How Much 90000 After Taxes Federal Paycheck Quick Facts Federal income tax rates range from 10 up to a top marginal rate of 37 The U S real median household income adjusted for inflation in 2022 was 74 580 9 U S states don t impose their own income tax for tax year 2023 How Your Paycheck Works Income Tax Withholding

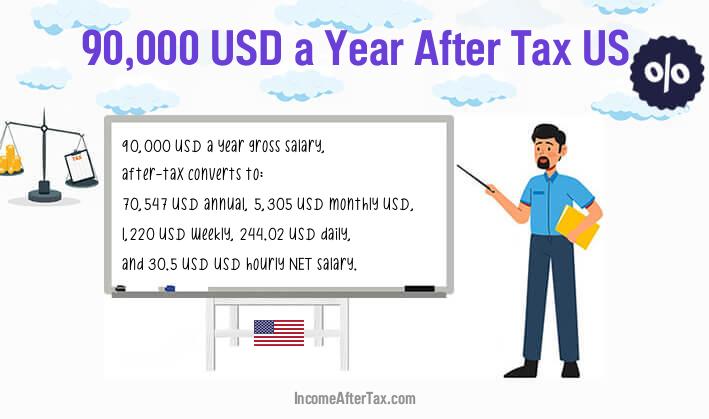

US Income Tax Calculator 90 000 After Tax US 90 000 After Tax US On this page you ll find a detailed analysis of a 90 000 after tax annual salary for 2023 with calculations for monthly weekly daily and hourly rates as of December 7th 2023 at 03 00 AM This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major change since 1987 Income Tax Calculator Budget Calculator Before Tax vs After Tax Income

How Much 90000 After Taxes

How Much 90000 After Taxes

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-90000-dollars-sm-2-1024x768.png

90 000 A Year Is How Much An Hour Monthly Budget Breakout

https://www.moneyforthemamas.com/wp-content/uploads/2022/07/dave-ramsey-recommended-budget-percentages-for-90000-salary-512x1024.jpg

90 000 A Year Is How Much An Hour Monthly Budget Breakout

https://www.moneyforthemamas.com/wp-content/uploads/2022/07/90k-a-year-is-how-much-an-hour-683x1024.jpg

Just plug in your expected income deductions and credits and the calculator will quickly estimate your 2023 2024 federal taxes Taxable income 86 150 Effective tax rate 16 6 Estimated Simply enter your taxable income filing status and the state you reside in to find out how much you can expect to pay Generally if your taxable income is below the 2022 2023 standard deduction

After paying all these taxes you will have a net income between 66 378 and 71 055 per year depending on which state or locality you live in or pay taxes in This calculates to the monthly take home pay of 5 531 5 921 Table Of Contents What taxes do I need to pay on earned income This helps you determine how much you pay as tax and what you earn after tax on a 90 000 salary The marginal tax rate on a salary income of USD 90 000 in the case of Idaho is 35 7 This is the tax rate applied to each level of income or tax bracket The average tax rate for a salary of USD 90K in Idaho is 26 5

More picture related to How Much 90000 After Taxes

How Much Does A Barndominium Cost My Barndominium Build

https://mybarndominiumbuild.com/wp-content/uploads/2021/10/How-Much-Does-a-Barndominium-Cost-768x432.png

How Much Did Jane Earn Before Taxes New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

What Is 90 000 After Tax In The US For 2022

https://mugshotbot.com/m?color=teal&hide_watermark=true&mode=dark&pattern=lines_in_motion&url=https://worldsalaries.com/us/salary-calculator/what-is-90000-after-tax/

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator Salary Calculator Results If you are living in California and earning a gross annual salary of 72 020 or 6 002 per month the total amount of taxes and contributions that will be deducted from your salary is 16 442 This means that your net income or salary after tax will be 55 578 per year 4 632 per month or 1 069 per week

How much is 90 000 a Month After Tax in the United States In the year 2023 in the United States 90 000 a month gross salary after tax is 685 225 annual 54 378 monthly 12 506 weekly 2 501 daily and 312 65 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 90 000 a FICA is a two part tax Both employees and employers pay 1 45 for Medicare and 6 2 for Social Security The latter has a wage base limit of 168 600 which means that after employees earn that much the tax is no longer deducted from their earnings for the rest of the year

90 000 After Tax 2022 2023 Income Tax UK

https://www.income-tax.co.uk/images/90000-after-tax-salary-uk-2020-medium.png

90 000 A Year After Tax Is How Much A Month Week Day An Hour

https://incomeaftertax.com/90000-after-tax-us.jpg?22

How Much 90000 After Taxes - This helps you determine how much you pay as tax and what you earn after tax on a 90 000 salary The marginal tax rate on a salary income of USD 90 000 in the case of Idaho is 35 7 This is the tax rate applied to each level of income or tax bracket The average tax rate for a salary of USD 90K in Idaho is 26 5