How Many Hours A Week Can An Employer Make A Salaried Employee Work Posted on January 17 The federal Fair Labor Standards Act FLSA does not limit the number of hours in a day or days in a week any employee salaried or hourly may be required or scheduled to work including overtime hours if the employee is at least 16 years old What the overtime pay laws dictate is how you must be paid for the hours worked

For covered nonexempt employees the FLSA requires overtime pay at a rate of not less than one and one half times an employee s regular rate of pay after 40 hours of work in a workweek Some exceptions to the 40 hours per week standard apply under special circumstances to police officers and fire fighters employed by public agencies and to For example when an hourly employee earns 15 per hour and works 41 hours in a week their pay is calculated as follows Regular pay for 40 hours 600 40 hours x 15 Overtime pay for 1 hour 22 50 1 hour x 15 x 1 5 Total pay 622 50 Remember not all employees qualify for overtime pay and understanding which employees are exempt from

How Many Hours A Week Can An Employer Make A Salaried Employee Work

:max_bytes(150000):strip_icc()/salary-vs-hourly-employee-397909_FINAL-fce8be5f596c446b8e32baccb628b82e.png)

How Many Hours A Week Can An Employer Make A Salaried Employee Work

https://www.thebalancemoney.com/thmb/lY8ITvpfNR5xxy8G426pWDOPizo=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/salary-vs-hourly-employee-397909_FINAL-fce8be5f596c446b8e32baccb628b82e.png

How Many Hours Should A Salaried Employee Work YouTube

https://i.ytimg.com/vi/R0YoyJSttyo/maxresdefault.jpg

AAPC s 2014 Salary Survey See How Your Salary Stacks Up AAPC

https://cache.aapc.com/blog/wp-content/uploads/2014/12/04123505/Hours-Worked-per-Week.png

For example if an employee has an annual salary of 60 000 and is paid semi monthly that individual s salary per pay period would be 60 000 24 2 500 For hourly employees employers must multiply the hourly rate by the number of hours worked So if an employee is paid 12 per hour and works 40 hours per week that individual s This fact sheet provides general information concerning what constitutes compensable time under the FLSA The Act requires that employees must receive at least the minimum wage and may not be employed for more than 40 hours in a week without receiving at least one and one half times their regular rates of pay for the overtime hours The amount employees should receive cannot be determined

In this case the overtime rate is 22 50 per hour 15 x 1 5 Since the employee only worked one hour over the standard 40 you would just add one hour of overtime pay to their wage like this 600 22 50 x 1 hour 622 50 But overtime pay doesn t apply to every employee and this is where most labor laws for salaried employees are Exempt employees often in executive professional or administrative roles must meet certain job duties requirements and be paid on a salary basis at not less than a specified minimum salary As of 2024 this threshold stands at 684 per week 35 568 annually However this amount can vary based on state labor laws

More picture related to How Many Hours A Week Can An Employer Make A Salaried Employee Work

:max_bytes(150000):strip_icc()/what-is-a-salary-employee-2062093_final-c12d49fe511a46c48ec6ea900f004318.png)

What Is A Salaried Employee

https://www.thebalancemoney.com/thmb/vkxO3KMz0cFc_cMUB_F6WvAtNRw=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/what-is-a-salary-employee-2062093_final-c12d49fe511a46c48ec6ea900f004318.png

How Many Hours Should A Salaried Employee Work

https://imageio.forbes.com/specials-images/dam/imageserve/58580272a7ea431d601b4785/0x0.jpg?format=jpg&height=900&width=1600&fit=bounds

What Are The Maximum Hours A Employee Can Work Swartz Swidler

https://swartz-legal.com/wp-content/uploads/2020/03/What-are-the-maximum-hours-a-salaried-employee-can-work.jpg

In fact for most professions an employee is exempt if he or she Is paid at least 23 600 per year or 455 per week Is paid on a salary basis and Performs exempt job duties Note job titles don t determine exempt status Rather it s all about the employee s specific job duties and salary As a rule of thumb exempt employees tend to An employer must pay an exempt employee the full predetermined salary amount free and clear for any week in which the employee performs any work without regard to the number of days or hours worked However there is no requirement that the predetermined salary be paid if the employee performs no work for an entire workweek

This language can be tricky because the hours and advance notice are not defined Companies use policies like this to keep their options open 40 Hours Is Just the Minimum for Full Time Employees Not the Maximum The federal Fair Labor Standards Act FLSA sets a standard of a 40 hour work week This act offers many protections but does not When it comes to determining how many hours over the standard work week if any a salaried person should have to work the amount of time required to satisfactorily complete the job should be a primary determining factor Often this does not exceed a 45 or 50 hour work week If a job requires 55 or 60 or more hours to perform many would

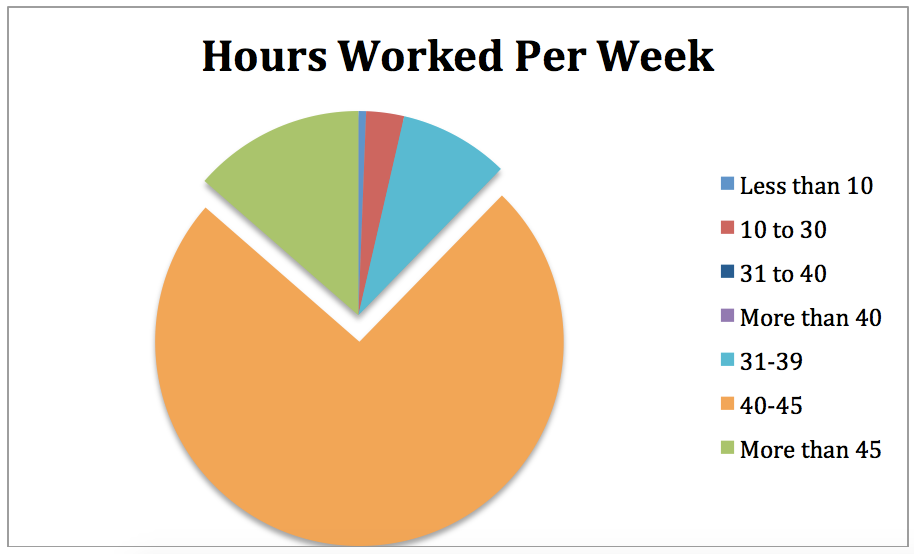

Average Working Hours Navigating Compensation Expectations Labor

https://blog-cdn.everhour.com/blog/wp-content/uploads/2021/04/[email protected]

Financial Planning For Salaried Employee Things To Know Merrymind

https://merrymind.in/wp-content/uploads/2020/05/59.jpg

How Many Hours A Week Can An Employer Make A Salaried Employee Work - This fact sheet provides general information concerning what constitutes compensable time under the FLSA The Act requires that employees must receive at least the minimum wage and may not be employed for more than 40 hours in a week without receiving at least one and one half times their regular rates of pay for the overtime hours The amount employees should receive cannot be determined