Dominican Republic Income Tax Rate Tax Year January 1 December 31 Tax Deadline March 31 Currency Dominican peso DOP Population 10 6 million Number of US Expats Estimated 25 000 Capital City Santo Domingo Primary Language Spanish Tax Treaty No Totalization Agreement No What Are Expat Taxes like for Americans Living in the Dominican Republic

What are the requirements for completing tax returns in Dominican Republic Resident IIT rates are determined based on a progressive scale provided by the DTC and regularly updated by the Dominican Tax Authority DGII Accordingly please find below the updated tax bracket concerning FY23 Individuals are taxed on a calendar year basis The Personal Income Tax Rate in Dominican Republic stands at 25 percent Personal Income Tax Rate in Dominican Republic averaged 25 45 percent from 2004 until 2023 reaching an all time high of 30 00 percent in 2006 and a record low of 25 00 percent in 2005 source Direccion General de Impuestos Internos 10Y 25Y 50Y MAX Compare Export API Embed

Dominican Republic Income Tax Rate

Dominican Republic Income Tax Rate

https://cabareteproperties.com/wp-content/uploads/2021/02/4-Op-411.jpg

Czech Republic Personal Income Tax Rate 2022 Data 2023 Forecast

https://d3fy651gv2fhd3.cloudfront.net/charts/[email protected]?s=czeirstax&v=202210240356V20220312

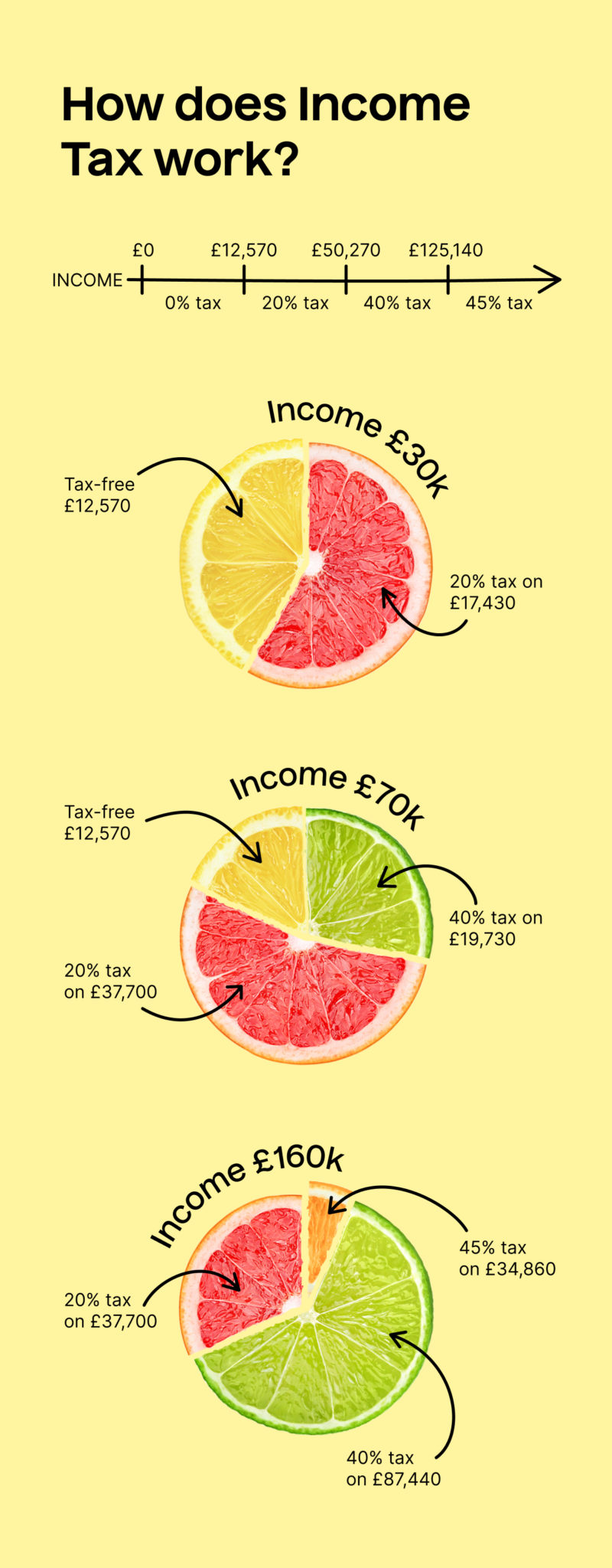

INCOME TAX RATE MyConfinedSpace

https://www.myconfinedspace.com/wp-content/uploads/2020/06/100616175_3810814845678208_4541851757159907328_n.jpg

The standard VAT rate in the Dominican Republic is 18 This rate is applied to most goods and services making it a considerable source of revenue for the government In certain cases a reduced VAT rate may apply Updated 2022 04 22 14 18 1 There s a broad range of taxes in the Dominican Republic to consider and this article will explain the different types and their rates We understand that this might be one of the most complex topics to consider when moving abroad Hence we have tried our best to keep it short and simple

Tax tables in Dominican Republic are simply a list of the relevent tax rates fixed amounts and or threholds used in the computation of tax in Dominican Republic the Dominican Republic tax tables also include specific notes and guidance on the validity of scenarios for example qualifying criterea for specific tax relief allowances and no Overview of business environment doing business in Dominican Republic as it pertains to taxation both individual and corporate Worldwide Tax Summaries Corporate income tax CIT rates Headline CIT rate 27 Corporate income tax CIT due dates CIT return due date 120 days after year end CIT final payment due date 120 days after year

More picture related to Dominican Republic Income Tax Rate

Income Tax Malaysia 2022 Who Pays And How Much

https://25174313.fs1.hubspotusercontent-eu1.net/hubfs/25174313/assets_comparehero/income-tax-how-much-featured-image.png#keepProtocol

Income Tax Rates In The UK TaxScouts

https://taxscouts.com/wp-content/uploads/TaxScouts_IncomeTax-800x2048.jpg

Live In A High Tax State Like Oregon Here Are 9 Ways To Lower Your Tax

https://uplevelwealth.com/wp-content/uploads/2023/02/17.jpg

How often is tax law amended and what are the processes for such amendments There have been 6 tax reforms in the last 12 years Currently the government is seeking to implement a fiscal reform which may include amendment to the tax legislation Tax rates For 2023 the net taxable income is taxed at progressive rates ranging from 0 to 25 The maximum tax rate is currently 25 on income earned over USD 15 213 for both residents and nonresidents The IIT rate is calculated progressively according to a scale adjusted annually by the DGII

Dominican Republic Non residents Income Tax Tables in 2023 Personal Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold 0 Income from 000 00 to 416 220 00 15 Choose a specific income tax year to see the Dominican Republic income tax rates and personal allowances used in the associated income tax calculator for the same tax year Dominican Republic 2023 Income Tax Calculator Dominican Republic 2022 Income Tax Calculator Dominican Republic 2021 Income Tax Calculator

Effective Income Tax Rate By State Tokocute

https://i2.wp.com/i.insider.com/62053574e2fe3c0019e9f92a?strip=all

Dominican Republic Allow Dual Citizenship For Expats DR1

https://dominicantoday.com/wp-content/uploads/2022/12/Dual-Passports-.jpg

Dominican Republic Income Tax Rate - Individual Income determination Last reviewed 04 December 2023 Employment income Broadly the entire remuneration in cash for personal services rendered in the Dominican Republic is subject to income tax except Christmas bonus contributions to the social security system severance and pre notice payments