How Do I Record Manual Payroll Tax Payments In Quickbooks Online Get your employees payroll pay stubs or a payroll report from your payroll service Select New Select Journal Entry Under the Journal date enter the paycheck date If you want to track the paycheck number enter it in the Journal no field Use the info from your payroll report to create the journal entry

Step 2 Prepare and print or save your payroll tax form Select Employees then Payroll Tax Forms and W 2s and select Process Payroll Forms Select the federal or state form you want to create from the list Select Create Form Select the Filing Period from the drop down and then select OK Streamline your payroll tax info and make managing your team easier with QuickBooks Payroll https quickbooks intuit payroll cid VIDEO CS US QBOPR NA N

How Do I Record Manual Payroll Tax Payments In Quickbooks Online

How Do I Record Manual Payroll Tax Payments In Quickbooks Online

https://free-template.co/wp-content/uploads/2022/01/1cf53f8084dd3be6/payroll-statement.jpeg

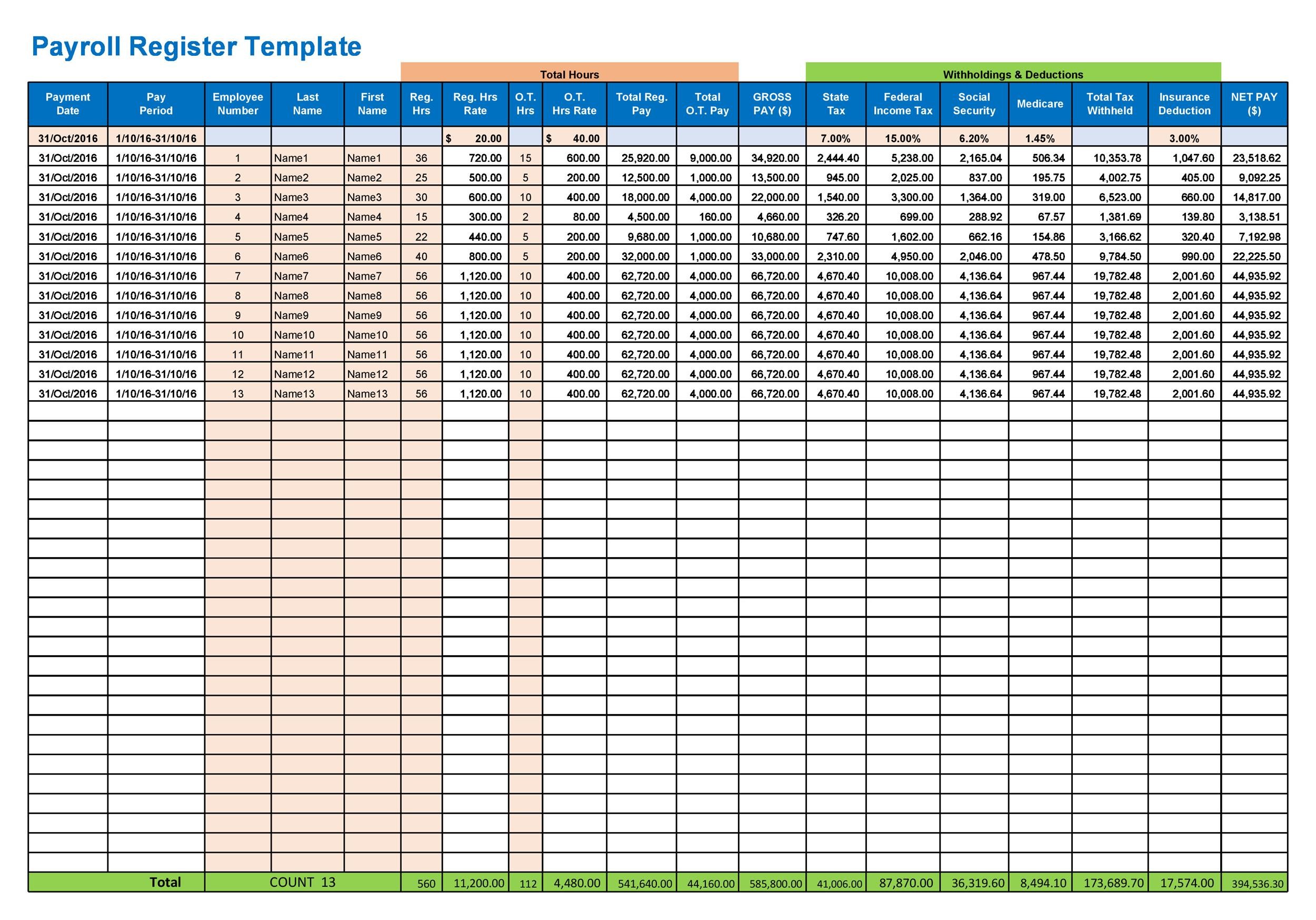

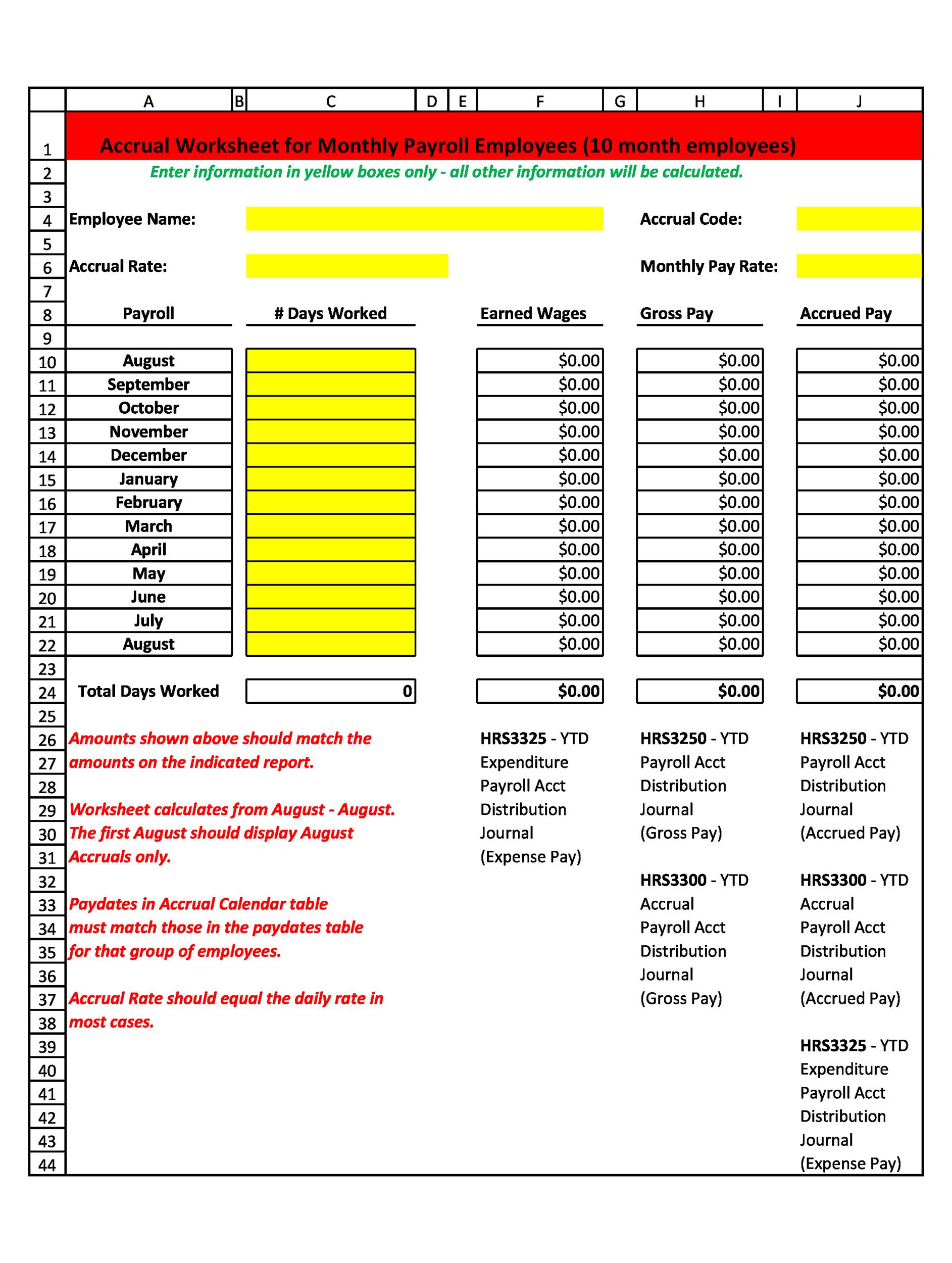

Payroll Calculator QuickBooks Tax Payments In QuickBooks

https://thepostrecords.com/wp-content/uploads/2021/11/QuickBooks-Paycheck-Calculator-1.jpg

Payroll Calculator Template Microsoft PDF Template

https://templatelab.com/wp-content/uploads/2018/03/payroll-template-25.jpg

Note You ll e pay and e file some taxes and forms at the same time like state unemployment in Step 2 Make sure you paid all taxes related to the form you want to file see Step 2 Go to Taxes and select Payroll tax Select Filings You ll see your forms to file under Action Needed Forms due later will show in Coming Up To do this open a regular browser Then press the following shortcut keys below Press Ctrl Shift N Google Chrome Ctrl Shift P Firefox Control Option P Safari Log in to your QBO account and try to select the bank to pay your taxes manually

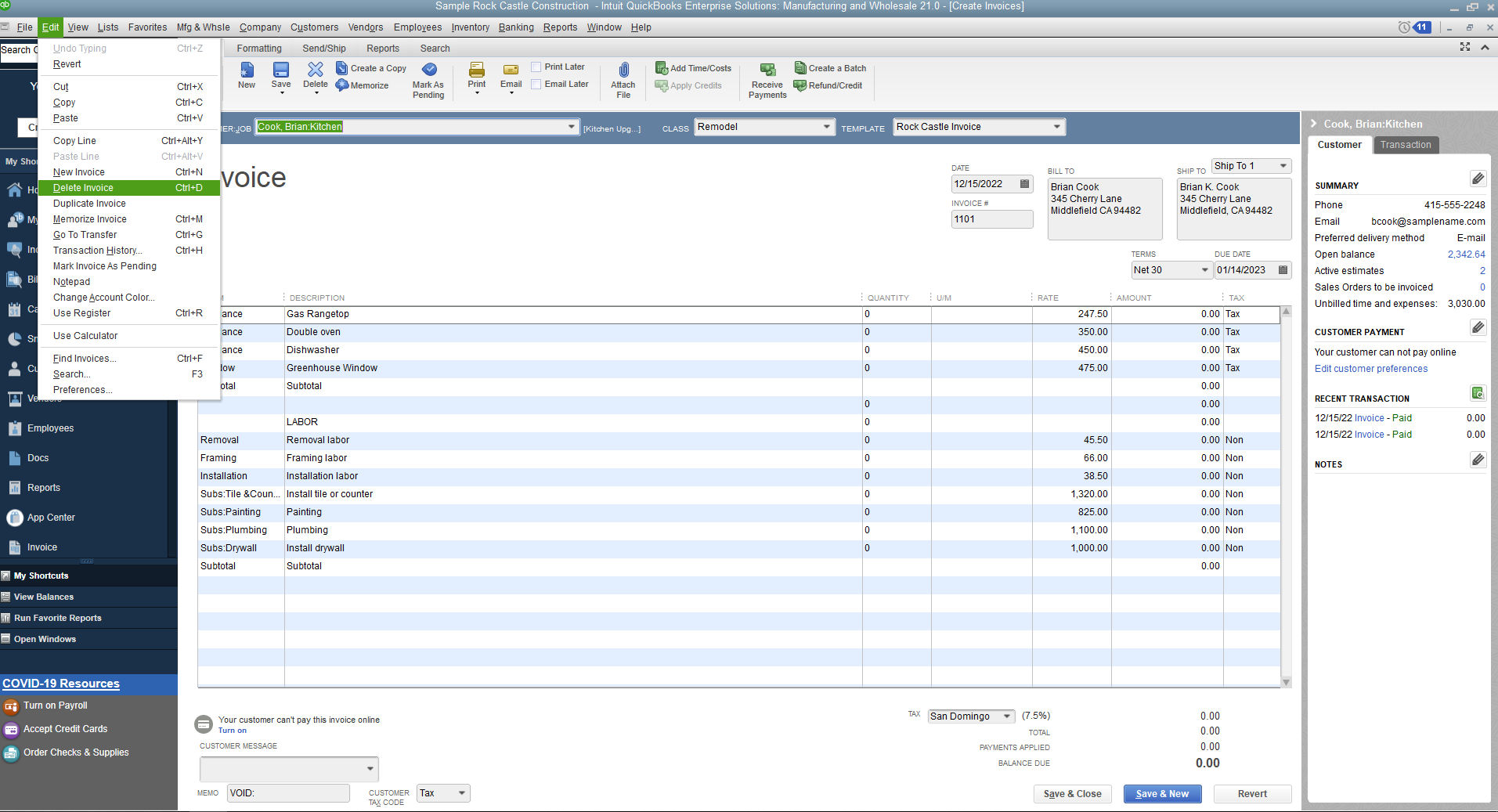

From the Edit dropdown menu select Preferences In the QuickBooks Desktop Payroll Features section select the Full payroll and the Manual Payroll checkboxes In the Get payday peace of mind window select Next and then Activate in the confirmation screen Select OK to apply the changes Select OK to exit out of the preferences window When you run payroll you also need to pay your payroll taxes as they become due We ll show you how to pay your taxes by electronic payment and by paper che

More picture related to How Do I Record Manual Payroll Tax Payments In Quickbooks Online

Delete Payment Received In Quickbooks Hooliveri

https://essential-it.com/wp-content/uploads/quickbooks-delete-invoice.jpg

Payroll Tax Payments Check Not Showing In QuickBooks Online In 2022

https://i.pinimg.com/originals/5b/e8/c3/5be8c364829e8bcde8925dc791e33a7c.jpg

Quickbooks Online Process An Invoice Payment

https://www.teachucomp.com/wp-content/uploads/blog-7-25-2016-ApplyOnePaymentToMultipleInvoicesInQuickBooks.png

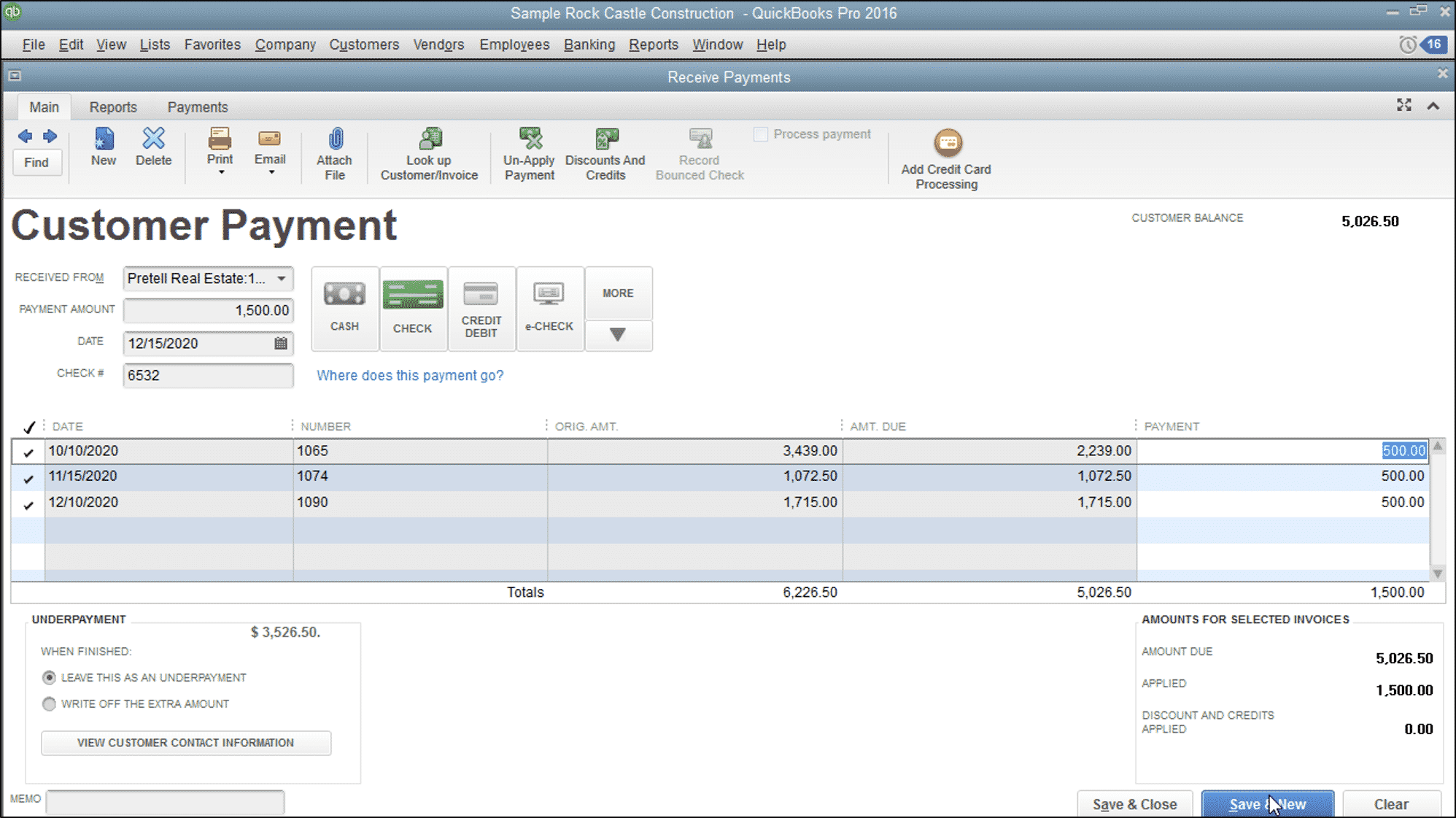

To manually record the payroll checks in QuickBooks Online we can create a journal entry This helps keep all your payroll data in one place Here s how Go to the New icon Select Journal entry Choose the date of the paycheck Select the correct debit and credit account Enter the other necessary details Learn about Manually Recording External Payroll in Intuit QuickBooks Online with the complete ad free training course here https www teachucomp course

Then click Pay Taxes On the Pay Taxes page click Record payment for the tax you want to pay If the tax you want to pay no longer appears on the Pay Taxes page see recording a tax payment for a prior tax period If the tax you want to pay no longer appears on the Pay Taxes page see Record a tax payment for a tax from a prior tax period To make a tax payment If you re signed up for our electronic services In the left navigation bar click Taxes Payroll Tax Then click Pay Taxes For the tax you want to pay click Create Payment Choose a payment date Earliest means the next available payment date Tax payments take two business days to process so the next available

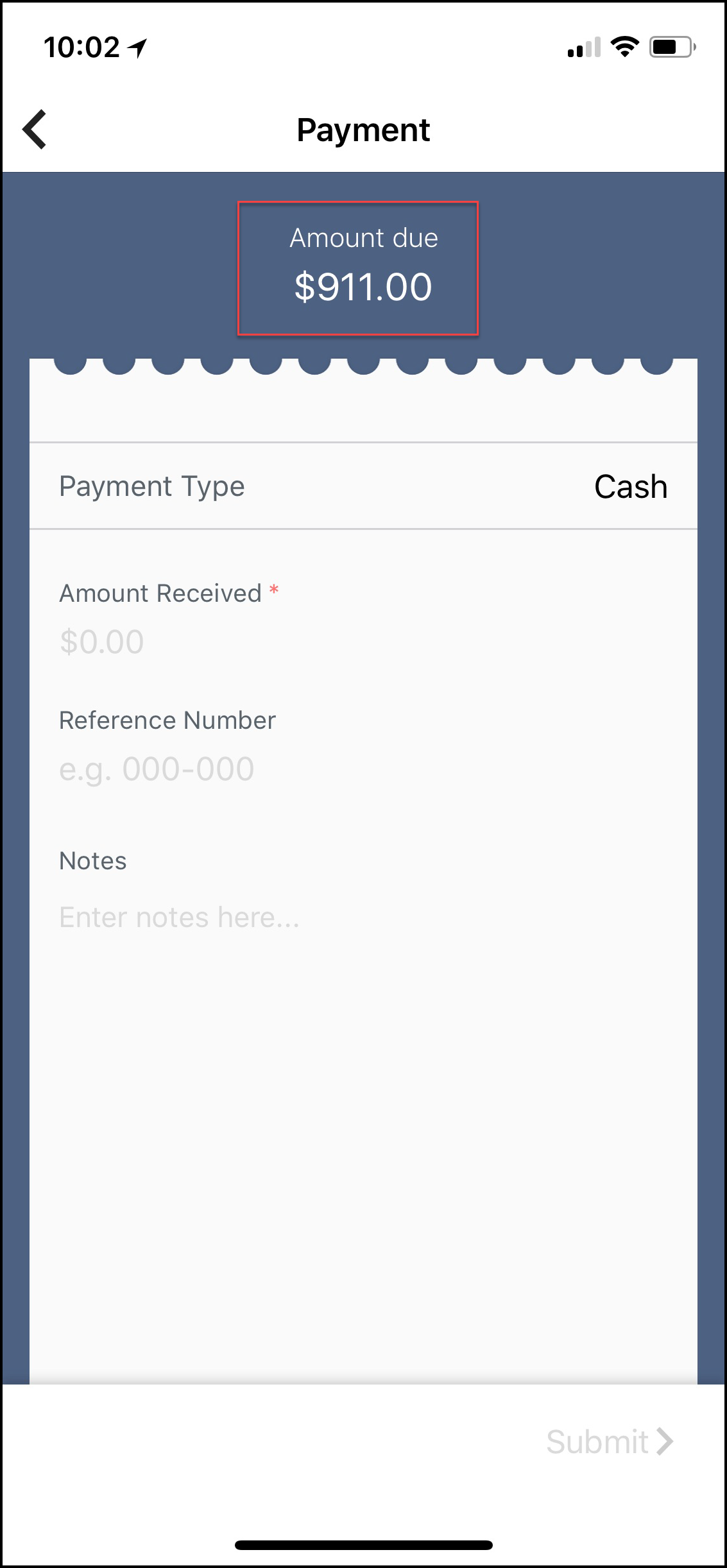

How Can I Record Payments In The Field Verizon Connect Work Help Center

https://support.work.fleetmatics.com/hc/article_attachments/4413414464019/mceclip1.png

Estimated Tax Payments YouTube

https://i.ytimg.com/vi/M8bq5etcL-A/maxresdefault.jpg

How Do I Record Manual Payroll Tax Payments In Quickbooks Online - Step 1 Collect your tax information Before running payroll for the first time you ll need to set up an Employer Identification Number EIN with the Internal Revenue Service IRS Your EIN is a unique number that identifies your business The application is free and you can access it online by mail or by phone