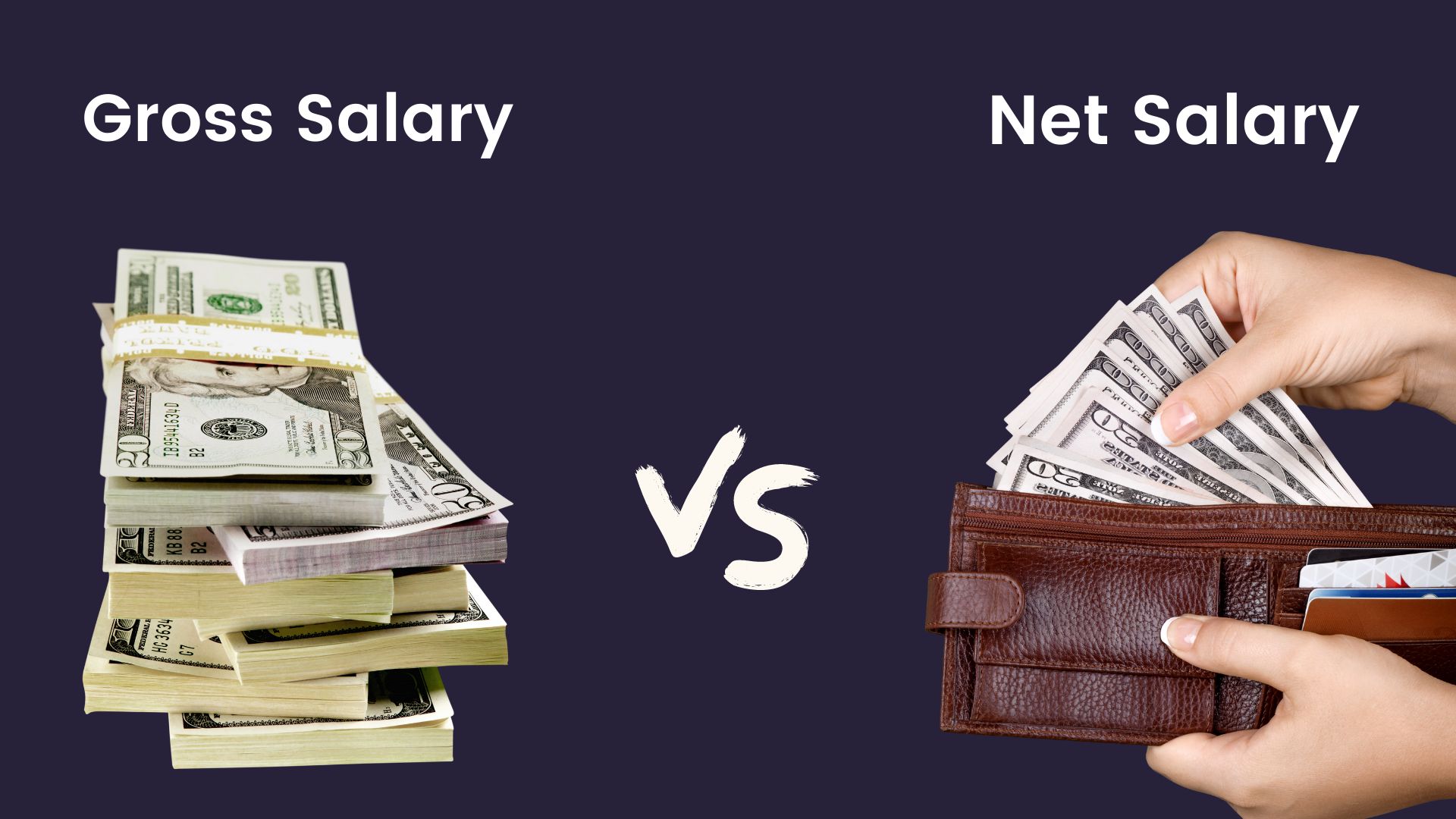

Does Salary Mean Gross Or Net Updated June 29 2023 Image description Whether you earn an annual salary or are paid hourly wages you might notice gross pay and net pay on your paycheck Understanding what is included in gross pay vs net pay will help you understand your total take home pay

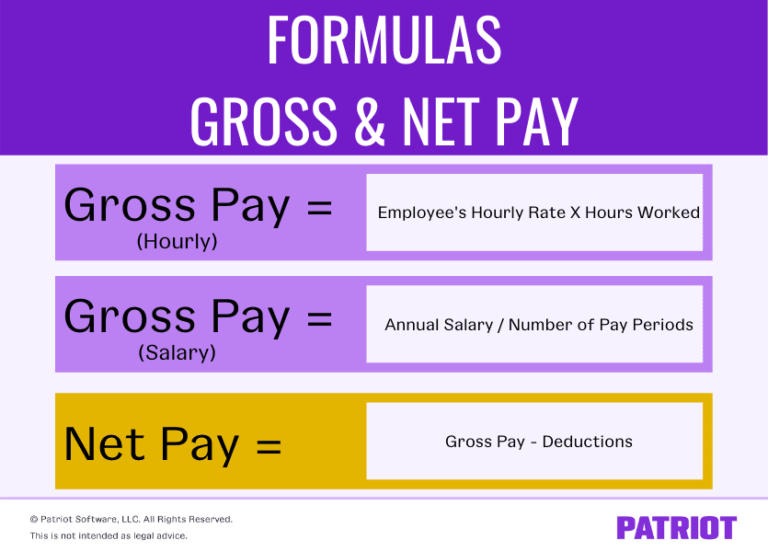

What Is Gross Pay Depending on the work you do and how you re compensated you may earn money a variety of ways from your salary or wages commissions bonuses or tips for example These payments make up your gross pay before any deductions like taxes are taken from your paycheck The method for calculating gross wages largely depends on how the employee is paid For salaried employees gross pay is equal to their annual salary divided by the number of pay periods in a year see chart below So if someone makes 48 000 per year and is paid monthly the gross pay will be 4 000 Pay Schedule Pay Periods

Does Salary Mean Gross Or Net

Does Salary Mean Gross Or Net

https://uploads-ssl.webflow.com/60ae205a9765a905fb4d243c/626aefc44f197c209ab27fe9_Gross vs net salary c.jpg

Gross Pay Vs Net Pay Definitions And Examples Indeed

https://images.ctfassets.net/pdf29us7flmy/1mWYaSiqsKhd8iV2E5UhXD/bb8f71b867741ce5d170c0c00f09781e/what-is-gross-pay-FINAL-JULY-02.png

How To Calculate Gross Annual Income From W2 Gambaran

https://decoalert.com/wp-content/uploads/2021/06/Is-base-salary-the-same-as-gross-pay-1024x576.jpg

Example If an employee s annual salary is 95 000 year and there are 26 payroll periods the bi weekly gross pay is 3 654 Net pay How to calculate deductions from gross pay Gross pay is the amount of money your employees receive before any taxes and deductions are taken out For example when you tell an employee I ll pay you 50 000 a year it means you will pay them 50 000 in gross wages Net pay is the amount of money your employees take home after all deductions have been taken out

2 Divide your employee s annual salary by the number of pay periods If you have a salaried employee making 60 000 per year here s how gross pay would look divided by each type of pay period Weekly 60 000 52 1 153 85 per pay period Every two weeks 60 000 26 2 307 69 per pay period Semimonthly 24 2 083 33 Monthly 12 4 166 67 To calculate your gross income when you re paid hourly count the number of hours you worked and multiply that by your hourly pay rate If you worked any overtime you ll multiply the overtime rate by your extra hours and add that number to your regular pay total

More picture related to Does Salary Mean Gross Or Net

How To Calculate Net Take Home Salary Haiper

https://www.patriotsoftware.com/wp-content/uploads/2019/12/gross-vs.-net-pay-visual.jpg

How To Calculate Net Income From Hourly Wage Haiper

https://www.patriotsoftware.com/wp-content/uploads/2018/09/gross-vs.-net-pay-part-2-1-768x552.png

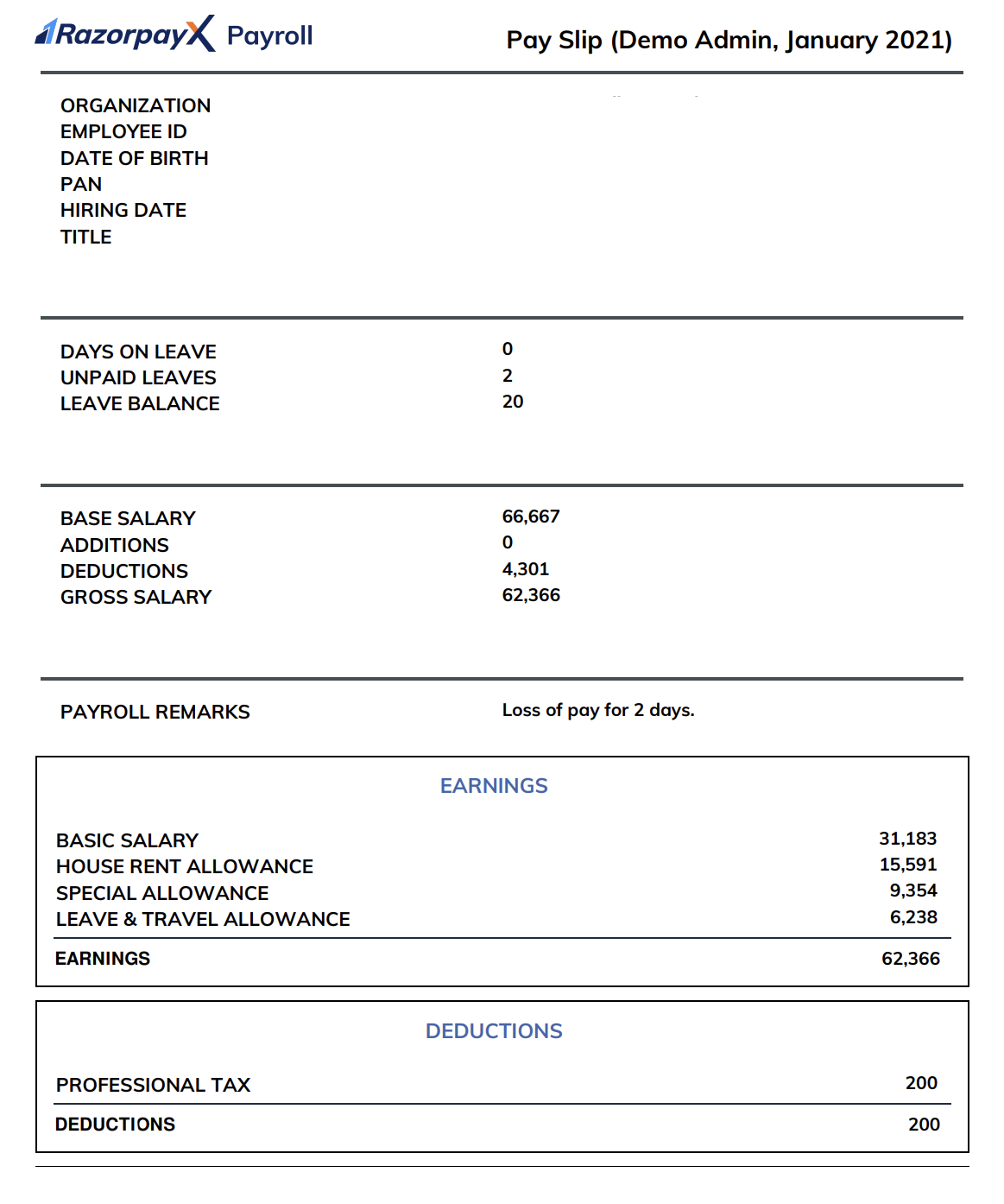

Gross Salary Simplified Meaning Components Calculation RazorpayX

https://d6xcmfyh68wv8.cloudfront.net/learn-content/uploads/2021/02/Screenshot-2021-03-04-at-4.20.13-PM.png

Guide Overview What s the difference between net pay and gross pay Most people will see two different numbers on their employment paychecks gross pay and net pay These two numbers each symbolize different amounts in relation to your income Net Pay Net pay is the total amount of money that the employer pays in a paycheck to an employee after all required and voluntary deductions are made To determine net pay gross pay is computed based on how an employee is classified by the organization An hourly or nonexempt employee is paid by the hours worked times the agreed upon hourly

The main difference between gross pay and net pay is that gross pay includes all of an employee s earnings before taxes and other deductions are taken out while net pay is the amount of money an employee actually receives after all deductions have been made Gross pay can be calculated by adding up all of an employee s hourly wages salary Updated November 10 2022 Understanding the difference between gross pay and net pay is necessary when it comes to understanding how much money you take home when you receive a paycheque The differences between these two common terms are often confusing to those who are starting a new job or are new to the workforce

Difference Between CTC Gross Salary And Net Salary

https://www.betterplace.co.in/blog/wp-content/uploads/2020/06/difference-between-ctc-and-gross-salary.jpg

What Is A Salary And How Does It Work 2023

https://i0.wp.com/images.ctfassets.net/q33z48p65a6w/JAk1egelcADKR7qDpw2GS/b073b8b9ba8f0199c68bc3778591f9b3/Stocksy_txpc2c3e39aqCs200_Medium_2562747.jpg?w=1200&h=645&fit=thumb

Does Salary Mean Gross Or Net - Gross pay is the amount of money your employees receive before any taxes and deductions are taken out For example when you tell an employee I ll pay you 50 000 a year it means you will pay them 50 000 in gross wages Net pay is the amount of money your employees take home after all deductions have been taken out