How Is Nj State Pension Calculated Disability Retirement There are two types of PERS Disability Retirement benefits select one Ordinary Disability You must have a minimum of 10 years of N J service credit and be considered totally and permanently disabled If you qualify for an Ordinary Disability Retirement the retirement allowance is 43 6 percent of your Final Average Salary or 1 64 percent of the Final Average

CWA State Monthly Employees CWA Employees of State Agencies Authorities State Colleges and Universities who are not paid through State Centralized Payroll and negotiate their contracts through the Office of Employee Relations Percentage of Salary Scales Union Negotiated and Non Aligned State Monthly Employees According to an NJ Spotlight News analysis of federal inflation data a retiree would need nearly 70 000 today to maintain the same buying power as an annual pension that was worth 50 000 in 2011 However simply restoring COLAs for all retired government workers in the state would come at a significant cost according to recent Department of

How Is Nj State Pension Calculated

How Is Nj State Pension Calculated

https://www.hummingbirdsplus.org/nature-blog-network/wp-content/uploads/2023/08/the-american-goldfinch-new-jerseys-state-bird-22.jpg

Social Security Retirement Application Form Fill Out And Sign

https://www.signnow.com/preview/492/746/492746308/large.png

Changes In NHS Pension Contributions Are You A Winner Or Loser

https://www.legalandmedical.co.uk/wp-content/uploads/2022/07/Pensionable-pay1-768x742.jpg

To calculate your retirement estimate all you need to do is Choose the New Jersey retirement calculator that s specific to your retirement plan type Enter the required information into the calculator Click calculate The number shown to you will be your estimated benefits at the time of your retirement The retirement estimate shown to New Jersey Division of Pensions Bene ts NJDPB Provisions of Law The PERS was established by New Jersey Statute and can be found in the New Jersey Statutes Annotated Title 43 Chapter 15A Changes in the law can only be made by an act of the State Legislature Rules govern ing the operation and administration of the system may

Pension Fund Member Retirement Cause Recipient Type Year of Retirement Between starting yyyy ending yyyy HINT Enter an unsigned whole number Total of Monthly Pension Allowance Greater Than Total of Monthly Allowances for an Individual Fund and Recipient Type HINT Enter an unsigned whole number no commas or decimal point Public Employee s Retirement System MEMBERSHIP imum pensionable salary of 1 500 You are not required to be a member of any other State or local government retirement system on Eligibility rules and regulations are described in general Membership Tier 2 Members who were en the basis of the same position terms in this guidebook and may not cover all situa rolled on or after

More picture related to How Is Nj State Pension Calculated

How To Claim Your State Pension Pounds And Sense

https://www.poundsandsense.com/wp-content/uploads/2021/11/InkedPension-letter_LI-768x1055.jpg

What Is The Retirement Age In Nj Retire Gen Z

https://retiregenz.com/wp-content/uploads/2023/05/what-is-the-retirement-age-in-nj-9KS4.jpg

Your State Pension Forecast Explained Which

https://media.product.which.co.uk/prod/images/original/12b4afe2cd76-statepensiongraphicforgareth1.jpg

New Jersey maintains separate pension funds for different groups of workers ranging from teachers to police officers and firefighters to judges Under the current law the COLA suspensions must remain in effect for individual pension funds until they are deemed to be 80 funded by the state s actuaries State vs local pensions The 2021 property tax credits were based on income and property taxes paid for tax year 2017 If your 2017 New Jersey gross income was 100 000 or less the benefit is equal to 10 of your 2006 property taxes up to a maximum of 10 000 If your 2017 New Jersey gross income was between 100 000 and 150 000 the benefit is equal to 5 of your

Since New Jersey does not tax Social Security income the 100 000 does not include Social Security he said In 2020 the maximum pension exclusion was 100 000 for married couples 75 000 PFRS 10 of annual salary DCRP 5 5 of annual salary Deferred Comp employee determines contribution Pension Tiers PERS Tier 1 enrolled before July 1 2007 Tier 2 enrolled on or after July 1 2007 and before November 2 2008 Tier 3 enrolled on or after November 2 2008 and on or before May 21 2010

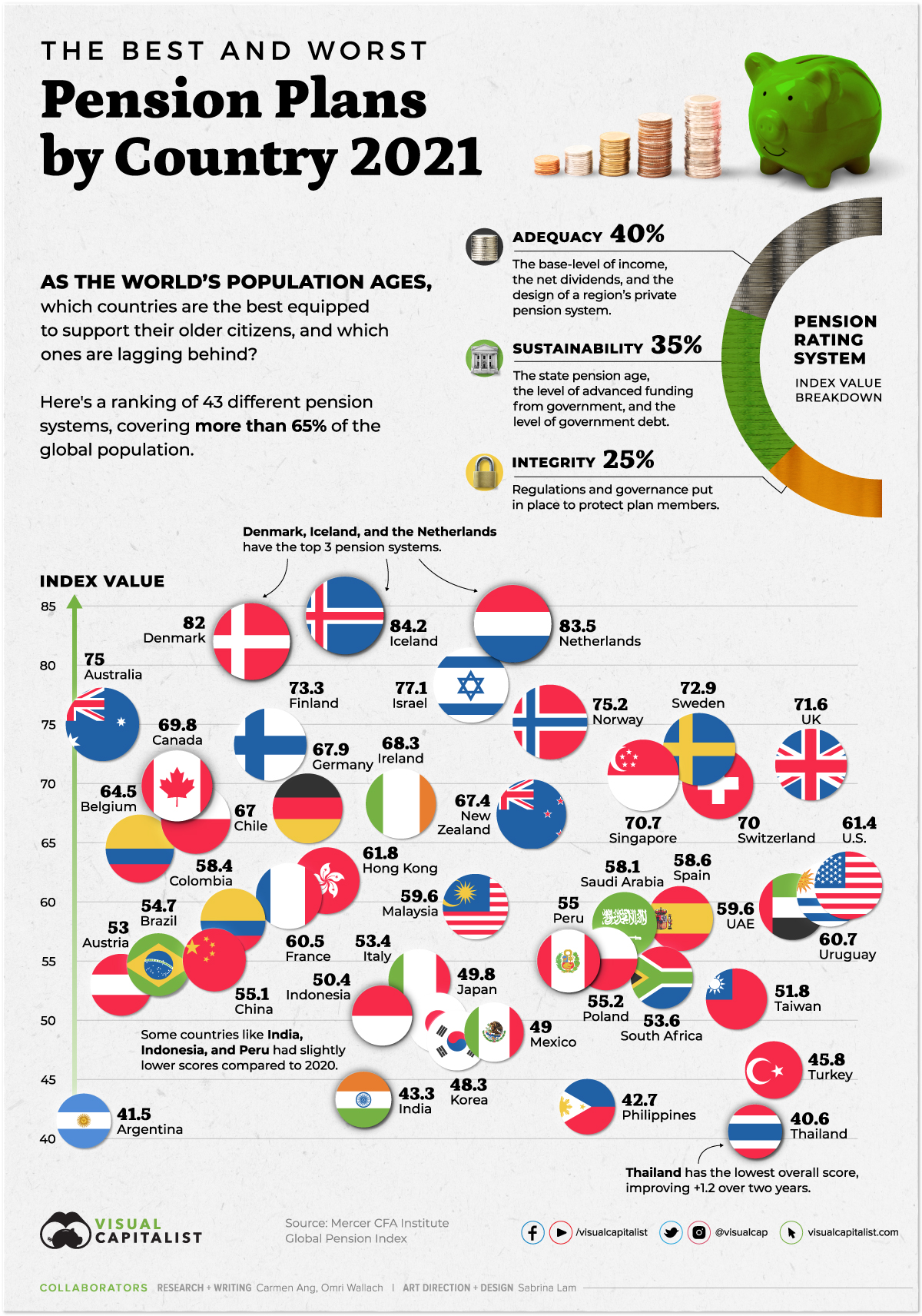

Ranked The Best And Worst Pension Plans By Country

https://www.visualcapitalist.com/wp-content/uploads/2021/11/The-Best-and-Worst-Pensions-Plans-Around-the-World-2021_Nov23_main.jpg

How To Use The Pension Calculator YouTube

https://i.ytimg.com/vi/ZX4NLahNq74/maxresdefault.jpg

How Is Nj State Pension Calculated - Pension Fund Member Retirement Cause Recipient Type Year of Retirement Between starting yyyy ending yyyy HINT Enter an unsigned whole number Total of Monthly Pension Allowance Greater Than Total of Monthly Allowances for an Individual Fund and Recipient Type HINT Enter an unsigned whole number no commas or decimal point