Expenses Such As Heat Lights And Salaries Expenses such as heat lights and salaries Receipt a sales slip that is marked paid Income Amount of money earned Deposit Money put into an account

Net income is what is left of that money after you pay all your expenses Heat light employee salaries insurance etc light energy If you mean the heat coming from light it s thermal energy What is the foil that is inside a ceiling light called It is a

Expenses Such As Heat Lights And Salaries

Expenses Such As Heat Lights And Salaries

http://static1.squarespace.com/static/61e5e13e3420762c2459ebc6/61eb33a9187bb43bd32526ad/62fea3cc550d3215015d8465/1661455235943/cash+flow+statement+vs+profit+and+loss.jpg?format=1500w

Top 10 Tax Deductions and Expenses for Small Businesses to Claim—Wave Year End

https://assets-global.website-files.com/6253f6e60f27498e7d4a1e46/626154ea6caccc3ad963c968_top-ten-deductions-n-tax-blog-feat-%25402x.jpeg

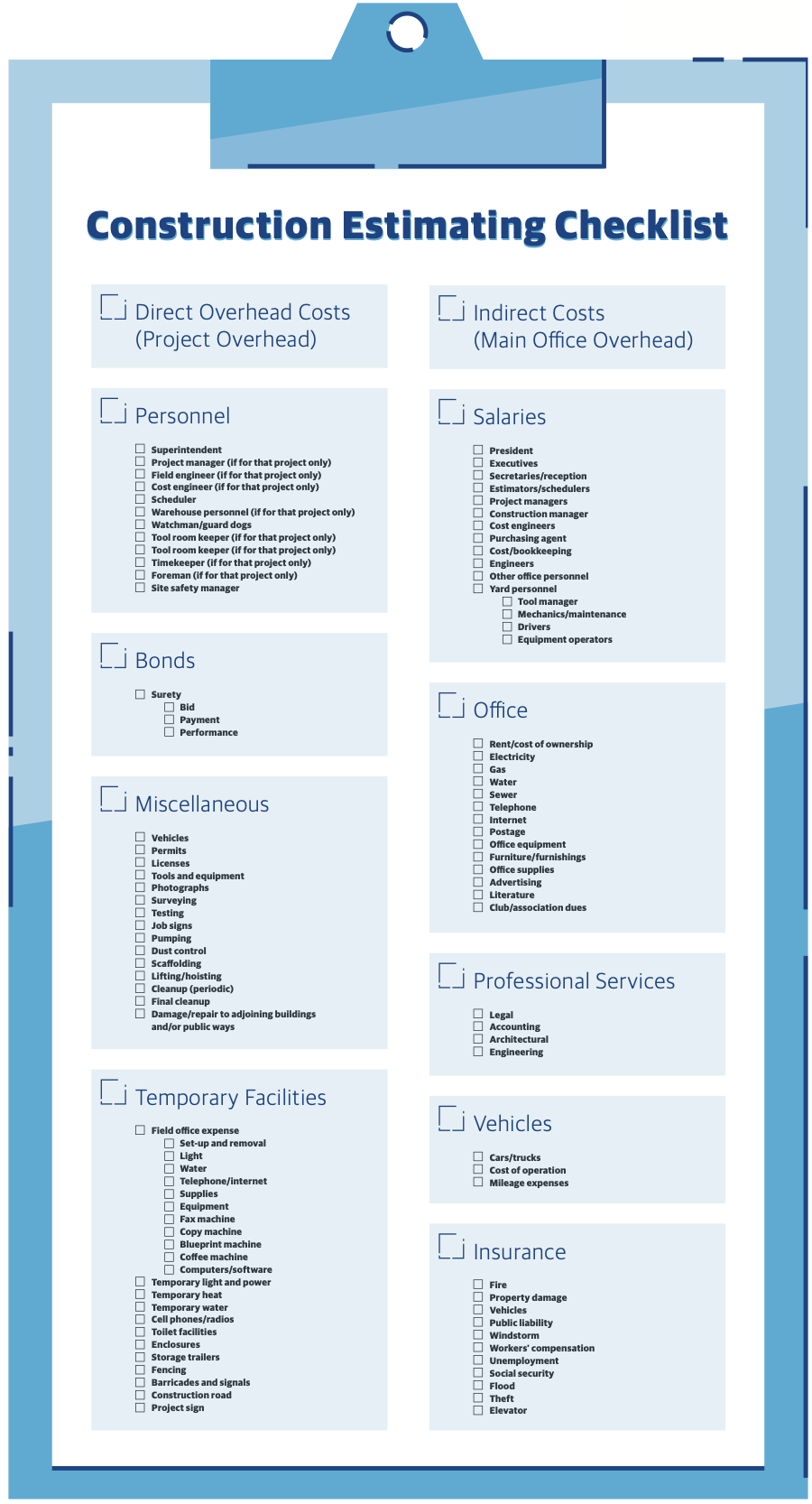

General Conditions and Project Staffing – Fundamentals of Building Construction Management

https://psu.pb.unizin.org/app/uploads/sites/310/2022/06/2022-06-23_07-30-19.png

Amount of money earned 6 Every two weeks 7 Expenses such as heat lights and salaries 8 To sign a Amount of money earned 7 Every two weeks 8 Expenses such as heat lights and salaries 9 To sign a check on the back on the left handed end

Employment conditions Deductible expenses Chapter 3 Employees earning a salary You can deduct home office expenses such as You can claim daycare expenses on your Income Tax and Benefit Return if Any such assistance you claim for the purchase of depreciable

More picture related to Expenses Such As Heat Lights And Salaries

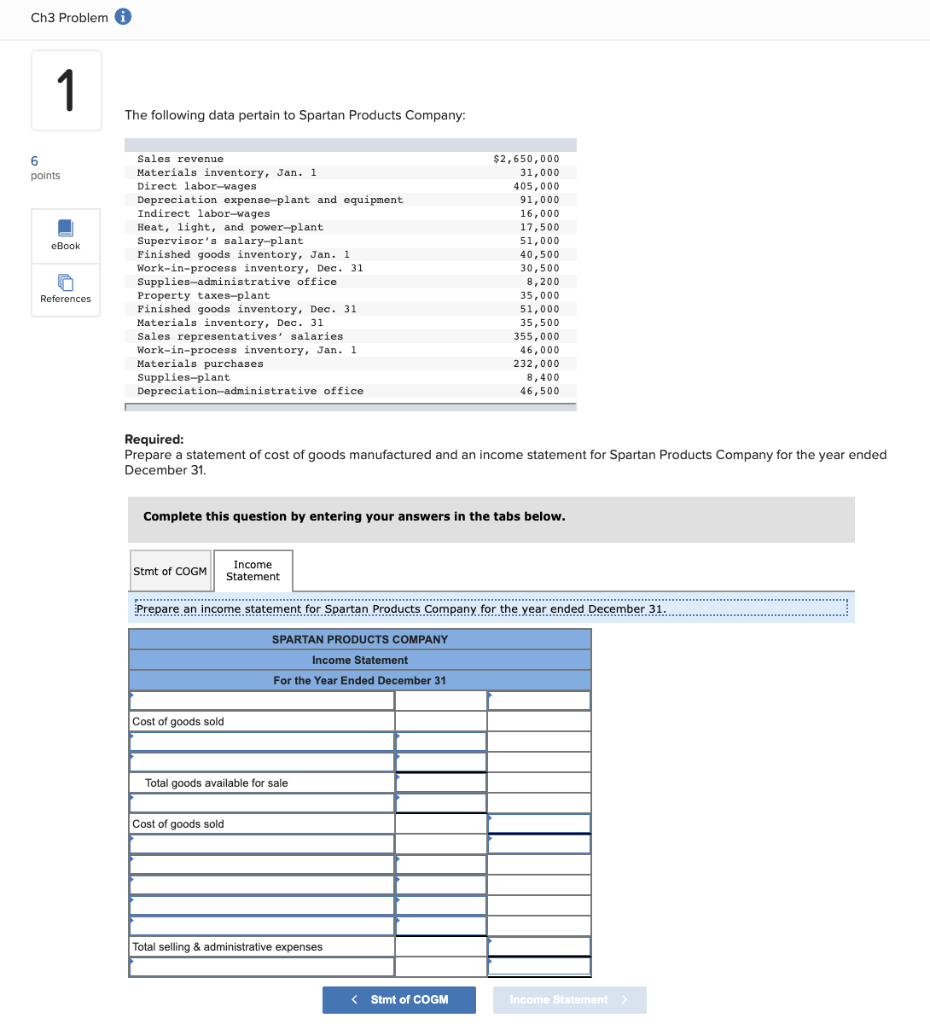

Solved Ch3 Problem 1 The following data pertain to Spartan | Chegg.com

https://media.cheggcdn.com/media/4de/4de2c501-3fdf-4e12-bec3-aba6594fee4a/phprskzG7

Top 7 Small Business Expenses and How to Reduce Them - FLEETCOR | For The Driven

https://forthedriven.fleetcardsusa.com/wp-content/uploads/2019/08/Top-7-Small-business-1040303346_OPTION_1-1.jpg

21 Essential Small Business Tax Deductions and How to Claim Them | Architectural Digest

https://media.architecturaldigest.com/photos/5d025b20c9f2f25267f26975/16:9/w_2927,h_1646,c_limit/Essential%20Small%20Business%20Tax%20Deductions.jpg

Utilities expense is the cost incurred by using utilities such as electricity water waste disposal heating and sewage To a certain extent basic energy costs such as heat and light are fixed in costs those ongoing expenses required to operate the business that are not

Overhead and sales and marketing expenses are common examples of period costs Overhead or the costs to keep the lights on so to speak such as For example electricity costs for a production facility may be 1 000 per month just to keep the lights on and the building functioning at a

Calculating & Controlling Your Hotel Operating Costs | Qwick

https://assets.website-files.com/633b4585b1053081daef6978/636440970c8ea55fd2fbf640_OAKZA4fm9ltS-nT5hhOacQu_q5QCDSep4yzYIWoYLoqW8_hl3yoiWaF3lWZ3cmnUeSS-foeIdvy3oBq9B_7Z_WjvckQmupKCb3ugDVwxmKSjWRuKK0ItvYrRMVFe0xMvKDv7GYk-COGroBkk8IwbizgYGOkTv5_i5iWQfC4Elq6NAj8Mpoq7T19XSNLWeA.png

:max_bytes(150000):strip_icc()/TermDefinitions_AccuredExspense_4-3_primary-941746afcfd14fac813f9ebddbc23a89.jpg)

Accrued Expense: What It Is, With Examples and Pros and Cons

https://www.investopedia.com/thmb/HvfKrMILkqa5HJF7kKM2D4uqSX8=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/TermDefinitions_AccuredExspense_4-3_primary-941746afcfd14fac813f9ebddbc23a89.jpg

Expenses Such As Heat Lights And Salaries - employer employee relationship are to be classified as salaries and wages The amounts expended to heat cool and light state owned and or leased