How Do You Work Out Gross Pay From Net Gross pay calculator Plug in the amount of money you d like to take home each pay period and this calculator will tell you what your before tax earnings need to be Important Note on Calculator The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates

To quickly find the net value from gross and tax follow the steps Write down the tax from gross rate as a decimal number e g 12 0 12 Multiply the tax rate by the gross price Subtract the result from the gross price You ve found the net value Use an online gross to net calculator if you want to verify the result There are six main steps to work out your final paycheck Step 1 Gross income Your net pay After calculating your total tax liability subtract deductions pre and post tax and any withholdings if applicable Do the following steps to get your take home pay Determine your gross income Work out your total federal income tax

How Do You Work Out Gross Pay From Net

How Do You Work Out Gross Pay From Net

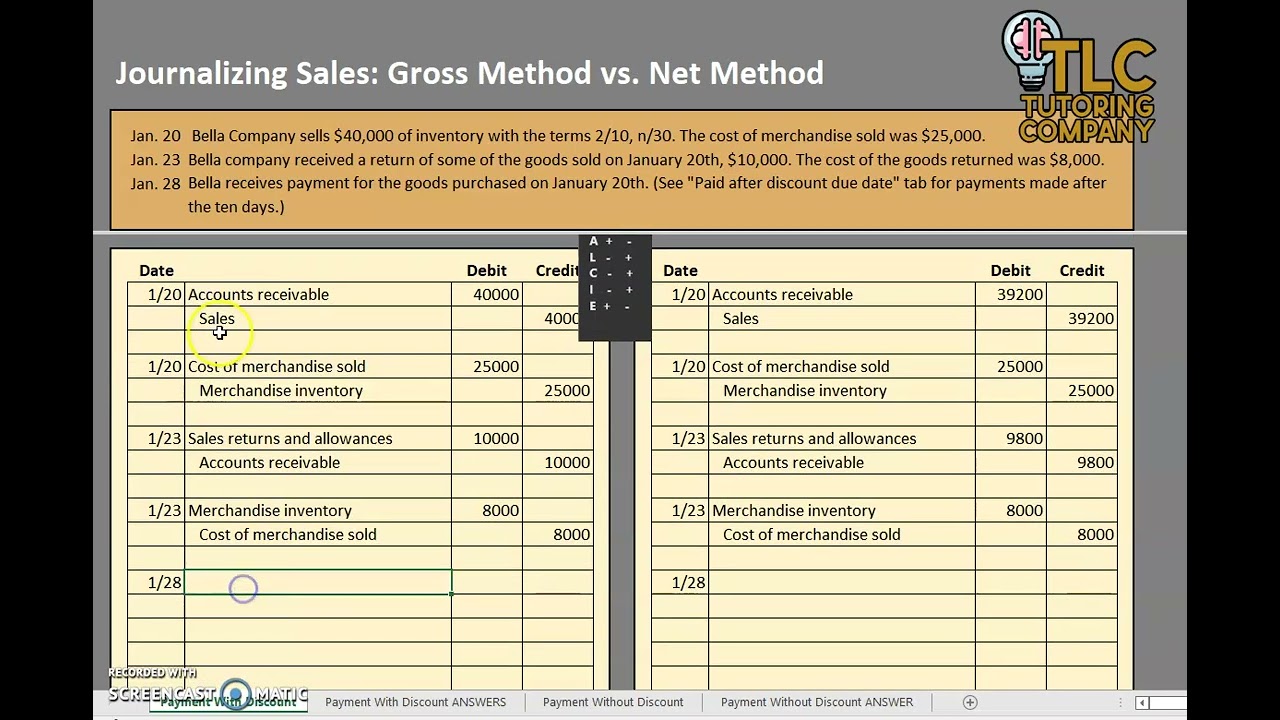

https://i.ytimg.com/vi/gol9h7T2xdY/maxresdefault.jpg

How To Calculate GROSS PROFIT Income Statement YouTube

https://i.ytimg.com/vi/zFjp-sVx2eQ/maxresdefault.jpg

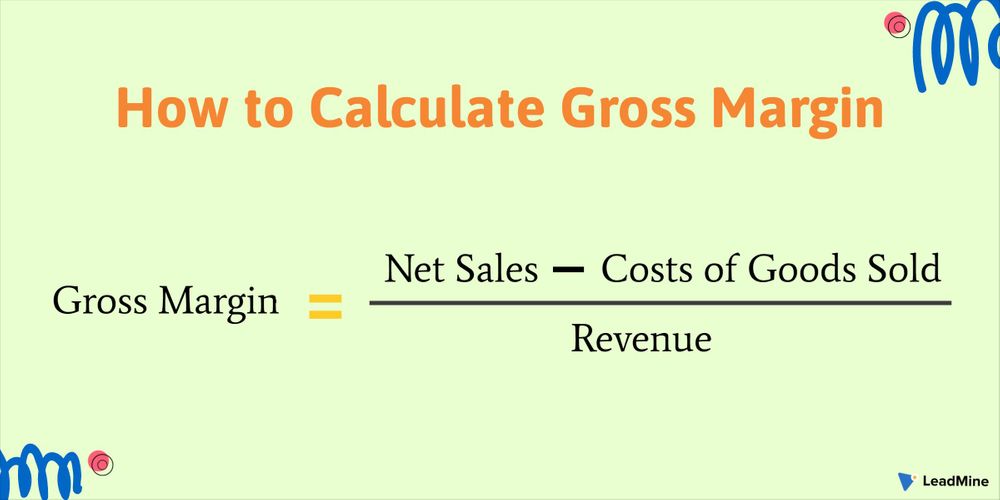

Gross Margin Definition Formula Profit Margin Vs Gross Margin

https://www.leadmine.net/glossary/content/images/size/w1000/2021/04/Calculate-Gross-Margin.jpeg

Calculate gross pay before taxes based on hours worked and rate of pay per hour including overtime To enter your time card times for a payroll related calculation use this time card calculator Gross Pay or Salary Gross pay is the total amount of money you get before taxes or other deductions are subtracted from your salary Related Gross Pay vs Net Pay Definitions and Examples Gross pay vs W 2 pay Gross pay represents the full amount paid to an employee while a W 2 determines taxable wages Employers determine taxable wages by deducting certain contributions such as retirement plan and flexible spending account contributions and health insurance premiums

If you want to pay your employees with a desired net pay amount but with taxes and deductions taken out you need to figure out the gross pay amount to run payroll For example you want to reward your employee with a 300 net pay bonus and you want to withhold Social Security Medicare 100 for federal income tax FIT and 100 for other How to calculate net pay 4 steps Once you have calculated an employee s gross pay the next step is determining their net pay the actual amount they take home after deductions Follow these steps to calculate net pay accurately Step 1 Start with gross pay Gross pay is the total earnings before any deductions

More picture related to How Do You Work Out Gross Pay From Net

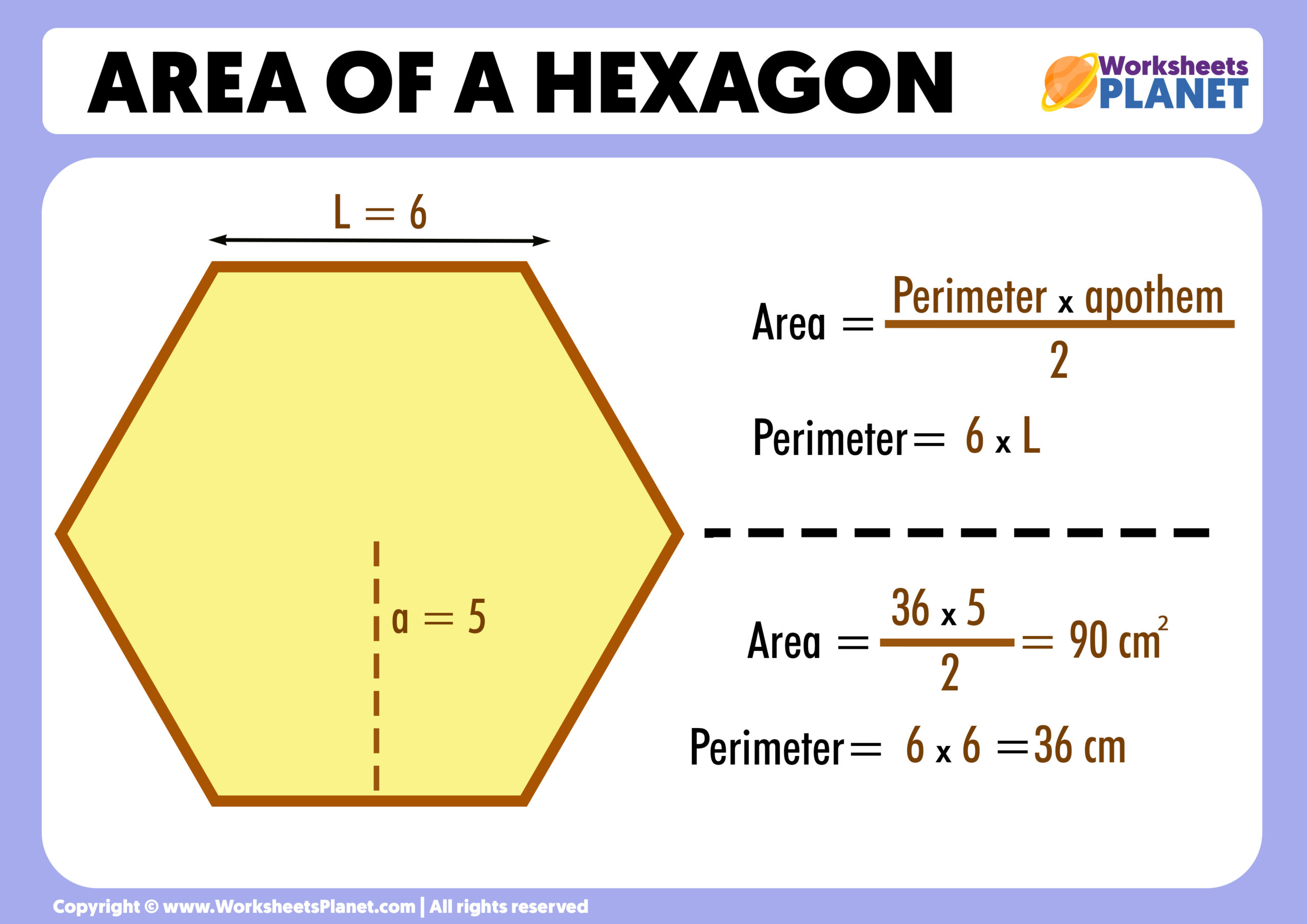

Area Of A Hexagon Formula Example

https://www.worksheetsplanet.com/wp-content/uploads/2022/09/Area-of-a-hexagon-scaled.jpg

Gross Auto

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_au/blog/images/image/gross-profit-outdoor-manufacturing-statement-inforgraphic-au.png

B4Tax Reverse Tax Calculator Apps On Google Play

https://play-lh.googleusercontent.com/uPStFY3xsE5hpHC1-qYNag0_BAFXiFE1BNI1rb_1zSBq3Cruin5Kbz0lXk_j4sOiLu-a

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 The gross pay method refers to whether the gross pay is an annual amount or a per period amount The annual amount is your gross pay for the whole year Per period amount is your gross pay every payday For example if your annual salary were 52 000 and you are paid weekly your annual amount is 52 000 and your per period amount is 1 000

[desc-10] [desc-11]

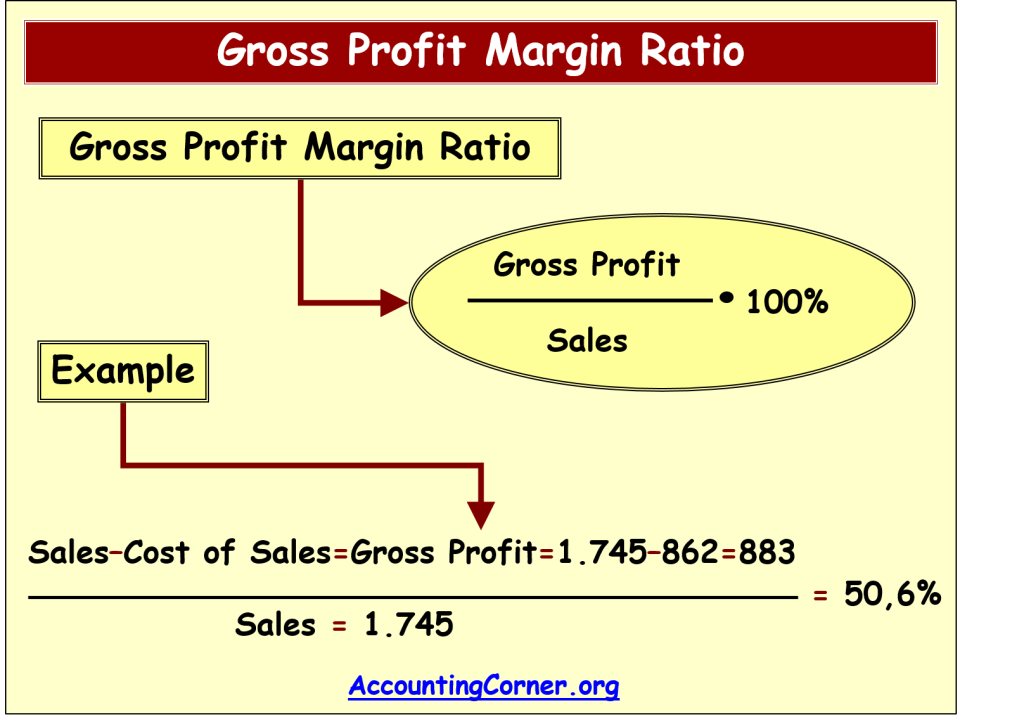

Net Profit Margin Equation Tessshebaylo

http://accountingcorner.org/wp-content/uploads/2016/01/gross_profit_example-1024x717.png

Gross Profit Formula Examples Calculator With Excel Template

https://cdn.educba.com/academy/wp-content/uploads/2019/05/Gross-Profit-Formula.jpg

How Do You Work Out Gross Pay From Net - [desc-12]