Does Monthly Income Include Allowances What Is Gross Monthly Income And How To Calculate It Indeed Editorial Team Updated March 10 2023 Gross monthly income is a financial concept that most professionals can benefit from understanding While you can expect this figure to appear on your pay stubs you can also calculate it yourself

What to include in gross monthly income When calculating your gross monthly income you have to include all your sources of income including Overtime pay Bonuses Commissions Income from businesses or other jobs Investments Related Types of Bonuses Definition and How To Get One Why knowing your gross monthly income is important Income do not include any allowance earnings or payments stemming from participation in WIOA Title I programs Per 20 CFR 683 275 d allowances following monthly income 770 290 490 490 490 and 490 The total income for the individual for 6 months is 3 020 To calculate the monthly average divide the

Does Monthly Income Include Allowances

Does Monthly Income Include Allowances

https://vnc-os.com/wp-content/uploads/2018/08/employee-allowances.jpg

What Is Gross Monthly Income How To Calculate It Increase It

https://walletsquirrel.com/wp-content/uploads/2021/08/What-Is-Gross-Monthly-Income-Pinterest-scaled.jpg

Solved Disposable Personal Income Is Income Spent For Chegg

https://d2vlcm61l7u1fs.cloudfront.net/media/633/6334734a-d2a2-46c0-839d-803d42719196/phpfVNEvY.png

Unemployment compensation is included in modified adjusted gross income and the section 36B g 1 unemployment rule does not affect the determination of modified adjusted gross income Consequently if your dependent received unemployment compensation for 2021 and is required to file a tax return for 2021 your household income would include your Car allowances paid in a set amount in periodic intervals are taxable While an allowance that is tracked with the dates times or receipts and does not exceed the mileage price set by the IRS is nontaxable Taxable Example Alan is given a car allowance of 1 000 per month to cover the lease maintenance and gas for a vehicle to be used for

1 Basic salary Sum paid to an employee that does not include bonuses benefits perks and incentives 2 HRA or House Rent Allowance The sum is paid towards covering the housing expenses of an employee 3 Provident fund contribution The employee s share of the salary towards the Employment Provident Fund The following allowances are taxable and must be included on your Form W 2 and reported on your return as wages Allowances paid to your spouse and minor children while you are training in the United States Living allowances designated by the Director of the Peace Corps as basic compensation This is the part for personal items such as

More picture related to Does Monthly Income Include Allowances

Estimated Monthly Income Vs Average Rent Flourish

https://public.flourish.studio/published_thumbnails/visualisation/1197388/c09087780a43b511.jpg

Simple Monthly Income Statement Template

https://www.bizzlibrary.com/Storage/Media/d8a48b7e-3744-40ee-843f-e64d3500e8be.png

What Are Monthly Income Mutual Funds

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2022/09/monthly-income-mutual-funds-image.jpg

Tax Withholding For employees withholding is the amount of federal income tax withheld from your paycheck The amount of income tax your employer withholds from your regular pay depends on two things The amount you earn The information you give your employer on Form W 4 For help with your withholding you may use the Tax Withholding Buy now accounting What are allowances Types and examples April 21 2022 If your business has employees keeping track of any allowances you give them is an important part of updating your accounting records But what exactly are allowances and how do they work Let s take a look What is an allowance

Renters are expected to pay a maximum of 30 of the monthly income on rent This portion of the contribution is called the Total Tenant Payment The cost of gross rent rent utility allowance above a family s maximum rent contribution is the amount of housing assistance paid by the HUD Income reflected on Mary s copy of her form 1040 as her annual income 5 6 Calculating Income Elements of Annual Income A Income of Adults and Dependents 1 Figure 5 2 summarizes whose income is counted 2 Adults Count the annual income of the head spouse or co head and other adult members of the family In addition persons under the

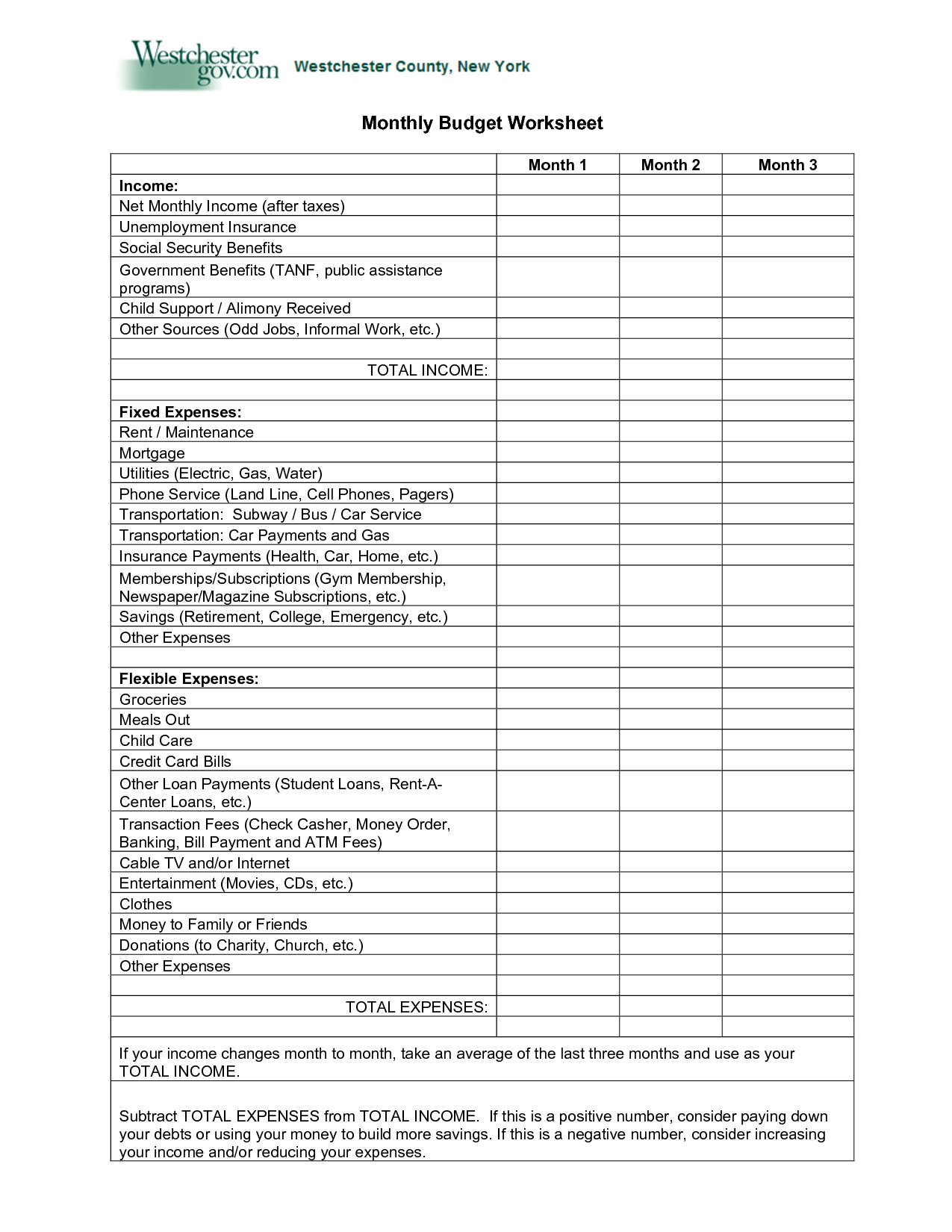

16 Budget Worksheet Monthly Bill Worksheeto

https://www.worksheeto.com/postpic/2013/11/monthly-income-budget-worksheet-printable_630901.png

Monthly Family Budget Templates At Allbusinesstemplates

https://www.allbusinesstemplates.com/thumbs/4a3d72c3-be9a-43dd-ac98-685ad4e56f76_1.png

Does Monthly Income Include Allowances - Types of income to include in your estimate Income type Include as income Notes Federal Taxable Wages from your job Yes If your pay stub lists federal taxable wages use that If not use gross income and subtract the amounts your employer takes out of your pay for child care health coverage and retirement plans Tips Yes