Goodyear Az Sales Tax Rate City Taxes Font Size Tax Rates Paid by Taxable Businesses The City of Goodyear imposes a Transaction Privilege Sales Tax on specific business activities The City tax is in addition to the tax imposed by the State and County The City of Goodyear tax rate is 2 5 and is imposed upon the business

Goodyear Tax Chart 1900 N Civic Square Goodyear AZ 85395 623 932 3910 or 800 872 1749 Careers Departments Site Map Privacy Policy Contact Us The current total local sales tax rate in Goodyear AZ is 8 800 The December 2020 total local sales tax rate was also 8 800 Sales Tax Breakdown Goodyear Details Goodyear AZ is in Maricopa County Goodyear is in the following zip codes 85338 85395 US Sales Tax Rates AZ Rates Sales Tax Calculator Sales Tax Table Follow SaleTaxCom

Goodyear Az Sales Tax Rate

Goodyear Az Sales Tax Rate

https://i.pinimg.com/originals/85/cb/68/85cb684ea2cf01eec379db4b59c0900e.jpg

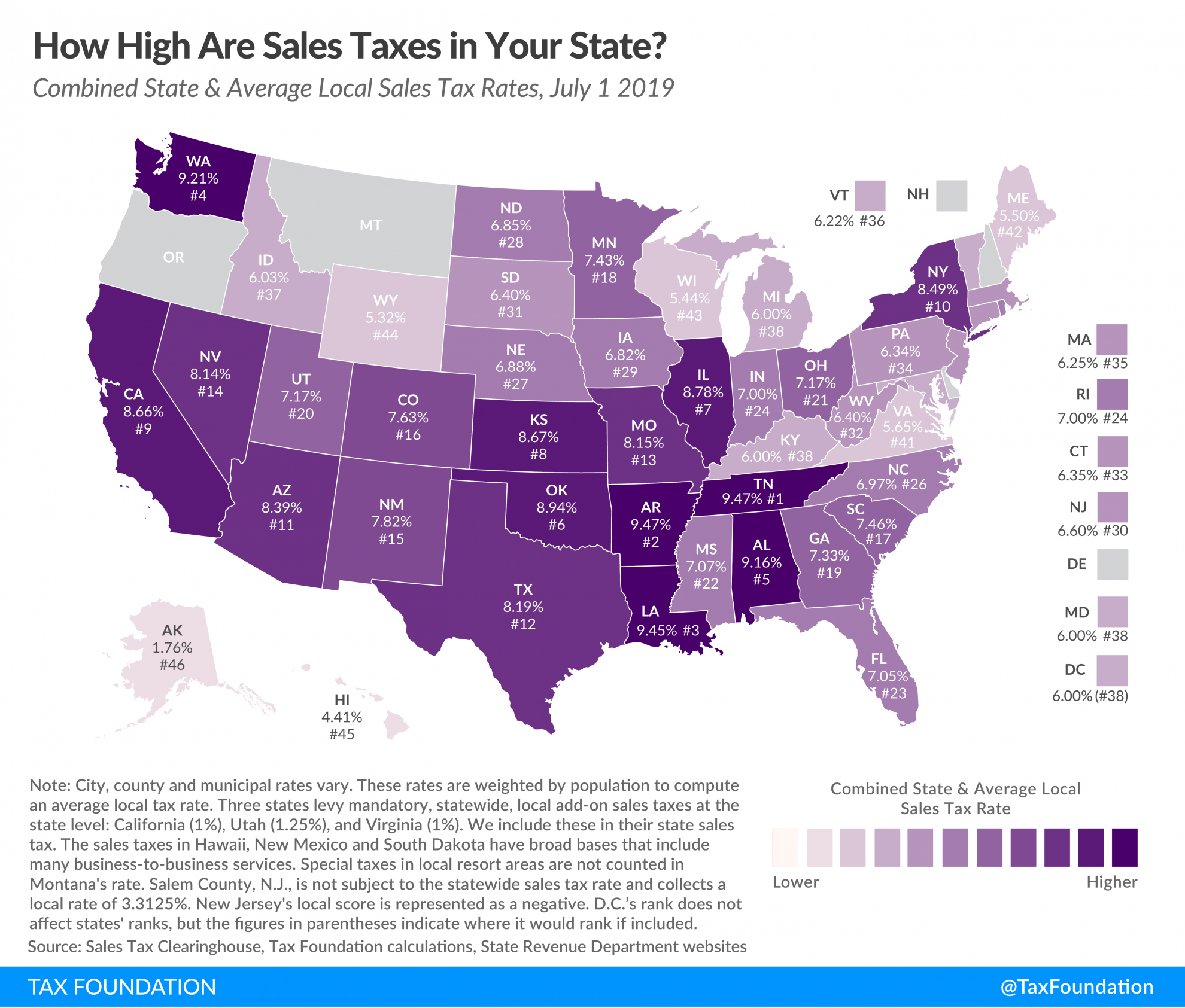

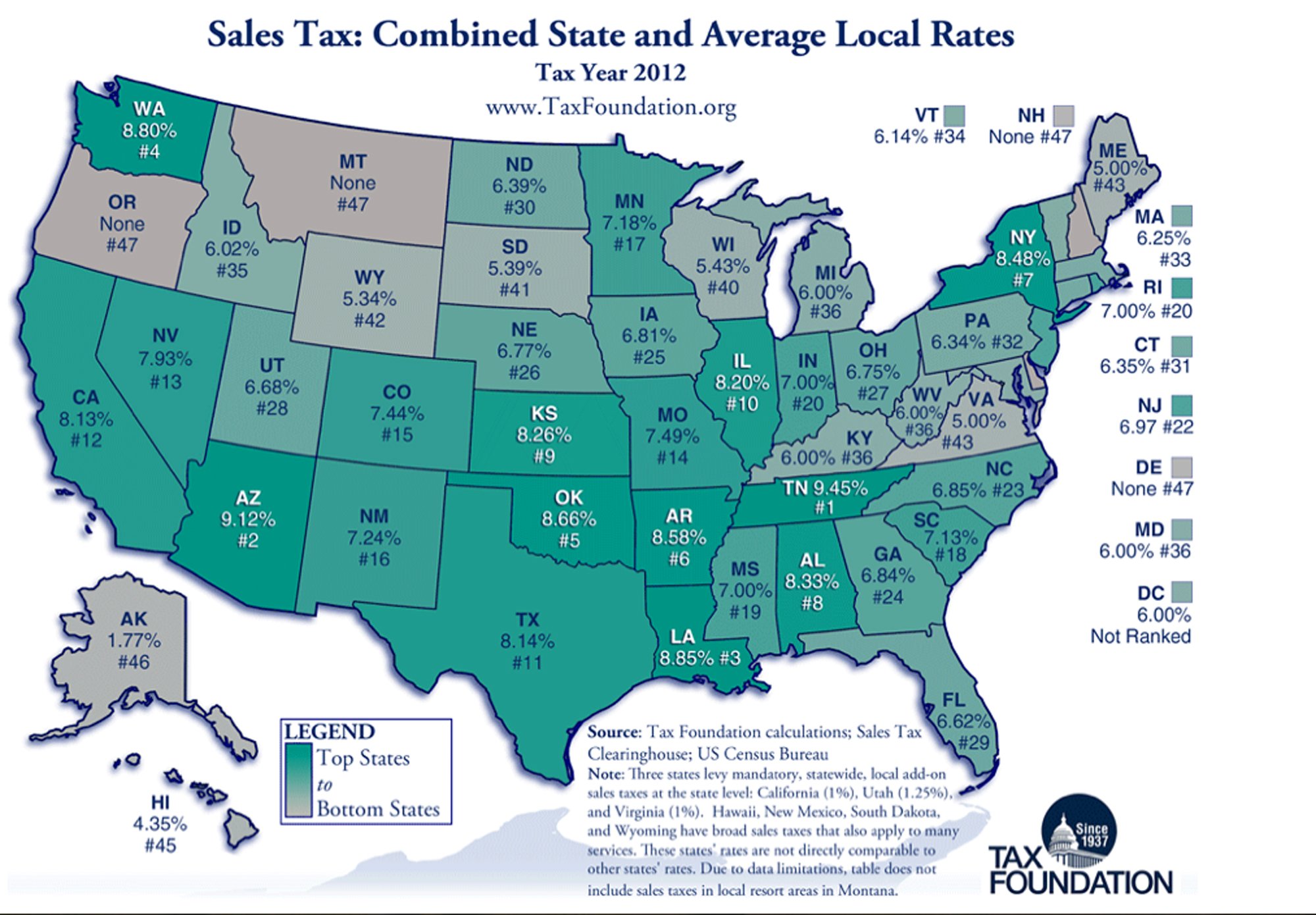

Arizona Sales Tax Sales Tax Arizona AZ Sales Tax Rate

https://1stopvat.com/wp-content/uploads/2022/05/13-1024x1024.png

What Is The Sales Tax In Arizona TaxesTalk

https://www.taxestalk.net/wp-content/uploads/arizona-sales-tax-rates-by-zip-code-rating-walls.png

Tax Rates Calculator Exemption Certificates For Businesses Taxability Vehicles More Goodyear Arizona Sales Tax Rate 2024 9 3 The Goodyear sales tax rate is 9 3 9 3 tax breakdown City Arizona Sales tax region name Buckeye Tax rates last updated in January 2024 The Goodyear Arizona sales tax is 8 80 consisting of 5 60 Arizona state sales tax and 3 20 Goodyear local sales taxes The local sales tax consists of a 0 70 county sales tax and a 2 50 city sales tax The Goodyear Sales Tax is collected by the merchant on all qualifying sales made within Goodyear

The sales tax rate in Goodyear is 8 8 and consists of 5 6 Arizona state sales tax 0 7 Maricopa County sales tax and 2 5 Goodyear city tax Goodyear is located within Maricopa County and has a population of approximately 48 800 and contains the following two ZIP codes 85338 and 85395 Goodyear Sales Tax Calculator Purchase Amount The Goodyear Arizona general sales tax rate is 5 6 Depending on the zipcode the sales tax rate of Goodyear may vary from 8 8 to 9 3 Every 2024 combined rates mentioned above are the results of Arizona state rate 5 6 the county rate 0 7 the Goodyear tax rate 2 5 to 3 There is no special rate for Goodyear

More picture related to Goodyear Az Sales Tax Rate

2021 Arizona Car Sales Tax Calculator Valley Chevy

https://www.valleychevy.com/wp-content/uploads/2018/07/AZ-Sales-tax-on-Cars-2019-1024x653.jpg

2021 Mercedes G550 Awd Highly Optioned Monza Grey Magno No Az

https://i.ebayimg.com/00/s/MTE5OVgxNjAw/z/Og4AAOSw~nVi7avm/$_57.JPG?set_id=8800005007

Tax Sales Illinois Tax Sales Rate

http://www.tucsonsentinel.com/files/entryimages/17-salestax-full.jpg

The 85338 Goodyear Arizona general sales tax rate is 8 8 The combined rate used in this calculator 8 8 is the result of the Arizona state rate 5 6 the 85338 s county rate 0 7 the Goodyear tax rate 2 5 Rate variation The 85338 s tax rate may change depending of the type of purchase The average cumulative sales tax rate in Goodyear Arizona is 9 05 with a range that spans from 8 8 to 9 3 This encompasses the rates on the state county city and special levels Goodyear is located within Maricopa County Arizona Within Goodyear there are around 2 zip codes with the most populous one being 85338

Goodyear in Arizona has a tax rate of 8 8 for 2024 this includes the Arizona Sales Tax Rate of 5 6 and Local Sales Tax Rates in Goodyear totaling 3 2 You can find more tax rates and allowances for Goodyear and Arizona in the 2024 Arizona Tax Tables How Does Sales Tax in Goodyear compare to the rest of Arizona The 2024 sales tax rate in Goodyear is 9 3 and consists of 5 6 Arizona state sales tax 0 7 Maricopa County sales tax and 3 Goodyear city tax 85395 Sales Tax Calculator Purchase Amount Sales Tax Rate Sales Tax 9 30 Purchase Price Tax 109 30 Protip Print out a free 9 3 sales tax table for quick sales tax calculations

Tempe Az Sales Tax Rate 2020 Nolan Rockwell

https://treasurer.maricopa.gov/Images/Tax_Bill_2021_TOP.png

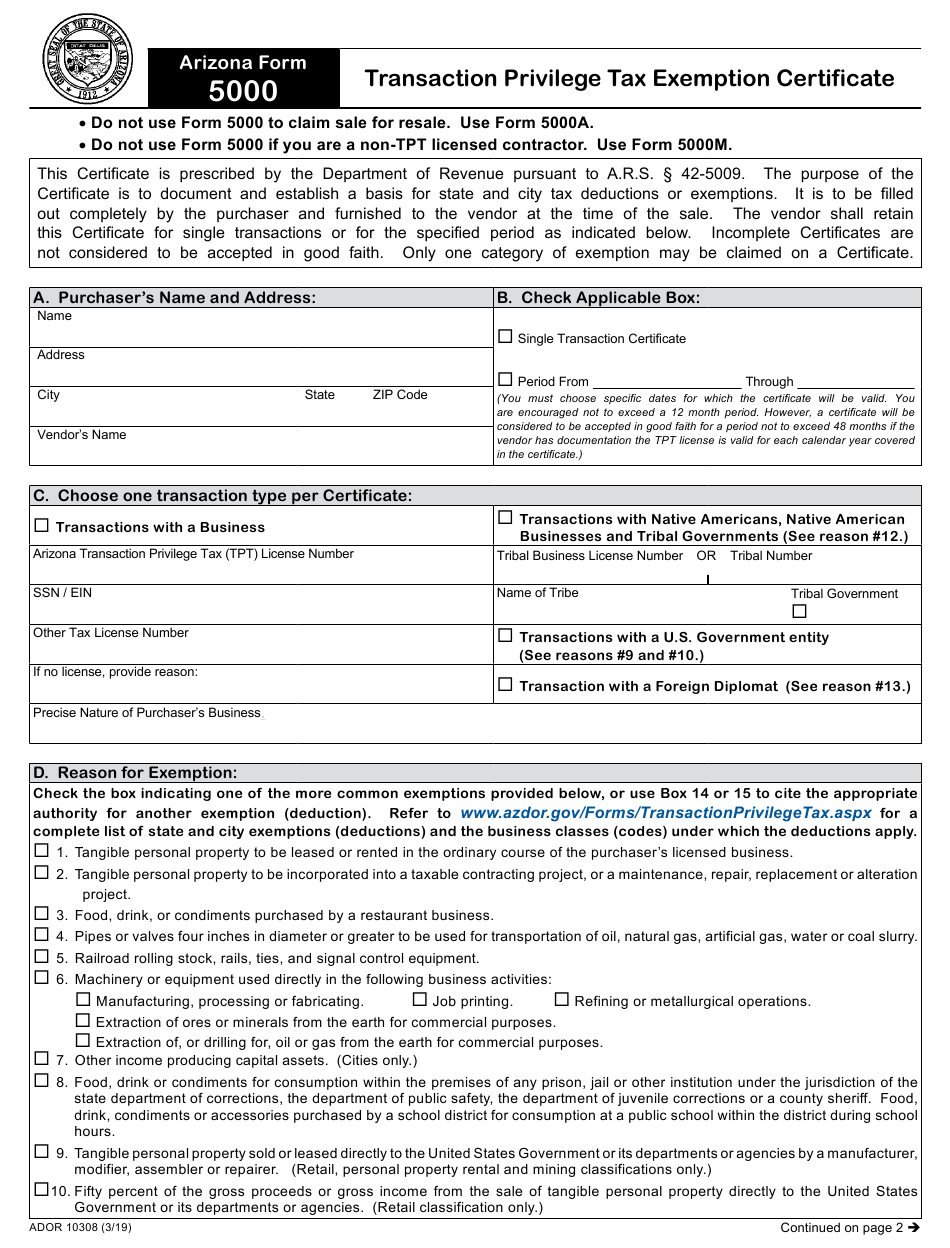

Arizona Property Tax Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/arizona-form-5000-ador10308-download-fillable-pdf-or-fill-online-2.png

Goodyear Az Sales Tax Rate - The sales tax rate in Goodyear is 8 8 and consists of 5 6 Arizona state sales tax 0 7 Maricopa County sales tax and 2 5 Goodyear city tax Goodyear is located within Maricopa County and has a population of approximately 48 800 and contains the following two ZIP codes 85338 and 85395 Goodyear Sales Tax Calculator Purchase Amount