How Do I Calculate Gross Income From Net Income The gross price would be 40 25 40 40 10 50 Net price is 40 gross price is 50 and the tax is 25 You perform a job and your gross pay is 50 The income tax is 20 so your net income is 50 20 50 10 40 In both examples we had the same gross and net amounts but the tax percentage turned out to be different

Use our US salary calculator to find out your net pay and how much tax you owe based on your gross income salaryafter tax Salary After Tax Home Calculators Gross Income 69 368 5 781 2 668 1 334 266 80 33 35 Tax Due 22 14 926 1 244 574 287 57 41 7 18 Federal Tax 7 102 592 273 137 27 32 3 41 The result is net income How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck

How Do I Calculate Gross Income From Net Income

How Do I Calculate Gross Income From Net Income

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_au/blog/images/image/gross-profit-outdoor-manufacturing-statement-inforgraphic-au.png

The Difference Between Gross Profit Margin And Net Profit Margin Net

https://i.pinimg.com/originals/de/ac/a5/deaca552a92314a9be581dc2728b2d92.jpg

How Do You Calculate Gross Income From W2 YouTube

https://i.ytimg.com/vi/z9zKH23WQ-E/maxresdefault.jpg

The formula for calculating net income is Revenue Cost of Goods Sold Expenses Net Income The first part of the formula revenue minus cost of goods sold is also the formula for gross income Check out our simple guide for how to calculate cost of goods sold So put another way the net income formula is FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

Step 1 Gross income First we need to determine your gross income If you are salaried your annual salary will be your gross income If you are paid hourly you must multiple the hours days and weeks The following is the formula for both cases Annual salary Annual salary Gross income Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

More picture related to How Do I Calculate Gross Income From Net Income

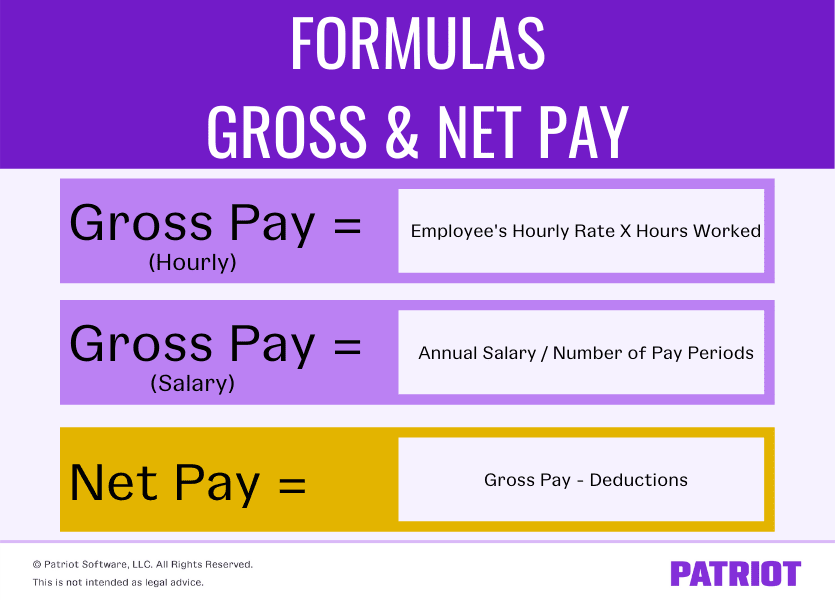

Gross Vs Net Pay What s The Difference

https://www.patriotsoftware.com/wp-content/uploads/2019/12/gross-vs.-net-pay-visual.jpg

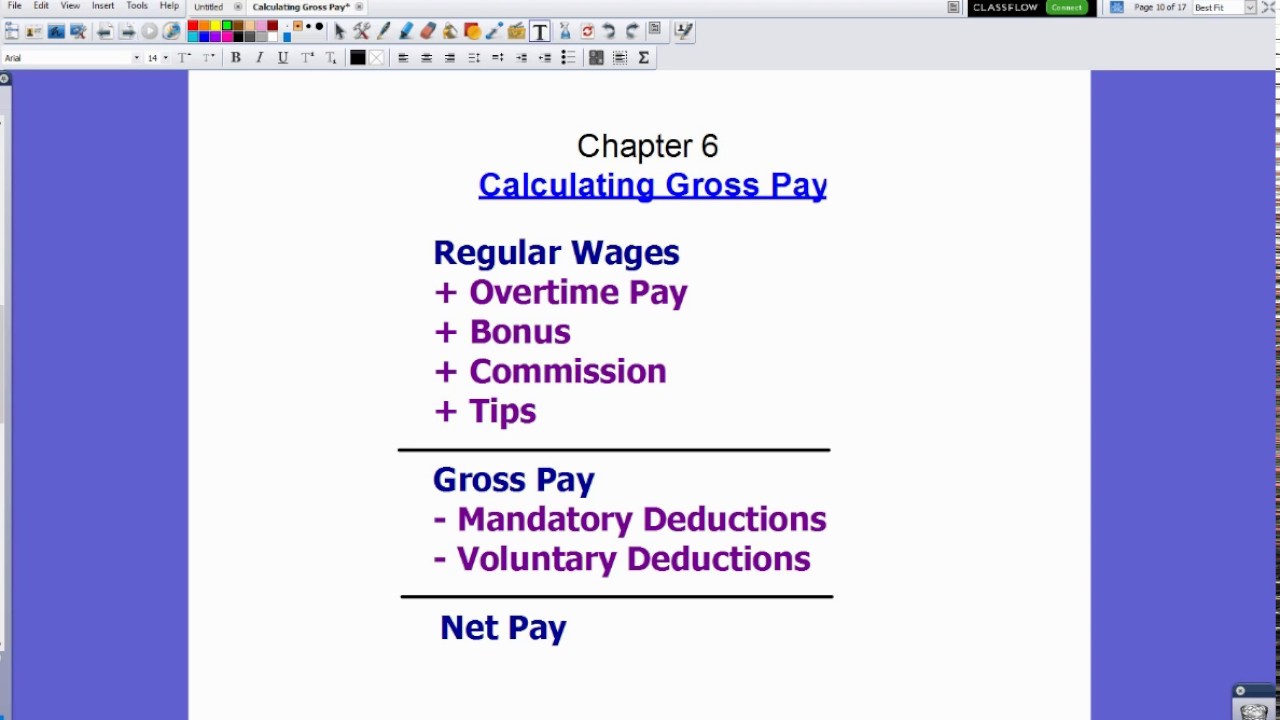

Calculating Gross Pay YouTube

https://i.ytimg.com/vi/vNrp3Yhqpv4/maxresdefault.jpg

Gross Pay Vs Net Pay What s The Difference

https://www.patriotsoftware.com/wp-content/uploads/2018/09/gross-vs.-net-pay-part-2-1.png

Step 3 enter an amount for dependents The old W4 used to ask for the number of dependents The new W4 asks for a dollar amount Here s how to calculate it If your total income will be 200k or less 400k if married multiply the number of children under 17 by 2 000 and other dependents by 500 Add up the total Gross income is money before taxation You can read more about it in the net to gross calculator The first four fields serve as a gross annual income calculator To calculate gross annual income enter the gross hourly wage in the first field of this yearly salary calculator The result in the fourth field will be your gross annual income

The Salary Calculator converts salary amounts to their corresponding values based on payment frequency Examples of payment frequencies include biweekly semi monthly or monthly payments Results include unadjusted figures and adjusted figures that account for vacation days and holidays per year Salary amount Gross pay is the total amount of money you get before taxes or other deductions are subtracted from your salary Your gross income or pay is usually not the same as your net pay especially if you must pay for taxes and other benefits such as health insurance Some people refer to this calculation as a unit rate conversion

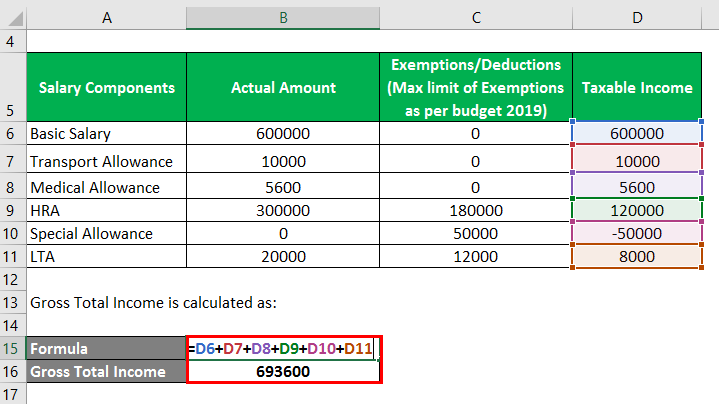

Calculate Your Annual Income With Our Free Paycheck Salary Annual

https://www.educba.com/academy/wp-content/uploads/2019/06/Taxable-Income-2.4.png

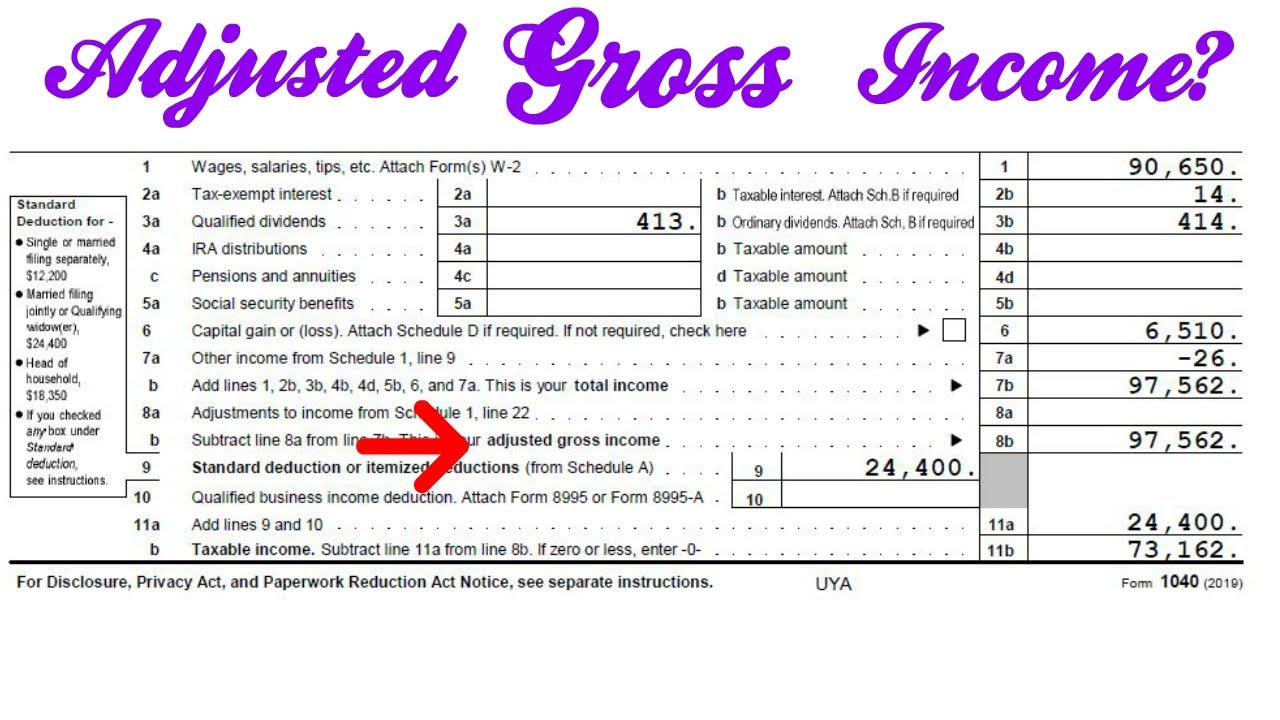

What Is Adjusted Gross Income Qualify For The Coronavirus Economic

https://i.ytimg.com/vi/ByI_RRbKZ1U/maxresdefault.jpg

How Do I Calculate Gross Income From Net Income - Step 1 Gross income First we need to determine your gross income If you are salaried your annual salary will be your gross income If you are paid hourly you must multiple the hours days and weeks The following is the formula for both cases Annual salary Annual salary Gross income