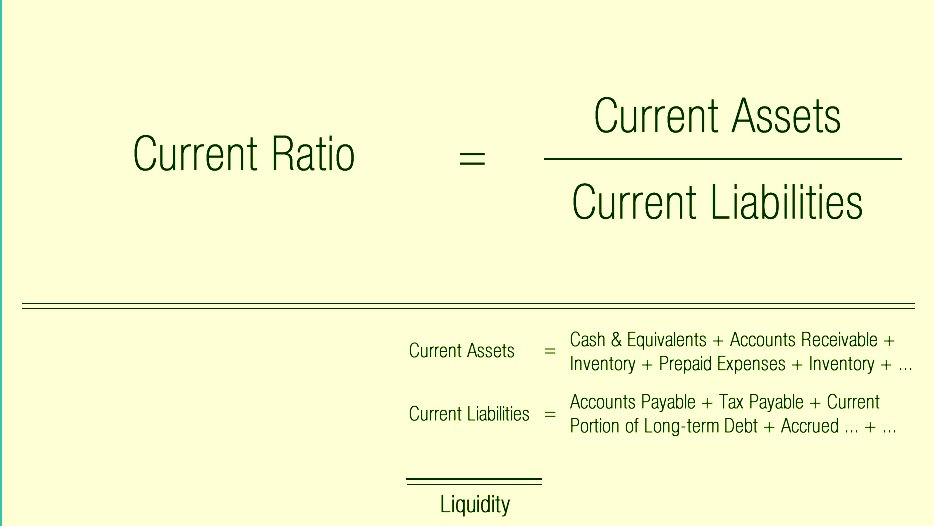

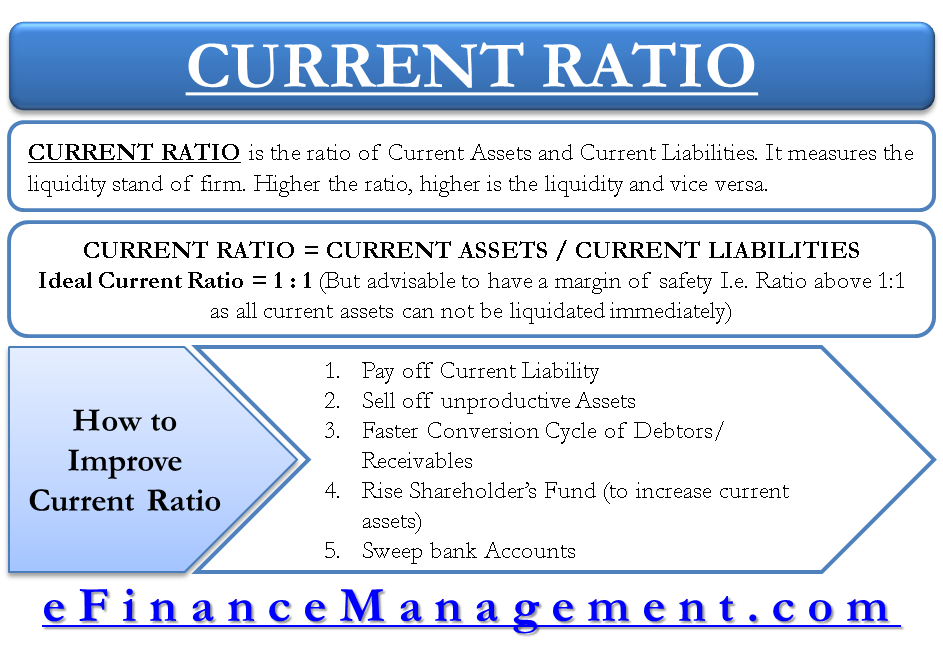

How Do You Find The Current Ratio In Accounting The current ratio is a very common financial ratio to measure liquidity Current ratio is equal to total current assets divided by total current liabilities A ratio greater than 1 means that the company has sufficient current assets to pay off short term liabilities A high ratio implies that the company has a thick liquidity cushion

The current ratio compares all of a company s current assets to its current liabilities The current ratio helps investors understand more about a company s ability to cover its short term Current Ratio Definition The current ratio or working capital ratio is a ratio of current assets to current liabilities within a business In other words it is defined as the total current assets divided by the total current liabilities The current ratio is one of the oldest ratios used in liquidity analysis

How Do You Find The Current Ratio In Accounting

How Do You Find The Current Ratio In Accounting

https://i.ytimg.com/vi/aHRkMy9cZMw/maxresdefault.jpg

Liquidity Archives Plan Projections

https://www.planprojections.com/wp-content/uploads/current-ratio-formula.png

Current Ratio Examples Of Current Ratio With Excel 59 OFF

https://www.paayi.com/wp-content/uploads/2018/05/current-ratio-formula-1.jpg

What is the Current Ratio The current ratio also known as the working capital ratio measures the capability of a business to meet its short term obligations that are due within a year The ratio considers the weight of total current assets versus total current liabilities It indicates the financial health of a company and how it can maximize the liquidity of its current assets to settle Current Ratio Definition The current ratio is a liquidity ratio that is used to calculate a company s ability to meet its short term debt and obligations or those due in a single year using assets available on its balance sheet It is also known as working capital ratio A current ratio of one or more is preferred by investors

Current ratio Current assets Current liabilities 1 100 000 400 000 2 75 times The current ratio is 2 75 which means the company s currents assets are 2 75 times more than its current liabilities Significance and interpretation Current ratio is a useful test of the short term debt paying ability of any business To calculate the current ratio you must divide a company s current assets by its current liabilities For example if a company has 500 000 in current assets and 250 000 in current liabilities its current ratio would be impacting the company s cash flow and lowering the current ratio 8 Changes in Accounting Policies Common

More picture related to How Do You Find The Current Ratio In Accounting

Transformer Turns Ratio Test Using High Voltage DV Power 42 OFF

https://i.ytimg.com/vi/ZUtZz2SfljQ/maxresdefault.jpg

Pin On Liquidity Ratio Analysis

https://i.pinimg.com/originals/b8/ae/7e/b8ae7e1827280e058991af119dde25bc.png

Go To Accounting Play Liquidity Course For Digital Learning And More

https://accountingplay.com/wp-content/uploads/2015/08/Quick_Ratio.png

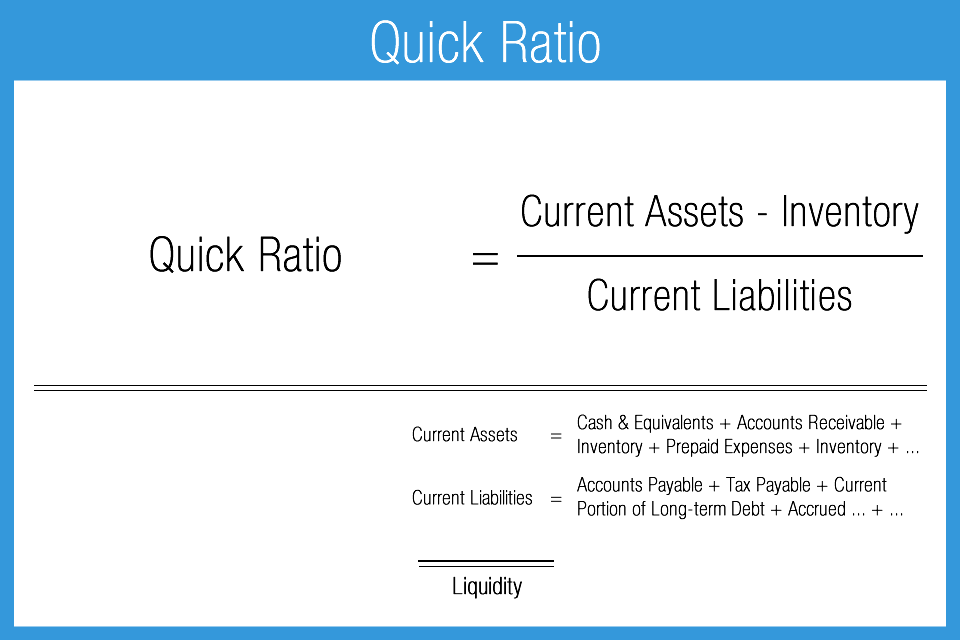

The current ratio is a liquidity ratio that evaluates the ability of a company to pay its short term or current liabilities with its short term or current assets The current ratio is also known as the working capital ratio This ratio gives investors and analysts insight into how a business can maximize the current assets on its balance sheet to satisfy its current debt and other payables 3 Types of Liquidity Ratios and How to Calculate Them There are three types of liquidity ratios which are taught in Strategic Financial Analysis Current ratio Quick ratio Cash ratio Below is a deeper dive into each Current Ratio A current ratio measures a company s ability to cover short term liabilities with its current assets The

[desc-10] [desc-11]

Current Ratio Formula

https://learn.financestrategists.com/wp-content/uploads/image.png

Current Ratio Formula

https://efinancemanagement.com/wp-content/uploads/2010/12/Current-Ratio.png

How Do You Find The Current Ratio In Accounting - To calculate the current ratio you must divide a company s current assets by its current liabilities For example if a company has 500 000 in current assets and 250 000 in current liabilities its current ratio would be impacting the company s cash flow and lowering the current ratio 8 Changes in Accounting Policies Common