Half Day Salary Deduction This fact sheet provides information on the salary basis requirement for the exemption from minimum wage and overtime pay provided by Section 13 a 1 of the FLSA as defined by Regulations 29 C F R Part 541

Deductions from an exempt employee s salary are permitted in very limited circumstances The following chart covers permitted and prohibited deductions under federal law Proceed Carefully Before Cutting into Salary When it comes to salaried employees it s critical to check deductions carefully Deductions in pay for personal sick time and unpaid disciplinary suspensions are permitted only in full day increments other than for FMLA

Half Day Salary Deduction

Half Day Salary Deduction

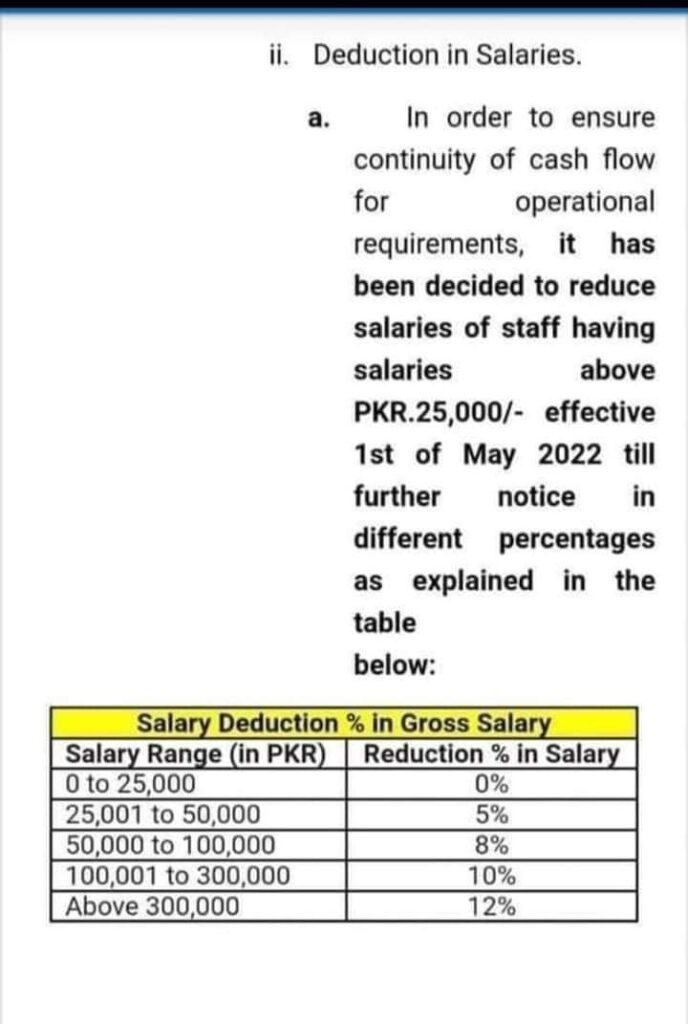

https://infoghar.com/wp-content/uploads/2022/06/Deduction-in-Salaries-688x1024.jpg

Salary Slip Templates 15 Free Printable Word Excel PDF

http://exceltemplate.net/wp-content/uploads/2017/06/Salary-Slip-Template.jpg

Mandatory Government Deductions From Salary SSS Philhealth Pag Ibig

https://i.ytimg.com/vi/lBO3PaW69Mc/maxresdefault.jpg

1 Read the FLSA regulations to determine if your partial day deduction is allowable for the salaried exempt employee The federal laws prohibit deductions from salaried exempt employees pay Deductions for partial day absences generally violate the salary basis rule except those occurring in the first or final week of an exempt employee s employment or for unpaid leave under the Family and Medical Leave Act If an exempt employee is absent for one and one half days for personal reasons the employer may only deduct for the one full day absence The exempt employee must receive a

2 Reducing their salary for misconduct without having a written policy Under federal rules you may make deductions from exempt employees salaries for unpaid disciplinary suspensions of one or more full days imposed in good faith for serious misconduct such as sexual harassment workplace violence drug or alcohol use or for violations of Deductions without pay may be made however when the employee is voluntarily absent from work for a day or more for personal reasons other than sickness or disability Thus if an employee is absent for a day or longer to handle personal affairs the salaried status will not be affected if deductions are made from salary for those absences

More picture related to Half Day Salary Deduction

19 Paying Off Mortgage NirvishaTami

https://i.pinimg.com/originals/b2/54/26/b2542669bf4e73025f8bd58af2de617c.png

Employee Salary Calculations Deductions Unpaid Salary More

https://singaporelegaladvice.com/wp-content/uploads/2011/05/Employee-Salary_-Calculations-Deductions-Unpaid-Salary-More.png

Request Letter To Stop Deduction From Salary Sample Letter Of Request

https://www.lettersinenglish.com/wp-content/uploads/request-letter-to-stop-deduction-from-salary.jpg

A sample policy demonstrating good faith compliance with the FLSA salary basis requirements for exempt employees The federal Fair Labor Standards Act FLSA allows employers to take partial day deductions from an employee s leave bank including paid time off PTO sick leave or vacation leave even if

If an employee requests a half day off without a bona fide leave plan may the employer deduct the pay for the half day from the employee s salary For private sector employees no Deductions from pay for partial day absences are not permitted except for very limited circumstances allowed in the federal Family and Medical Leave Act FMLA Can an employer deduct a half day pay if a salaried employee and I goes home sick early How about requiring an unpaid day off My employer sent a memo out today that we are required to take Dec 24 off Offices are closed And Salaried employees are required to either use PTO or take an unpaid day

Should You Include A Salary Range In Job Descriptions PCN

https://teampcn.com/wp-content/uploads/2022/11/PCN_Article_Salary-Ranges-1.gif

Salary Slip Format In Excel And Word SemiOffice Com

https://i0.wp.com/semioffice.com/wp-content/uploads/2022/08/Download-Salary-Slip-in-Excel-Format-Free.png?ssl=1

Half Day Salary Deduction - Updated on Jul 06 2024 Free paycheck calculator to calculate your hourly and salary income after taxes deductions and exemptions