Does Base Salary Include Superannuation When including super in your employee s salaries you should ensure that you are still paying your employees at least the minimum wage under an award or enterprise agreement For example say the minimum wage is currently around 42 000 per year and an award free employee receives 47 000 per year inclusive of super

Salary packages typically include your base salary as well as additional benefits incentives or rewards such as superannuation annual and sick leave car allowance or bonuses With a salary package money is usually deducted from your salary before tax for these items or services It is up to the individual employer whether they advertise By definition income salary does NOT include Superannuation don t be fooled by someone advertising salary of say 60k and later saying it includes Super I d say that would be illegal Part of the reason could be the maximum super contribution base employers are only obliged to pay the 9 5 up to a maximum of 57 090 per quarter

Does Base Salary Include Superannuation

Does Base Salary Include Superannuation

https://images.fastcompany.net/image/upload/w_1280,f_auto,q_auto,fl_lossy/wp-cms/uploads/2022/11/p-1-90804238-why-we-need-to-eliminate-salary-negotiations-altogether.jpg

Wage Africa Get Compare Salaries In Africa

https://wageafrica.com/assets/images/salary1.jpg

What Does A Base Salary Include

https://images.lawpath.com.au/2022/06/Group-816.jpg

Hourly wages unlike annual salaries hourly wages depend on the actual hours worked For example an annual base salary of 60 000 in Australia calculates to around 5 000 per month before taxes and other deductions That equals roughly 30 per hour if you were to break it down to an hourly wage Base salary 100 000 10 5 super of 10 500 Total salary including super 115 000 Should the gross payment amount be 100 000 or 115 000 I am aware that any additional amounts salary sacrificed into super are not included in the gross payment and are instead included in the Reportable employer superannuation contributions section

Fact Checked Superannuation is a compulsory savings scheme through which a portion of your income is set aside for the years following your retirement Super is calculated based on your base salary If you re an Australian worker your employer is required to make superannuation contributions on your behalf to a super fund of your choosing The base salary plus recognised allowances that they are receiving at the date of the current review This may result in their superannuation salary being backdated to a point prior to their birthday review or their cessation of employment it does not include the hourly rate change by virtue of a salary increase

More picture related to Does Base Salary Include Superannuation

Base Salary And Your Benefits Package Indeed

https://dpuk71x9wlmkf.cloudfront.net/assets/2019/05/15220611/Base_Salary_How_Does_it_Fit_Into_Your_Entire_Compensation_Package__social.png

Salary Map DNA325

https://dna325.com/blog/wp-content/uploads/2018/08/join_header.png

What Is Base Salary Unravelling The Mystery And Cracking The Code CJ CO

https://www.cjco.com.au/wp-content/uploads/what-is-base-salary-1200x1800.jpg

The SGC rate is the minimum percentage of your ordinary time earnings that your employer must pay to your super fund on your behalf For 2024 25 the SGC rate is 11 5 but this will gradually increase to 12 by 1 July 2025 In other words if you re eligible for the super guarantee the minimum super contribution your employer must pay you If your salary package is inclusive of super this can be described as your salary including super That means that if you re earning 65 000 including super your ordinary time earnings are 58 558 55 and your employer is contributing 6 441 45 to your superannuation How does it work and are you eligible for super

Your employer is required to pay a minimum amount based on the current super guarantee rate of your ordinary time earnings into super This is set to gradually rise over the coming years At the time of writing the superannuation rate is 10 55k inclusive of super means your annual salary is 50k and 5k will be paid into your superannuation Taxation of Superannuation in Australia In summary contributions made to super are not included in taxable income and do not need to be declared on your tax return Withdrawals from super generally do need to be included in your tax return but will usually only be taxable income if you are under age 60

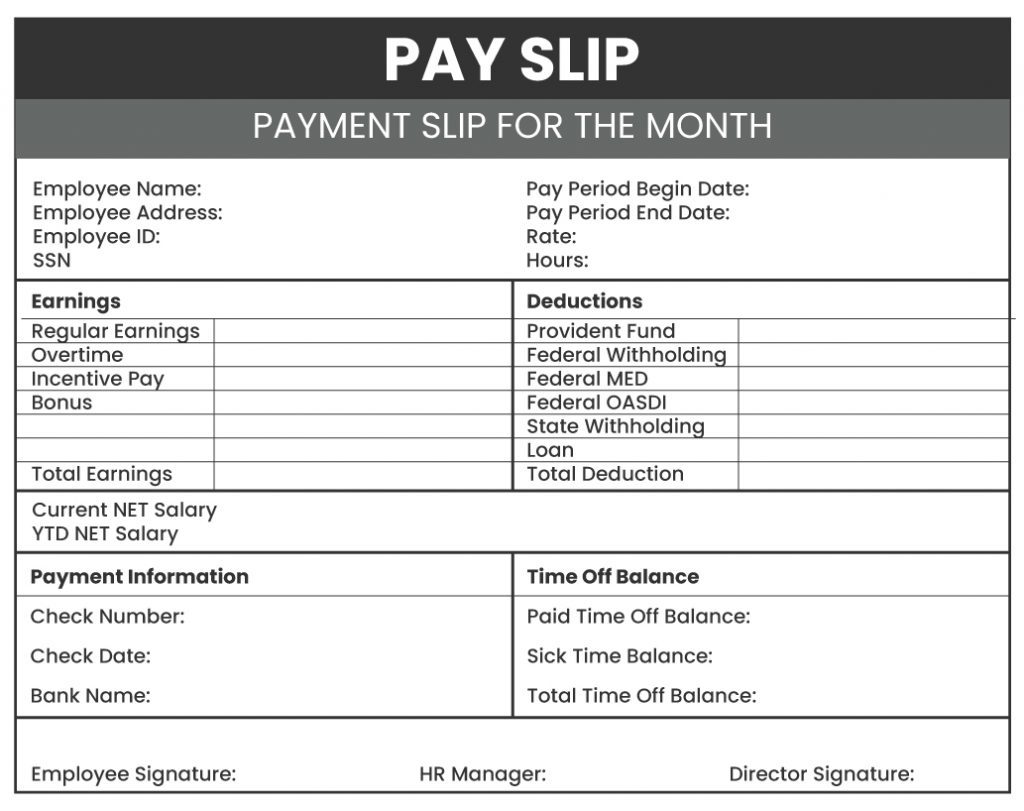

Guide On Reading And Understanding Your First Payslip In 2022 UpGrad

https://upgradcampus.com/wp-content/uploads/2022/09/pay-slip-1024x811.jpg

NACE Salary Survey Subscription

https://www.naceweb.org/uploadedimages/images/2021/feature/2021-nace-salary-survey-winter-961x600.jpg

Does Base Salary Include Superannuation - Base Salary is a mandatory field in the Workplace Profile It refers to an employee s actual annual earnings before tax in full time and full year equivalent amounts minus compulsory superannuation and other employee payments and benefits Base Salary is an employee s gross base salary before tax and includes