Farm Service Agency Income Limits 2023 Farm Service Agency U S Department of Agriculture Resources Loans Conservation Disaster Recovery Income Support 2019 Through 2023 Commodity Programs Price Loss Coverage PLC and Agricultural Risk Coverage ARC other than peanuts Decouples the combined 125 000 payment limit for PLC ARC from Lon Loan Deficiency Program LDP

The Agricultural Act of the 1970 established the first payment limitation provisions Since that time the payment limitation provisions have been expanded to include Decouples the combined 125 000 payment limit for PLC ARC from Lon Loan Deficiency Program LDP and Market Loan Gain MLG for covered commodities and peanuts Beginning with crop year 2019 LDP s and MLG s are no longer subject to Payment Limitation or Payment Eligibility provisions including actively engaged in farming and

Farm Service Agency Income Limits 2023

Farm Service Agency Income Limits 2023

https://corporatebenefitsnetwork.com/wp-content/uploads/2023-Contribution-limits.jpg

Roth IRA 401k 403b Retirement Contribution And Income Limits 2023

https://i.ytimg.com/vi/9XxaY8gQ4Rw/maxresdefault.jpg

Student Loans Parent Income Limits 2023 Finance News

https://q-5.net/wp-content/uploads/2023/06/private_student_loans_social1-1536x804.jpg

In the latest year available 2020 1 of individuals filing a Schedule F farm income return had an AGI of over 1 000 000 and thus would not qualify for most farm programs due to the AGI limit A further 1 6 had an income of between 500 000 and 1 000 000 so probably less than 2 of individuals reporting a Schedule F farm income return have Payment limits will be in effect for the 2023 and 2024 disaster payments and ranching will have a 125 000 payment limit The average farm income is based on the average total gross income

The 2018 Farm Bill requires the implementation of an average adjusted gross income AGI limitation for payment eligibility for the 2019 through 2023 program years The AGI limitation provision applies to most programs administered by the U S Department of Agriculture s USDA Farm Service Agency FSA Congress first included an AGI limitation on farm program payments in the 2002 Farm Bill and has made several adjustments in recent farm bills Below is a history of AGI limits for farm program payments that was compiled by the Congressional Research Service

More picture related to Farm Service Agency Income Limits 2023

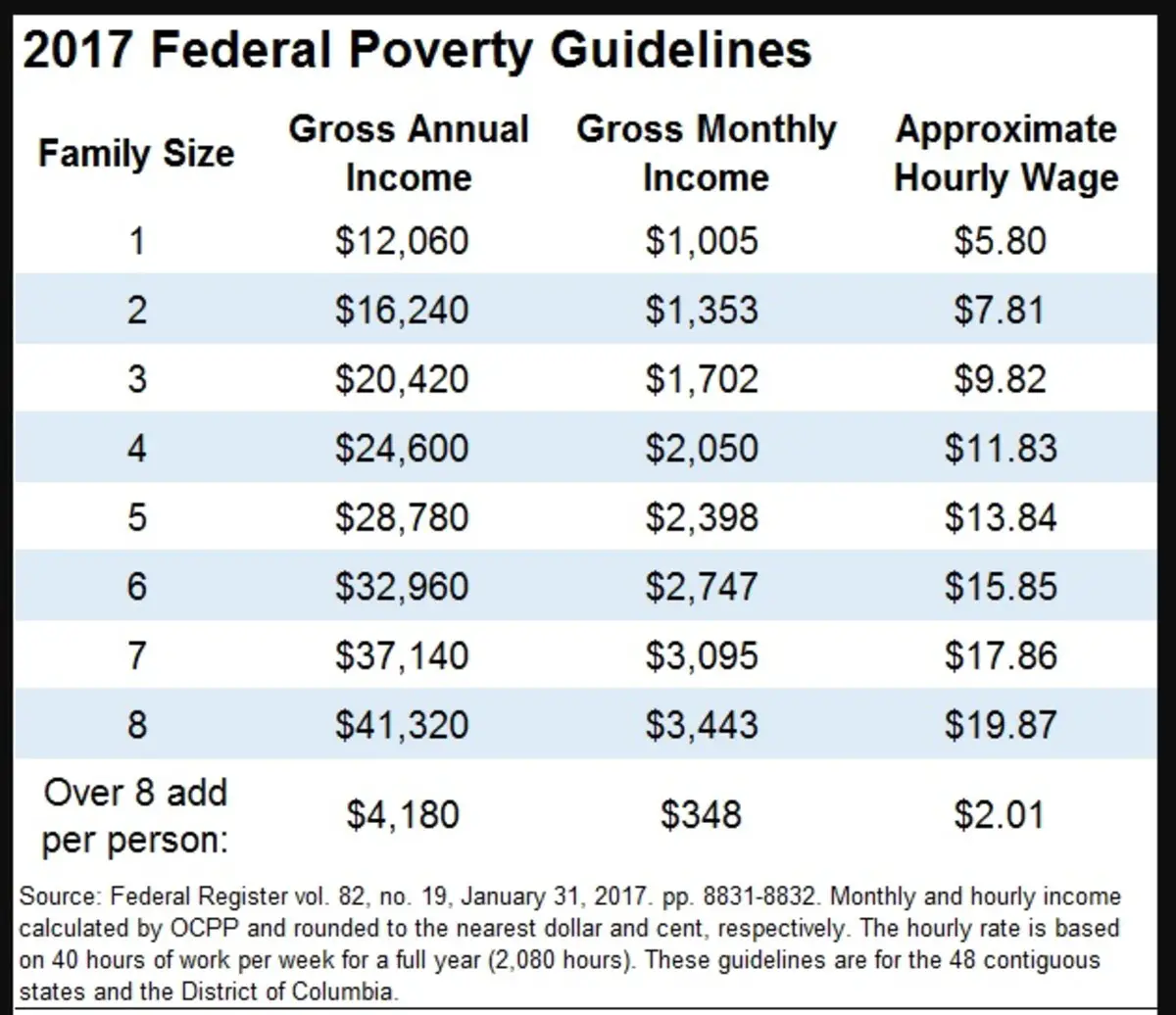

Covered California Income Limits

https://i2.wp.com/insuremekevin.com/wp-content/uploads/2018/10/2019-Covered-California-Medi-Cal-Income-Chart.jpg

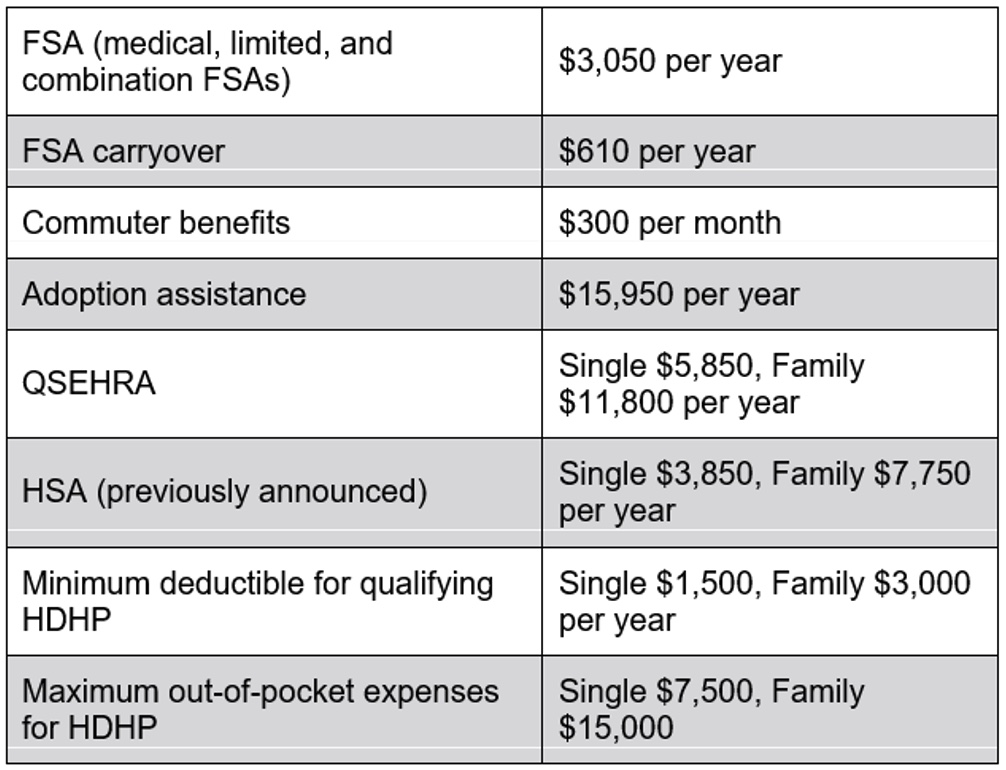

IRS Announces 2023 HSA Limits Blog Medcom Benefits

https://medcombenefits.com/images/uploads/blog/2023_HSA_Limits_Table.jpg

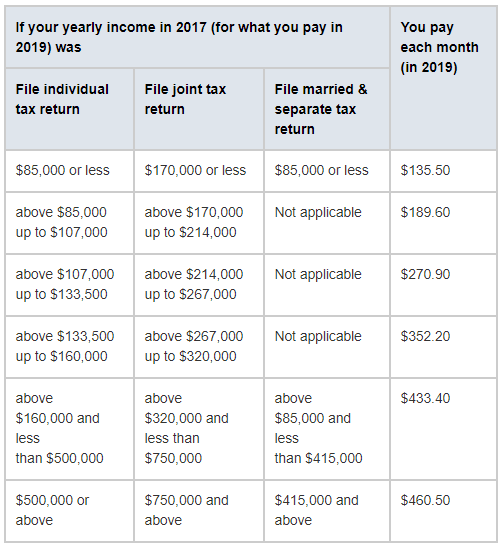

What Are Income Limits For Medicare MedicareTalk

https://www.medicaretalk.net/wp-content/uploads/what-determines-medicare-premiums-brighton-jones.png

The 2018 Farm Bill requires the implementation of an average adjusted gross income AGI limitation for payment eligibility for the 2019 through 2023 program years The AGI limitation provision applies to most programs administered by the U S Department of Agriculture s USDA Farm Service Agency FSA and Natural Resources Conservation Service NRCS This fact sheet discusses Continued Farm disaster assistance for 2023 and 2024 as reported to local Farm Service Agency offices are eligible for payments as well as 50 percent of 2024 prevent plant acres to eligible crops in 2024 or entities that receive less than 75 percent of their income from farming and ranching will have a 125 000 payment limit The average farm

[desc-10] [desc-11]

What s The Household Income To Qualify For Food Stamps FoodStampsTalk

https://www.foodstampstalk.com/wp-content/uploads/maximum-income-to-qualify-for-food-stamps-in-california-x8x-token.jpeg

The Farm Service Administration In 1942

https://wp.oldmagazinearticles.com/wp-content/uploads/farm-service-agency-in-1942_500.jpg

Farm Service Agency Income Limits 2023 - [desc-12]