Dominican Republic Corporate Income Tax Rate Resident or branch corporations or consortiums are subject to Dominican corporate income tax impuesto sobre la renta or ISR on their local income only or income coming from activities within the country The income tax rate is 27 Non resident companies also pay corporate income tax on income sourced in Dominican territories in the absence of a permanent business

Income Tax Both companies and individuals must pay taxes on their net taxable income Corporate Tax Rate The rate for all business entities is a flat 27 Unlike in the United States and other countries in the Dominican Republic the tax treatment for corporations LLC s and partnerships is exactly the same Overview of business environment doing business in Dominican Republic as it pertains to taxation both individual and corporate Worldwide Tax Summaries Corporate income tax CIT rates Headline CIT rate 27 Corporate income tax CIT due dates CIT return due date 120 days after year end

Dominican Republic Corporate Income Tax Rate

Dominican Republic Corporate Income Tax Rate

https://live.staticflickr.com/65535/52575587835_f559ac76f6_b.jpg

State Corporate Income Tax Rates And Key Findings What You Need To

https://files.taxfoundation.org/20230210132819/2023-CIT-rates.png

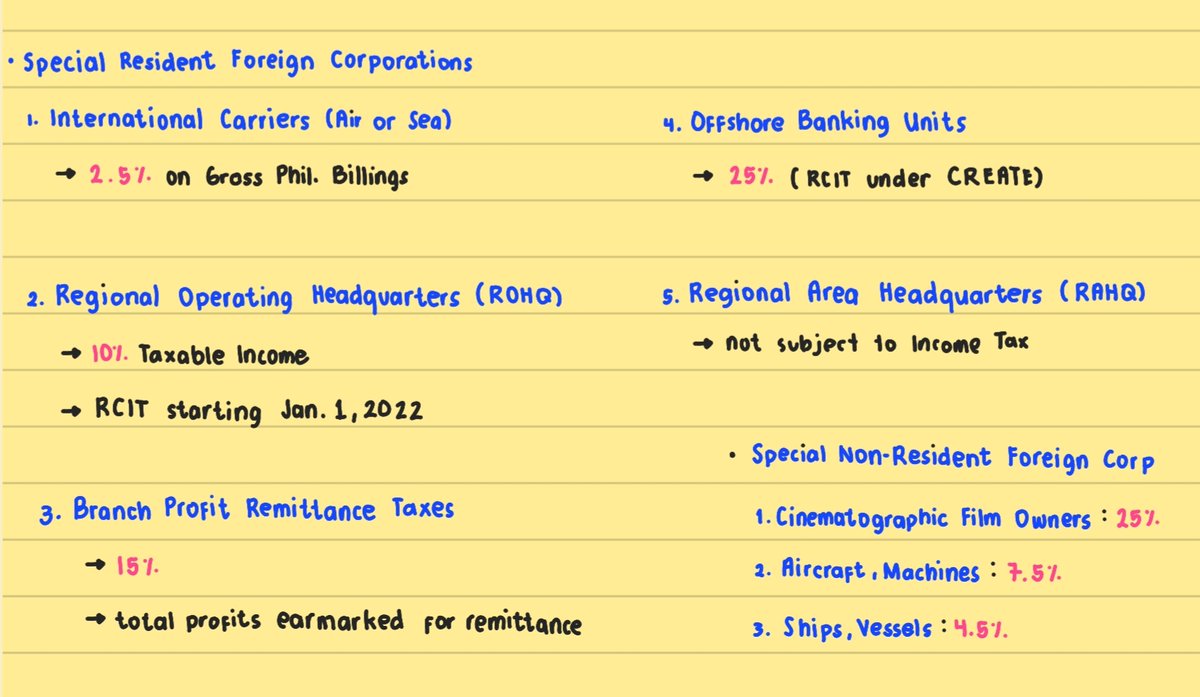

Unknown Cpale Reviewee On Twitter Corporate Income Tax Rates

https://pbs.twimg.com/media/Fy7I3D5aYAAKVoF.jpg

The Corporate Tax Rate in Dominican Republic stands at 27 percent Corporate Tax Rate in Dominican Republic averaged 26 48 percent from 1997 until 2025 reaching an all time high of 30 00 percent in 2006 and a record low of 25 00 percent in 1998 source Direccion General de Impuestos Internos Governance Income Tax Act Chapter 67 01 of the Laws of Dominica Payee Non individual persons or enterprises Companies etc Due Date Due and payable every three months at the end of the companies financial year

Dominican Republic Corporate Tax Rate was 27 in 2023 Take profit provides actual data about the tax rate that Dominican Republic companies and corporations pay from net income Personal Income Tax Rate 2023 25 25 Sales Tax Rate 2023 18 18 Corporate Tax Rate in other countries Country Updated Actual Previous Colombia 2022 In addition to this tax there is also the Asset Tax Return which must be filed on the same deadline as the Corporate Income Tax Return in the Dominican Republic The resulting tax must be paid in two equal installments with the first due on the same deadline set for the payment of the ISR and the second six 6 months after the first

More picture related to Dominican Republic Corporate Income Tax Rate

In Focus UAE Corporate Income Tax Law SCHL TER GRAF

https://www.schlueter-graf.com/fileadmin/user_upload/221212_CIT-.jpg

Colombia Income Tax Calculator 2024

https://co.icalculator.com/img/og/CO/80.png

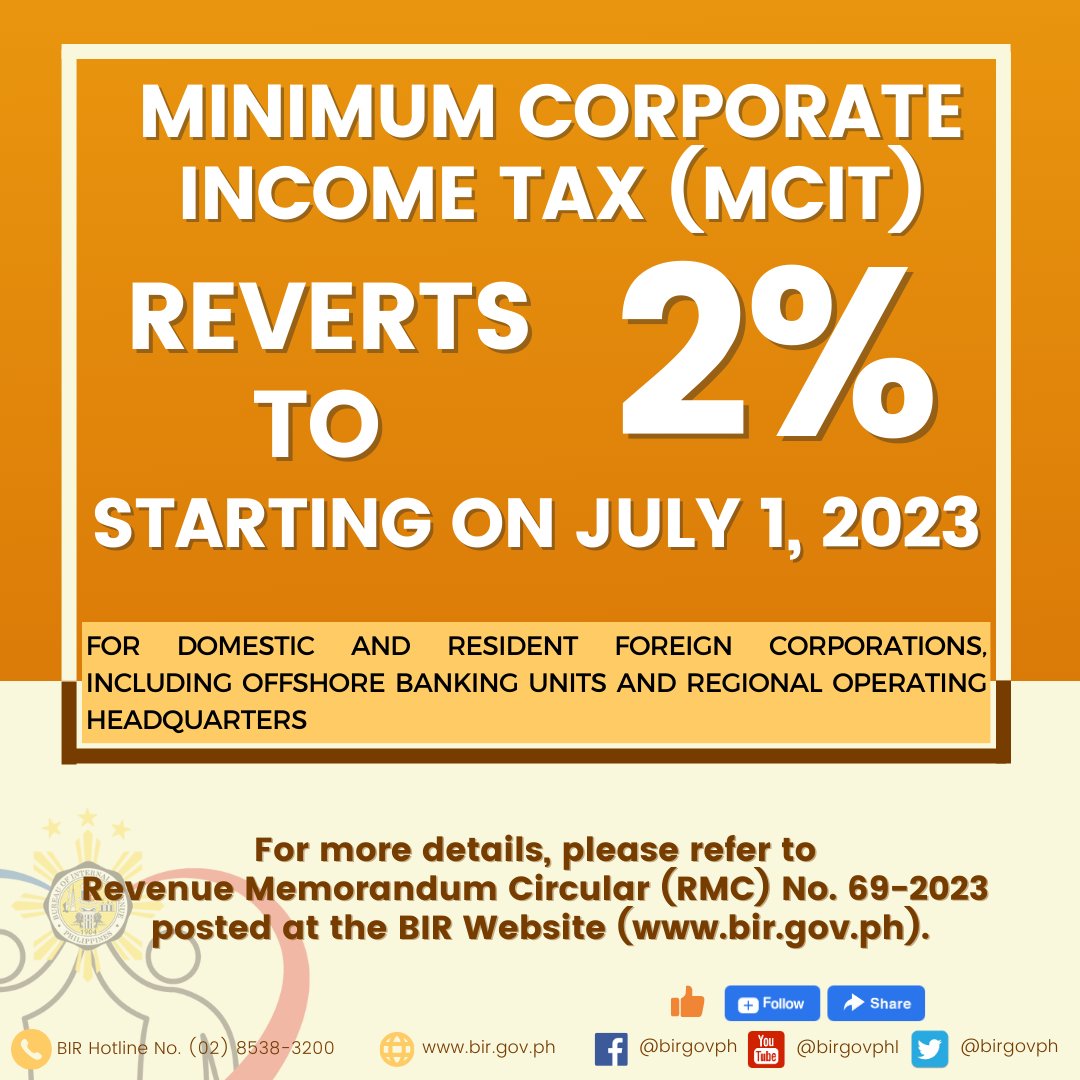

Birgovph On Twitter Effective July 1 2023 The Minimum Corporate

https://pbs.twimg.com/media/F09ysuMaYAE77_0?format=jpg&name=medium

Understanding corporate income tax in the Dominican Republic is essential for businesses seeking compliance and financial success This comprehensive overview explores corporate tax rates applicable deductions and advantages offered to both resident and non resident corporations Learn about the taxation framework the role of the General Directorate of Internal Revenue and the special The DTC establishes as year end one of the following 31 December 31 March 30 June or 30 September Once the year end is selected any change should be authorised by the tax authorities Tax returns The Corporate Annual Tax Return Form IR 2 must be filed within 120 days after year end

[desc-10] [desc-11]

2024 State Corporate Income Tax Rates Brackets EFILETAXONLINE COM

http://taxfoundation.org/wp-content/uploads/2024/01/CIT_Rates_24.png

Live In A High Tax State Like Oregon Here Are 9 Ways To Lower Your Tax

https://uplevelwealth.com/wp-content/uploads/2023/02/17.jpg

Dominican Republic Corporate Income Tax Rate - Governance Income Tax Act Chapter 67 01 of the Laws of Dominica Payee Non individual persons or enterprises Companies etc Due Date Due and payable every three months at the end of the companies financial year