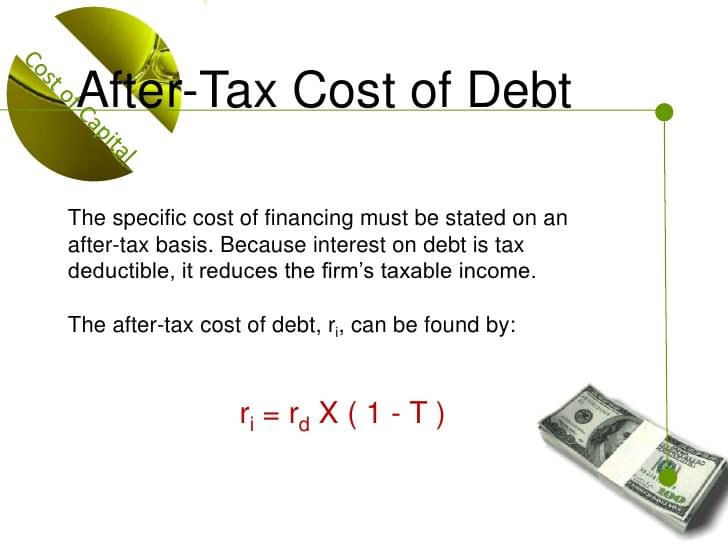

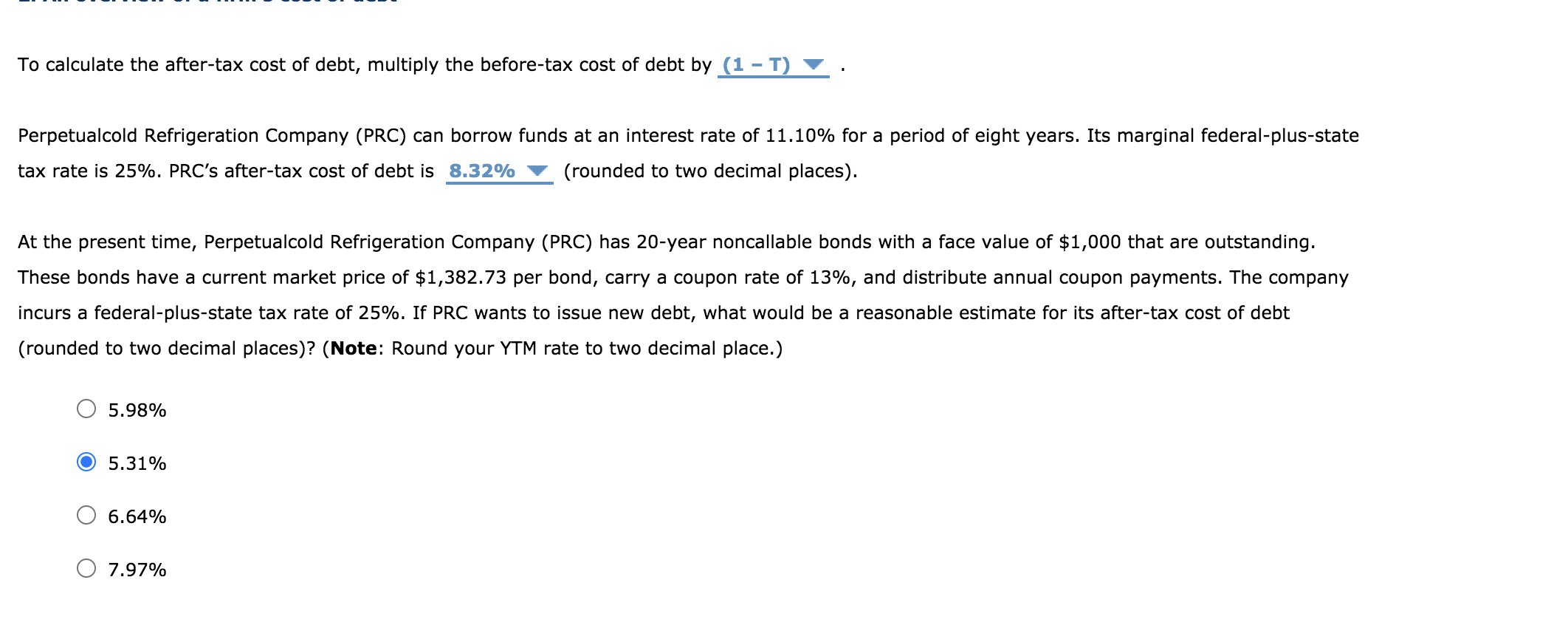

Formula To Calculate After Tax Cost Of Debt Further the pre tax cost of the debt can be calculated simply by obtaining an interest rate in the debt instrument 4 Calculate after tax cost of debt You have a pre tax cost of interest an effective interest rate and all the debt balances at this stage These all the costs need to be entered in the following formula

To arrive at the after tax cost of debt we multiply the pre tax cost of debt by 1 tax rate After Tax Cost of Debt 5 6 x 1 25 4 2 3 After Tax Cost of Debt Calculation Analysis For the next section of our modeling exercise we ll calculate the cost of debt but in a more visually illustrative format The after tax cost of debt can be calculated using the after tax cost of debt formula shown below after tax cost of debt before tax cost of debt 1 marginal corporate tax rate Thus in our example the after tax cost of debt of Bill s Brilliant Barnacles is

Formula To Calculate After Tax Cost Of Debt

Formula To Calculate After Tax Cost Of Debt

https://img-aws.ehowcdn.com/877x500p/s3-us-west-1.amazonaws.com/contentlab.studiod/getty/13ec0c3d4ddd4751a00f41f696c9d7d4.jpg

Cost Of Debt Formula AccountingCoaching

https://accountingcoaching.online/wp-content/uploads/2020/12/image-i4Y0mKofW3F82SLP.png

Learn How To Calculate After Tax Cost Of Debt And Stop Losing Money

https://demodirt.com/wp-admin/admin-ajax.php?action=rank_math_overlay_thumb&id=11028&type=gif&hash=383ae521882aa44f4e3ce9eabdbe1bbb

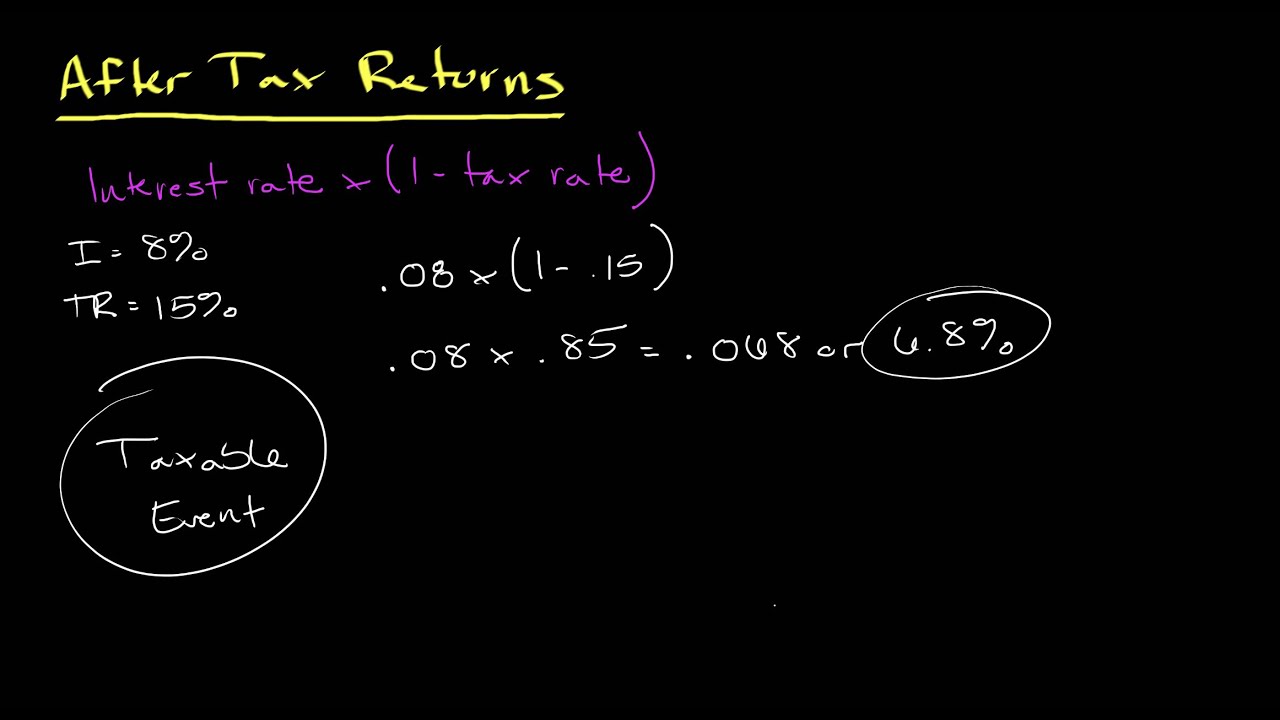

Net Income After Taxes enter 0 01 if you do not wish to calculate after tax cost of debt Calculate Data Copy to Clipboard New Calculation Cost of Debt Formula Examples Cost of debt can be calculated in one of two ways The after tax cost of debt formula is shown below To calculate it you ll need to know the before tax figure To calculate the after tax cost of debt use the following formula after tax cost of debt effective interest rate 1 tax rate If you also want to calculate the after tax cost of debt you will need the tax rate How to Calculate Cost of Debt Gather Data from Financial Statements 2 Calculate Before Tax Cost of Debt

Step 3 Calculate the after tax cost of debt Now that we ve done all that leg work we can plug our values into the after tax cost of debt formula after tax cost of debt before tax cost of debt 1 marginal corporate tax rate 5 5 6 9 1 20 Let s look at the same equation but use decimals 0 055 0 069 1 0 2 The formula to calculate the After tax Cost of Debt is text After tax Cost of Debt text Pre tax Cost of Debt times 1 text Marginal Corporate Tax Rate Description The After tax Cost of Debt measures the effective interest rate a company pays on its debt after accounting for tax deductions It helps determine the true cost of

More picture related to Formula To Calculate After Tax Cost Of Debt

How To Calculate Cost Of Debt With Examples Layer Blog

https://blog.golayer.io/uploads/images/builder/image-blocks/_w1832h1030/How-to-Calculate-Cost-of-Debt-After-Tax-Cost-of-Debt-Value.png

How To Calculate After tax Cost Of Debt

https://www.bizmanualz.com/wp-content/uploads/2023/09/Calculate-After-tax-Cost-of-Debt.jpg

Calculating After Tax Returns Personal Finance Series YouTube

https://i.ytimg.com/vi/eY1YM5lxJW4/maxresdefault.jpg

The After tax Cost of Debt Calculator is used to estimate the actual cost of debt after considering tax deductions on interest payments This helps businesses assess the real cost of financing with debt and make more informed decisions about borrowing 2 How do I calculate the After tax Cost of Debt To calculate the After tax Cost of Debt An After tax Cost of Debt Calculator helps businesses and investors calculate the cost of debt after factoring in taxes Learn how to use this calculator for accurate financial planning The formula to calculate the After tax Cost of Debt is as follows After tax Cost of Debt Interest Rate 1 Tax Rate Where

[desc-10] [desc-11]

Solved To Calculate The After tax Cost Of Debt Multiply The Chegg

https://media.cheggcdn.com/media/cc4/cc45a072-1154-414f-b6a3-6760593b2e83/php0CSG7i

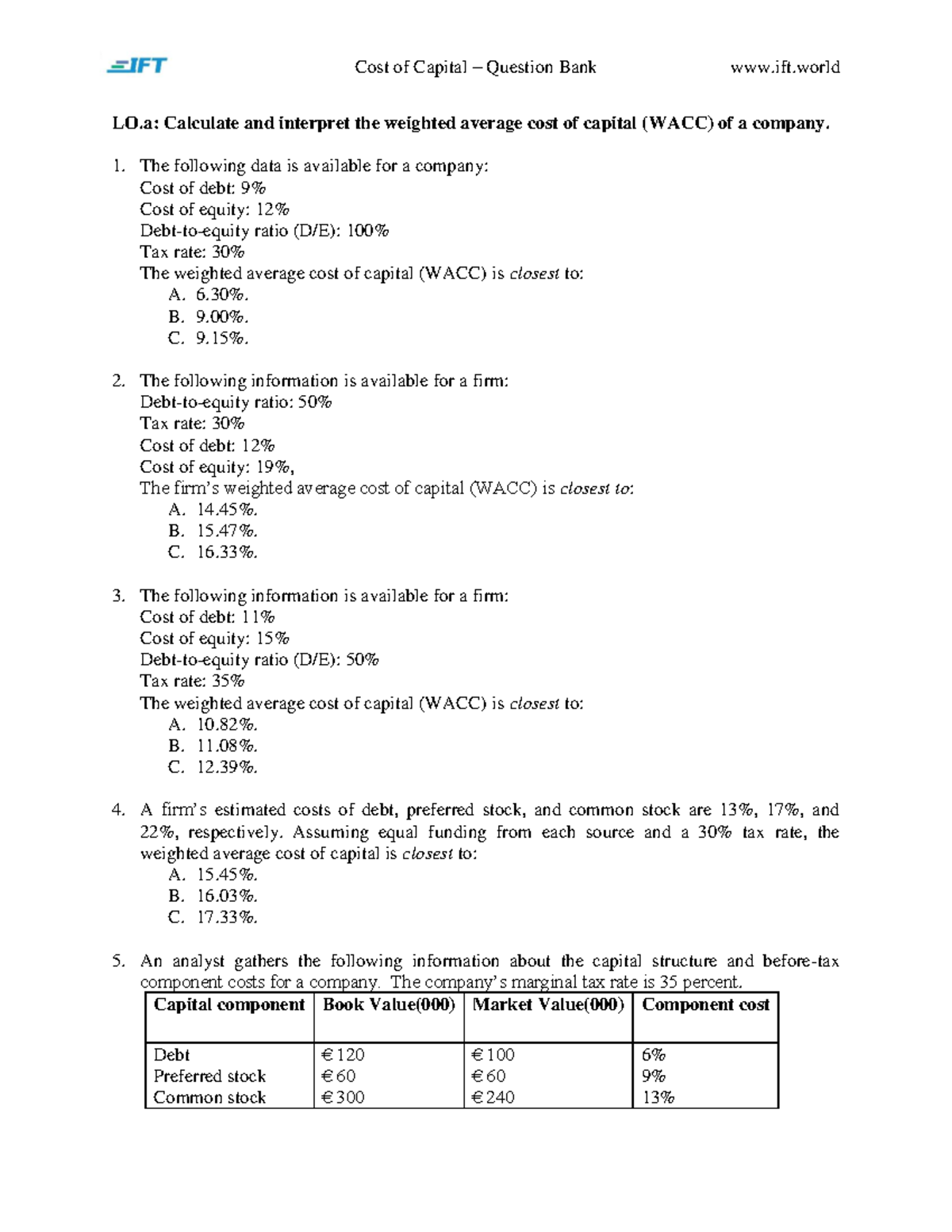

R36 Cost Of Capital Q Bank LO Calculate And Interpret The Weighted

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/1aa8abf4664c0e4f1e58fd20ef01c614/thumb_1200_1553.png

Formula To Calculate After Tax Cost Of Debt - [desc-12]