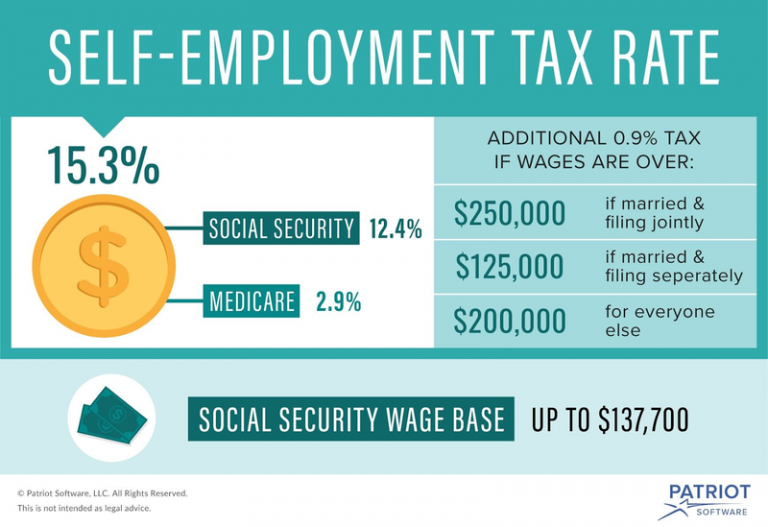

How Do I Pay My Tax As Self Employed The self employment tax rate is 15 3 The rate consists of two parts 12 4 for social security old age survivors and disability insurance and 2 9 for Medicare hospital insurance For 2023 the first 160 200 of your combined wages tips and net earnings is subject to any combination of the Social Security part of self employment tax

Here s how you d calculate your self employment taxes Determine your self employment tax base Multiply your net earnings by 92 35 0 9235 to get your tax base 50 000 x 92 35 46 175 You usually must pay self employment tax if you had net earnings from self employment of 400 or more Generally the amount subject to self employment tax is 92 35 of your net earnings from self employment You calculate net earnings by subtracting ordinary and necessary trade or business expenses from the gross income you derived from your

How Do I Pay My Tax As Self Employed

How Do I Pay My Tax As Self Employed

https://www.gatwickaccountant.com/wp-content/uploads/2022/08/How-to-Pay-HMRC-Self-Assessment-Income-Tax-Bill-in-UK.jpg

How Do I Pay Into Social Security If I Am Self employed

https://glassnercarltonfinancial.com/wp-content/uploads/2020/08/TAXES-FOR-THE-SELF-EMPLOYED-_-HOW-BUSINESS-OWNERS-FILE-SOCIAL-SECURITY-ON-YOUR-TAX-RETURN-THUMBNAIL.jpg

8 Ways To Pay Less In Taxes And Save Money Business Tax Tax

https://i.pinimg.com/originals/f3/3f/96/f33f9697cbf4b37e6f4f972bfc18d500.jpg

Sole proprietors are also subject to a special self employment tax which helps fund Social Security and Medicare although you can deduct 50 of the tax you pay They generally must make estimated tax payments too Plus if you have employees you ll have to withhold pay and report payroll taxes for them as well Self employment tax applies to self employed people who earned more than 400 during the year The self employment tax rate a combination of Social Security and Medicare taxes is 15 3 for

Filing self employment taxes is fairly straightforward You basically tell the IRS how much you earn and subtract business expenses from that amount Then you calculate the tax you owe and pay it Once you have an estimate for your yearly taxes divide that number by four Pay your quarterly taxes by their due dates If your income or expenses change a lot during the year that may affect the taxes you need to pay each quarter For example If your company loses a big customer your income drops

More picture related to How Do I Pay My Tax As Self Employed

What Is The Self Employment Tax And How Do You Calculate It Ramsey

https://cdn.ramseysolutions.net/media/blog/taxes/business-taxes/self-employment-tax.jpg

How To Calculate Tax Liability For Your Business

https://kominosolutions.com/wp-content/uploads/2020/11/BB1aHvs7-768x527.png

Guide To Self Employed Tax Returns Checkatrade

https://www.checkatrade.com/blog/wp-content/uploads/2022/02/self-employed-tax-return-1.jpg

The self employment tax rate is 15 3 and it breaks down to 12 4 for Social Security and 2 9 for Medicare Self employed individuals pay the 12 4 on the first 160 200 of their net income in If you re self employed you pay the combined employee and employer amount This amount is a 12 4 Social Security tax on up to 168 600 of your net earnings and a 2 9 Medicare tax on your entire net earnings If your earned income is more than 200 000 250 000 for married couples filing jointly you must pay 0 9 more in Medicare taxes

If you re employed and self employed the amount of income tax you ll pay will be based on your combined earnings Here are the income tax rates for the 2024 25 tax year England Wales Scotland 0 0 to 12 570 personal allowance 0 0 to 12 570 personal allowance 20 12 571 to 50 270 basic rate The self employment tax rate is 15 3 of your net profit or loss from your business for a year You must figure your business taxes for the year including income expenses tax credits and other adjustments The result is your net earnings the same thing as profit or loss This tax rate is related to the FICA tax rate for FICA taxes

How To Calculate Self Employment Tax YouTube

https://i.ytimg.com/vi/dmxwb20vSLo/maxresdefault.jpg

How Do I Pay My Self Assessment Tax Bill

https://media.freshbooks.com/wp-content/uploads/2022/01/how-do-i-pay-my-self-assessment-tax.jpg

How Do I Pay My Tax As Self Employed - Filing self employment taxes is fairly straightforward You basically tell the IRS how much you earn and subtract business expenses from that amount Then you calculate the tax you owe and pay it