How Much A Week Is 50000 A Year After Taxes FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

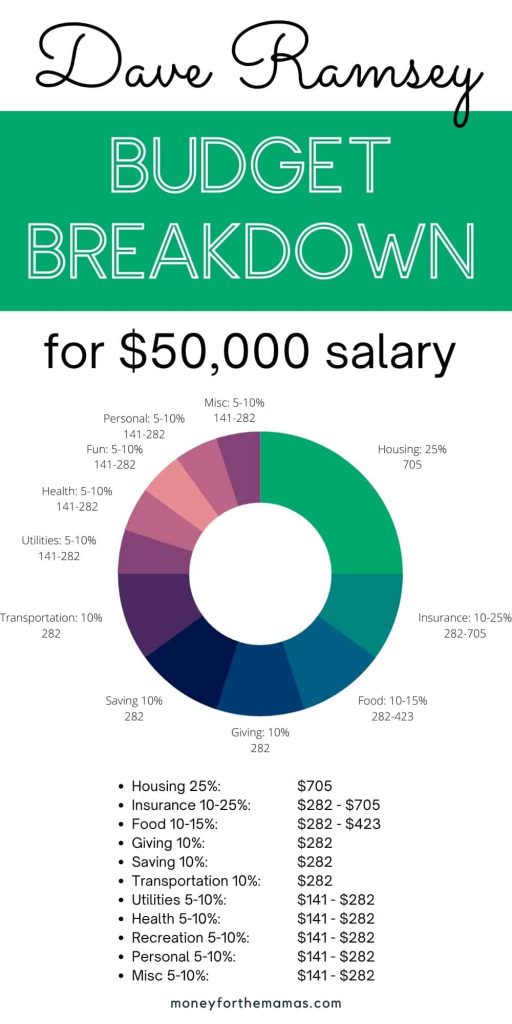

In the year 2024 in the United States 50 000 a year gross salary after tax is 41 935 annual 3 176 monthly 730 38 weekly 146 08 daily and 18 26 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 50 000 a year after tax in the United States Yearly What is 42 159 00 as a gross salary An individual who receives 42 159 00 net salary after taxes is paid 50 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security Let s look at how to calculate the payroll deductions in the US How to calculate Tax Medicare and Social Security on a 50 000 00 salary

How Much A Week Is 50000 A Year After Taxes

How Much A Week Is 50000 A Year After Taxes

https://www.moneyforthemamas.com/wp-content/uploads/2022/05/dave-ramsey-budget-percentages-for-50000-salary-512x1024.jpg

Establishment Of After Tax Cash Flow Example YouTube

https://i.ytimg.com/vi/jo2lvnXSYhA/maxresdefault.jpg

How Much Is 70 000 A Year After Taxes filing Single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-70000-dollars-sm-2-1024x768.png

Use our US salary calculator to find out your net pay and how much tax you owe based on your gross income salaryafter tax Salary After Tax Home Calculators 26 Working weeks per year 52 Working days per week 5 Working hours per week 40 0 Show Taxes Monthly Gross Income 5 781 69 368 2 668 1 334 266 80 33 35 Tax Due Work Hours per Week 50 000 a year is how much per hour Work Hours per Week 37 5 Yearly Salary 50 000 Monthly Salary 4 167 Biweekly Salary 1 923 Weekly Salary 962 50 000 a year after taxes in Newfoundland and Labrador 50 000 a year after taxes in Nova Scotia 50 000 a year after taxes in Northwest Territories

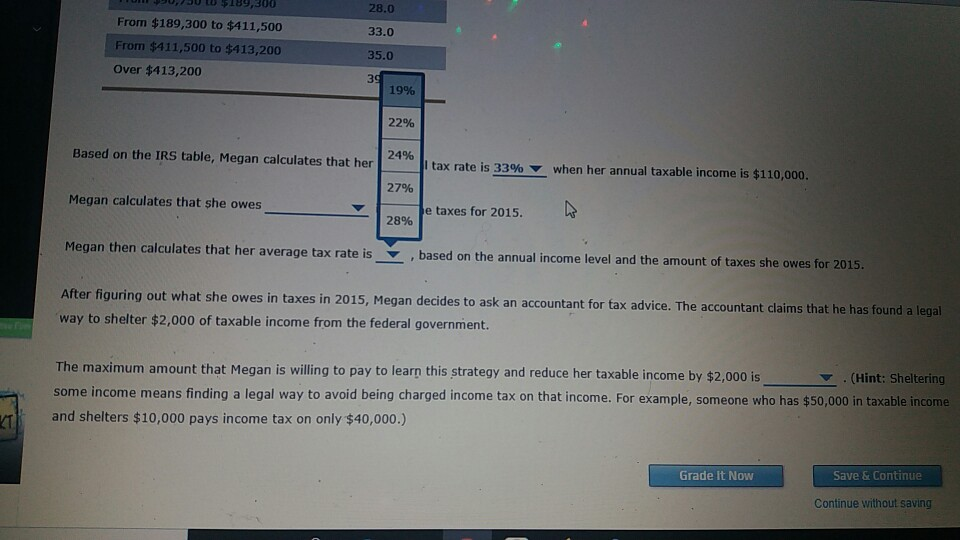

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly They are used to fund social Security and Medicare For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax 2014 46 784 2013 46 337 2012 41 553 Every taxpayer in North Carolina will pay 4 75 of their taxable income in state taxes North Carolina has not always had a flat income tax rate though In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes

More picture related to How Much A Week Is 50000 A Year After Taxes

25 Ways We SAVED 50 000 Minimalist MONEY SAVING Tips YouTube

https://i.ytimg.com/vi/Bx-UyFVUu8g/maxresdefault.jpg

Solved

https://media.cheggcdn.com/media/583/5833c65c-9061-4f08-8f59-c5cf647403ee/image.png

Save 50K In 1 Year Money Saving Methods Money Management Finance

https://i.pinimg.com/736x/af/36/a8/af36a85755bb019e2723158c8f81d446.jpg

For instance if your hourly wage is 34 you work 40 hours per week and 52 weeks per year your annual income would be 70 720 If you are taxed at 12 your net annual income would come to 62 233 60 Calculate net income after taxes Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net income after taxes The IRS uses many factors to calculate the actual tax you may owe in any given year Note that if you are

2014 55 173 2013 55 156 2012 51 904 Pennsylvania levies a flat state income tax rate of 3 07 Therefore your income level and filing status will not affect the income tax rate you pay at the state level Pennsylvania is one of just eight states that has a flat income tax rate and of those states it has the lowest rate Take home pay 50 000 State income tax paid for single person 0 Marginal state income tax 2 Effective state income tax 0 Jordan Rosenfeld contributed to the reporting of this article Methodology For this study GOBankingRates analyzed the 2024 tax rates to find the average amount the average person pays in state taxes in each state

50000 A Year Is How Much An Hour What Jobs Pay That

https://thehustlestory.com/wp-content/uploads/2022/11/Screenshot-2022-11-30-at-3.06.32-PM.png

50K SAVINGS CHALLENGE In 1 Year Money Saving Challenge Etsy

https://i.etsystatic.com/33820553/r/il/18ab53/3738087382/il_1588xN.3738087382_t9tv.jpg

How Much A Week Is 50000 A Year After Taxes - Work Hours per Week 50 000 a year is how much per hour Work Hours per Week 37 5 Yearly Salary 50 000 Monthly Salary 4 167 Biweekly Salary 1 923 Weekly Salary 962 50 000 a year after taxes in Newfoundland and Labrador 50 000 a year after taxes in Nova Scotia 50 000 a year after taxes in Northwest Territories