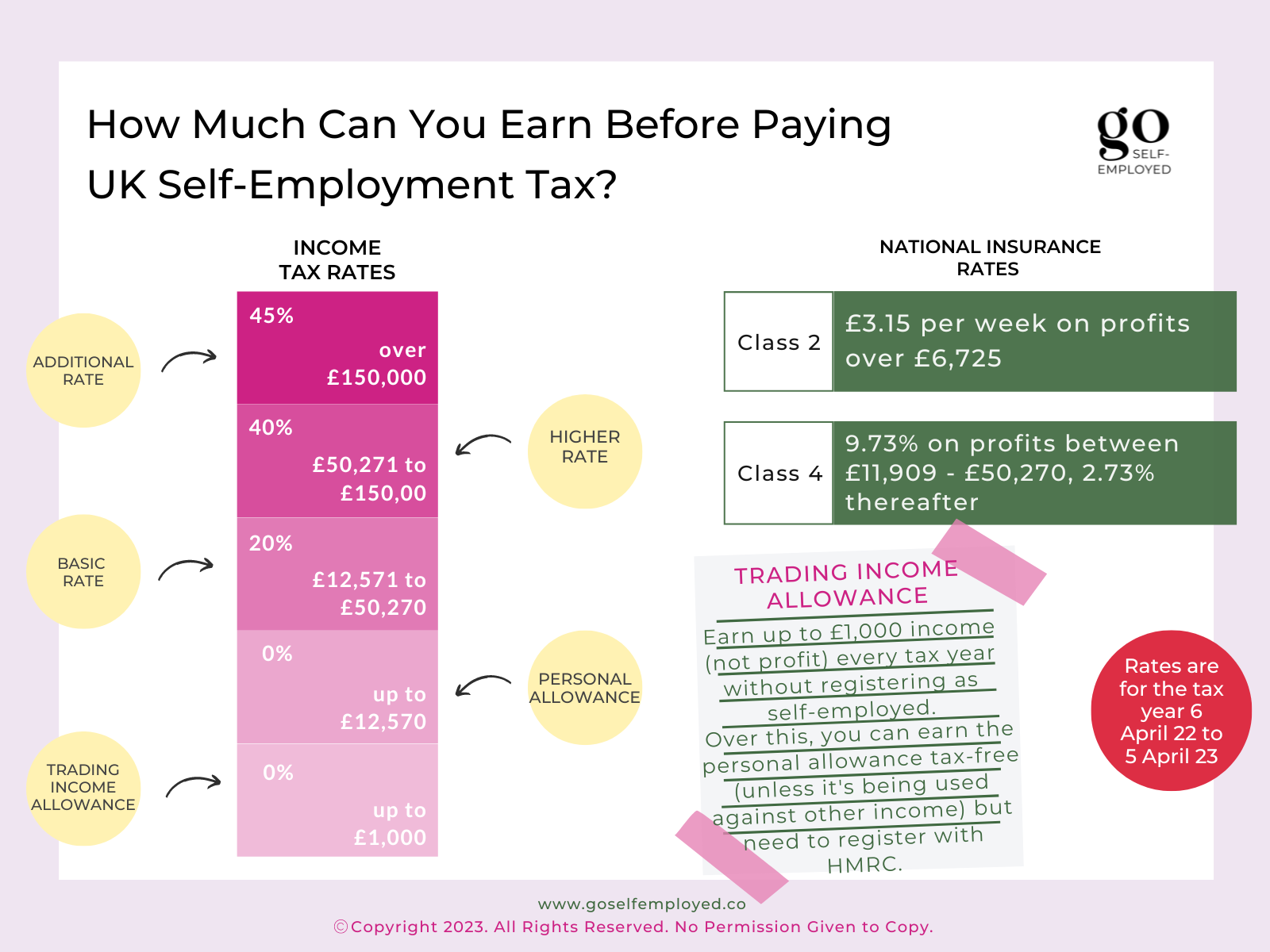

From 6 January 2024 the Class 1 rate that 27 million workers pay will fall from 12 to 10 which will lower your bill in 2023 24 Our calculator can show you how much you will pay Then from 6 April 2024 the Class 2 flat rate currently 3 45 a week that self employed people pay will be scrapped and the Class 4 rate will drop from 9 to 8 1 Class 1 National Insurance thresholds Employers and employees pay Class 1 National Insurance depending on how much the employee earns You can view these earnings thresholds by

For example if you earn 1 000 a week you pay nothing on the first 242 10 72 50 on the next 725 2 66p on the next 33 This is calculated each time you get paid so you could pay different amounts if your pay changes each time Your National Insurance contributions will stop completely when you reach State Pension age An employee earning between 123 and 242 a week from one job self employed and your profits are between 6 725 and 12 570 a year Your contributions are treated as having been paid to protect

More picture related to How Much Can You Earn Per Week Before Paying Tax And National Insurance

How Much Can You Earn Before Paying Income Tax Evening Standard

https://static.standard.co.uk/2023/03/27/00/f01b91ef08d35c211f0a6de634c15922Y29udGVudHNlYXJjaGFwaSwxNjc5NzYwNTI3-2.34653039.jpg?width=968&auto=webp&quality=50&crop=968:645%2Csmart

How Much Money Do I Need By Age To Retire Early Harry Point

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2018/10/after-tax-investment-amounts-by-age-to-retire-early-base-case-FS.png

How Much Can I Earn In UK Before Paying Tax Accounting Firms

https://www.accountingfirms.co.uk/wp-content/uploads/2022/12/earn-before-paying-tax-1.png

This threshold increases to 242 per week from 5 July 2022 At higher levels of earnings above 190 242 but less than 967 you pay National insurance at a fixed percentage on your earnings 13 25 For earnings above this level you pay a small National Insurance charge 3 25 on the additional earnings More than one employment National Insurance contributions NICs are the UK s second biggest tax expected to raise almost 150 billion in 2021 22 about 20 of all tax revenue 120 per week in 2021 22 even if they earn less than the primary threshold 184 per week and therefore do not actually pay NICs Furthermore people receive National

If you don t have to pay National Insurance you might be eligible for National Insurance credits or you can choose to make voluntary contributions Both help you build up qualifying years which count towards your entitlement for the state pension and other benefits Find out more National Insurance and benefits If you earn between the Primary Threshold and the Upper Earnings Limit then you will pay the standard rate of National Insurance 13 25 in 2022 23 on your earnings over the Primary Threshold The Primary Threshold in 2022 23 is 190 per week to 5 July 2022 then 242 from 6 July 2022 The Upper Earning Limit is 967 per week for 2022 23

Tax And National Insurance For Employee Benefits Hooray Health

https://hoorayinsurance.co.uk/wp-content/uploads/2021/01/Tax-and-National-Insurance-for-Employee-Benefits-2048x1152.png

How Much Can You Earn Before Paying UK Self Employment Tax

https://goselfemployed.co/wp-content/uploads/2023/01/Earn-before-paying-tax.png

How Much Can You Earn Per Week Before Paying Tax And National Insurance - If you earn between 242 to 967 a week or 1 048 to 4 189 a month you will pay National Insurance at a rate of 13 25 this is up 1 25 percentage points from the 12 you would have paid in the previous tax year For anything you earn over 4 189 per month you will pay a rate of 3 25 up 1 25 percentage points from 2 in the